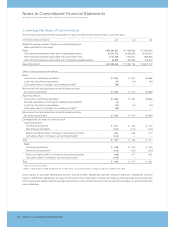

IBM 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

84_ NotestoConsolidatedFinancialStatements

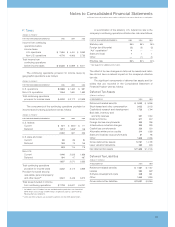

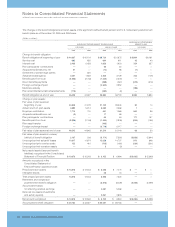

Thefollowingtable summarizes optionactivityunderthePlansduring2005,2004 and2003.

2005 2004 2003

WTD. AVG. WTD. AVG. WTD. AVG.

EXERCISE NO. OFSHARES EXERCISE NO. OFSHARES EXERCISE NO. OFSHARES

PRICE UNDEROPTION PRICE UNDEROPTION PRICE UNDEROPTION

BalanceatJanuary1 $««89 249,347,906 $«86 244,966,052 $««84 222,936,700

Optionsgranted 100 13,016,765 97 26,537,055 83 41,275,832

Optionsexercised 47 (11,690,186) 47 (14,035,038) 40 (11,205,228)

Optionscanceled/expired 97 (14,604,445) 93 (8,120,163) 100 (8,041,252)

BalanceatDecember31 $««91 236,070,040 $«89 249,347,906 $««86 244,966,052

ExercisableatDecember31 $««92 176,962,180 $«89 159,607,886 $««85 134,735,326

DuringtheyearsendedDecember 31,2005 and 2004,the company granted approximately12.5millionand5.0millionstockoptions,

respectively,withexercisepricesgreaterthanthestockpriceatthedateofgrant.Thesestockoptionshadweighted-averageexercise

prices of$100and$106fortheyearsendedDecember31,2005and2004,respectively,andareincludedinthetableabove.

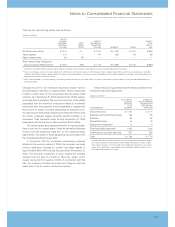

ThesharesunderoptionatDecember31,2005,wereinthefollowingexercisepriceranges:

OPTIONSOUTSTANDING

WTD. AVG.

WTD. AVG. NUMBER AGGREGATE REMAINING

EXERCISE OFSHARES INTRINSIC CONTRACTUAL

EXERCISEPRICERANGE PRICE UNDEROPTION VALUE LIFE(INYEARS)

$26-$60 $««48 35,593,399 $«1,212,877,220 3

$61-$85 77 50,945,363 264,034,471 7

$86-$105 98 86,319,099 — 7

$106andover 117 63,212,179 — 5

$««91 236,070,040 $«1,476,911,691 6

OPTIONS EXERCISABLE

WTD. AVG.

WTD. AVG. NUMBER AGGREGATE REMAINING

EXERCISE OFSHARES INTRINSIC CONTRACTUAL

EXERCISEPRICERANGE PRICE UNDEROPTION VALUE LIFE(INYEARS)

$26-$60 $««47 32,957,932 $«1,156,119,178 2

$61-$85 76 29,865,255 185,271,642 7

$86-$105 98 50,977,898 — 5

$106andover 117 63,161,095 — 5

$««92 176,962,180 $«1,341,390,820 5

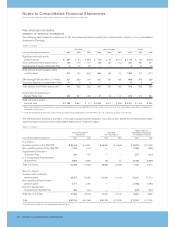

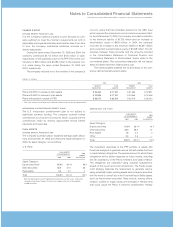

upontheprobabilityofachievementofperformancetargets.The

ultimatenumberofsharesissuedandtherelatedcompensation

costrecognizedasexpensewillbebasedonacomparisonofthe

finalperformancemetricstothespecifiedtargets.

A majority of stock-based compensation expense for the

yearsendedDecember31,2005,2004and2003wasgenerated

from stock options. Stock options are awards which allow the

employeetopurchasesharesofthecompany’sstockatafixed

price.Stockoptionsaregrantedatanexercisepriceequaltoor

greaterthanthecompanystockpriceatthedateofgrant.These

awards,whichgenerallyvest25percentperyear,arefullyvested

fouryearsfromthegrantdateandhaveacontractualtermoften

years. In 2004, the company implemented a new stock-based

program for its senior executives, designed to drive improved

performanceandincreasetheownershipexecutiveshaveinthe

company. Under this program, the company’s top executives

receivestockoptionspricedata10percentpremiumtotheaver-

age market price of IBM stock on the grant date. In addition,

these executives have the opportunity to receive at-the-money

optionsbyagreeingtodeferacertainpercentageoftheirannual

incentivecompensationintoIBMequity,whereitisheldforthree

yearsoruntilretirement.In2005,thisprogramwasexpandedto

coverallexecutivesofthecompany.Optionsunderthisprogram

become100percentvested threeyears fromthe dateofgrant

andhaveacontractualtermoftenyears.