IBM 2005 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

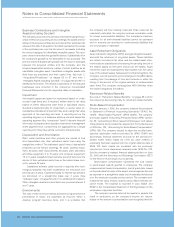

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

68_ NotestoConsolidatedFinancialStatements

E.Inventories

(Dollarsinmillions)

ATDECEMBER31: 2005 2004

Finishedgoods $««««902 $«1,179

Workinprocessandrawmaterials 1,939 2,137

Total $«2,841 $«3,316

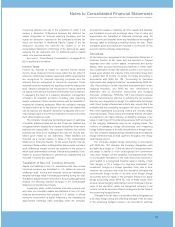

F. FinancingReceivables

(Dollarsinmillions)

ATDECEMBER31: 2005 2004

Short-term:

Netinvestmentinsales-typeleases $«««4,435 $«««5,074

Commercialfinancingreceivables 5,053 5,571

Client loan receivables 3,752 4,485

Installmentpaymentreceivables 510 641

Othernon-GlobalFinancingrelated —30

Total $«13,750 $«15,801

Long-term:

Netinvestmentinsales-typeleases $«««5,393 $«««6,049

Commercialfinancingreceivables 17 139

Client loan receivables 3,901 4,491

Installmentpaymentreceivables 317 271

Total $«««9,628 $«10,950

Netinvestmentinsales-typeleasesisforleasesthatrelateprin-

cipallytothe company’s equipment andare forterms ranging

from two to seven years. Net investment in sales-type leases

includesunguaranteedresidualvaluesof$792 millionand$836

million at December 31, 2005 and 2004, respectively, and is

reflectednetofunearnedincomeof$939 millionand$1,077mil-

lionand ofallowance for uncollectible accounts of$176 million

and$269 millionatthosedates,respectively.Scheduledmaturi-

ties of minimum lease payments outstanding at December 31,

2005,expressedasapercentageofthetotal,areapproximately:

2006, 48 percent; 2007, 28 percent; 2008, 17 percent; 2009,

5 percent;and2010 andbeyond,2percent.

Commercial financing receivables arise primarily from

inventory and accounts receivable financing for dealers and

remarketers of IBM and non-IBM products. Payment terms for

inventoryfinancinggenerallyrangefrom30to75days. Payment

termsforaccountsreceivablefinancinggenerallyrangefrom30

to90days.

Client loan receivablesrelateto loans that areprovidedby

Global Financing to the company’s clients to finance the

purchaseofthecompany’ssoftwareandservices. Separatecon-

tractual relationships on these financing arrangements are for

termsrangingfromtwoto seven yearsrequiringstraight-linepay-

mentsovertheterm.Eachfinancingcontractispricedindepend-

entlyatcompetitivemarketrates.Thecompanyhasahistoryof

enforcingthetermsoftheseseparatefinancingagreements.

The company did not have financing receivables held for

saleasofDecember31,2005and2004.

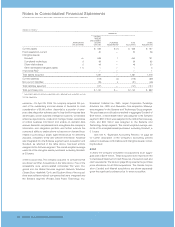

G.Plant,RentalMachinesandOtherProperty

(Dollarsinmillions)

ATDECEMBER31: 2005 2004

Landandlandimprovements $««««««684 $««««««840

Buildingsandbuildingimprovements 8,312 9,100

Plant,laboratoryandofficeequipment 21,760 22,701

30,756 32,641

Less:Accumulateddepreciation 18,600 18,973

12,156 13,668

Rentalmachines 3,505 3,744

Less:Accumulateddepreciation 1,905 2,237

1,600 1,507

Total $«13,756 $«15,175

H.InvestmentsandSundryAssets

(Dollarsinmillions)

ATDECEMBER31: 2005 2004*

Deferredtaxes $««1,832 $««4,671

Allianceinvestments:

Equitymethod 456 550

Non-equity method 558 309

Deferredtransition andset-up costs

andotherdeferredarrangements** 804 572

Long-termdeposits 200 209

Derivatives—non-current+160 48

Otherassets 964 756

Total $««4,974 $««7,115

* Reclassifiedtoconformwith2005presentation.

** Deferredtransition andset-up costs andotherdeferredarrangementsarerelated

toGlobalServicesclientarrangements.Alsoseenote A,“SignificantAccounting

Policies,”onpage 56 foradditionalinformation.

+ Seenote L,“DerivativesandHedgingTransactions,”onpages 71 to74 forthefair

valueofallderivativesreportedintheConsolidatedStatementofFinancialPosition.

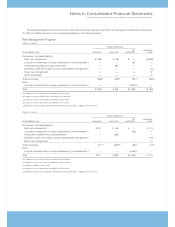

I.IntangibleAssetsIncludingGoodwill

Thefollowing table details thecompany’sintangibleassetbal-

ancesbymajorassetclass:

(Dollarsinmillions)

ATDECEMBER31,2005

GROSS NET

CARRYING ACCUMULATED CARRYING

INTANGIBLEASSETCLASS AMOUNT AMORTIZATION AMOUNT

Capitalized software $«1,805 $«««««(802) $«1,003

Client-related ««««910 «(490) «420

Completedtechnology 383 (270) 113

Strategicalliances 104 (68) 36

Patents/trademarks 32 (17) 15

Other* 218 (142) 76

Total $«3,452 $««(1,789) $«1,663

* Otherintangiblesareprimarilyacquiredproprietaryandnonproprietarybusiness

processes,methodologiesandsystems,andimpactsfromcurrencytranslation.