IBM 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

42_ ManagementDiscussion

amount of the restructuring charges could be materially

impacted.Seenote R,“2005Actions” onpages 80 and 81 fora

descriptionofrestructuringactions.

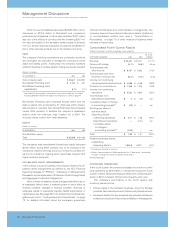

CurrencyRateFluctuations

Changesintherelativevaluesofnon-U.S.currenciestotheU.S.

dollaraffectthecompany’sresults.AtDecember31,2005,cur-

rencychangesresultedinassetsandliabilitiesdenominatedin

localcurrenciesbeingtranslatedinto fewer dollarsthanatyear-

end 2004. The company uses a variety of financial hedging

instruments to limit specific currency risks related to financing

transactions and other foreign currency-based transactions.

Furtherdiscussionofcurrencyandhedgingappearsin note L,

“DerivativesandHedgingTransactions,” onpages 71 to 74.

The company earned approximately 45 percent of its net

incomeincurrenciesotherthantheU.S.dollar. Thecompanyalso

maintains hedging programs to limit the volatility of currency

impactsonthecompany’s financial results.Thesehedgingpro-

grams limit the impact of currency changes on the company’s

financialresultsbutdonoteliminatethem.Inadditiontothetrans-

lation of earnings and the company’s hedging programs, the

impactofcurrencychangesalsomayaffectthecompany’spric-

ingandsourcingactions.Forexample,thecompanymayprocure

components and supplies in multiple functional currencies and

sell products and services in other currencies. Therefore, it is

impracticaltoquantifytheimpact of currencyonthesetransac-

tions and on consolidated net income. Generally, the company

believesthatextendedperiodsofdollarweaknessarepositivefor

netincomeandextendedperiodsofdollarstrengtharenegative,

althoughthepreciseimpactisdifficulttoassess.

Fornon-U.S.subsidiariesandbranchesthatoperateinU.S.

dollars or whose economic environment is highly inflationary,

translation adjustments are reflected in results of operations,

as required by SFAS No. 52, “Foreign Currency Translation.”

Generally,thecompanymanagescurrencyriskintheseentities

bylinkingpricesandcontractstoU.S.dollarsandbyentering

intoforeigncurrencyhedgecontracts.

MarketRisk

In the normal course of business, the financial position of the

companyisroutinelysubjecttoavarietyofrisks.Inadditionto

themarketriskassociatedwithinterestrateandcurrencymove-

ments on outstanding debt and non-U.S. dollar denominated

assetsandliabilities,otherexamplesofriskincludecollectibility

ofaccountsreceivableandrecoverabilityofresidualvalueson

leasedassets.

Thecompanyregularlyassessestheserisksandhasestab-

lished policies and business practices to protect against the

adverse effects of these and other potential exposures. As a

result,thecompanydoesnotanticipateanymateriallossesfrom

theserisks.

The company’s debt in support of the Global Financing

businessandthegeographicbreadthofthecompany’sopera-

tionscontain anelementofmarketriskfromchangesininterest

and currency rates. The company manages this risk, in part,

through the use of a variety of financial instruments including

derivatives, as explained in note L, “Derivatives and Hedging

Transactions,” onpages 71 to74.

Tomeetdisclosurerequirements,thecompanyperformsa

sensitivity analysis to determine the effects that market risk

exposuresmayhaveon the fairvaluesof the company’s debt

andotherfinancialinstruments.

Thefinancialinstrumentsthatareincludedinthesensitivity

analysiscompriseallofthecompany’scashandcashequiva-

lents, marketable securities, long-term non-lease receivables,

investments, long-term and short-term debt and all derivative

financial instruments. The company’s portfolio of derivative

financialinstrumentsgenerallyincludesinterestrateswaps,for-

eigncurrencyswaps,forwardcontractsandoptioncontracts.

Toperformthesensitivity analysis, thecompanyassesses

the risk of loss in fair values from the effect of hypothetical

changesininterestratesandforeigncurrencyexchangerates

onmarket-sensitiveinstruments.Themarketvaluesforinterest

andforeigncurrencyexchangeriskarecomputedbasedonthe

presentvalueoffuturecashflowsasaffectedbythechangesin

rates that are attributable to the market risk being measured.

The discount rates used for the present value computations

were selected based on market interest and foreign currency

exchangerates ineffectatDecember31,2005 and2004.The

differences in this comparison are the hypothetical gains or

lossesassociatedwitheachtypeofrisk.

Information provided by the sensitivity analysis does not

necessarilyrepresenttheactual changes in fair value thatthe

companywouldincurundernormalmarketconditionsbecause,

duetopracticallimitations,allvariablesotherthanthespecific

marketriskfactorareheldconstant.Inaddition,theresultsofthe

modelareconstrainedbythefactthatcertainitemsarespecifi-

callyexcludedfromtheanalysis,whilethefinancialinstruments

relatingtothefinancingorhedgingofthoseitemsareincluded

bydefinition.Excludeditemsincludeleasedassets,forecasted

foreigncurrencycashflowsandthecompany’snetinvestment

inforeignoperations.As aconsequence,reported changes in

the values of some of the financial instruments impacting the

resultsofthesensitivityanalysisarenotmatchedwiththeoffset-

ting changes in the values of the items that those instruments

aredesignedtofinanceorhedge.

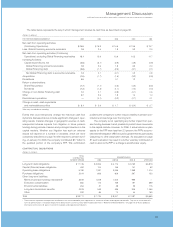

TheresultsofthesensitivityanalysisatDecember31,2005,

andDecember31,2004,areasfollows:

INTEREST RATE RISK

At December 31, 2005, a10 percent decrease in the levels of

interestrateswithallothervariablesheldconstantwouldresult

in an increase inthefairmarketvalueofthecompany’sfinancial

instrumentsof$18 millionascomparedwithadecreaseof$172

millionatDecember31,2004.A10percentincreaseinthelev-

elsofinterestrateswithallothervariablesheldconstantwould

resultin a decreaseinthefairvalueofthecompany’sfinancial

instrumentsof$8 millionascomparedto anincreaseof $153 mil-

lionatDecember31,2004.Changesintherelativesensitivityof

thefairvalueofthecompany’sfinancialinstrumentportfoliofor

thesetheoreticalchangesinthelevelofinterestratesareprima-

rilydrivenby changes inthecompany’s debtmaturity,interest

rateprofileandamount.