IBM 2005 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

70_ NotestoConsolidatedFinancialStatements

J. SecuritizationofReceivables

Thecompanyperiodicallysellsreceivablesthroughthesecuriti-

zation of trade receivables, loans, and leases. The company

retainsservicingrightsinthesecuritizedreceivablesforwhichit

receivesaservicingfee.Anygainorlossincurredasaresultof

suchsalesisrecognizedintheperiodinwhichthesaleoccurs.

During 2005, the company renewed its trade receivables

securitization facility that allows for the ongoing sale of up to

$500millionoftradereceivables.Thisfacilitywasputinplacein

2001 asanuncommittedfacility;however,itwasconvertedtoa

committed facility in 2004. The facility, which renews annually,

was put in place to provide backup liquidity and can be

accessedon a threedays’ notice.The company did nothave

anyamountsoutstanding under thetradereceivablessecuriti-

zationfacility atDecember31, 2005or2004.During2005,the

company securitized $6.3 million of trade receivables and

retained the servicing responsibilities for which it received a

servicingfee. In2005,boththepre-taxlossonthesaleofreceiv-

ables and the servicing fees received were insignificant. No

tradereceivableswere securitized in2004.

Thecompanyutilizescertainofitsfinancingreceivablesas

collateral for nonrecourse borrowings. Financing receivables

pledgedascollateralforborrowingswere$318 millionand$249

millionatDecember31,2005and2004,respectively.Thesebor-

rowingsareincludedinnote K,“Borrowings,” below.

K.Borrowings

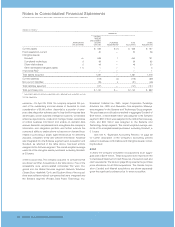

Short-TermDebt

(Dollarsinmillions)

ATDECEMBER31: 2005 2004

Commercialpaper $««««858 $«3,151

Short-termloans 3,370 1,340

Long-termdebt—currentmaturities 2,988 3,608

Total $«7,216 $«8,099

The weighted-average interest rates for commercial paper at

December31,2005and2004,were 4.3 percentand2.2percent,

respectively.Theweighted-averageinterestratesforshort-term

loanswere 2.2 percentand1.5percentatDecember31, 2005

and2004,respectively.

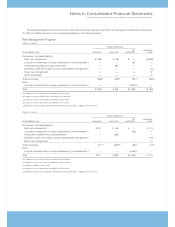

Long-Term Debt

PRE-SWAP BORROWING

(Dollarsinmillions)

MATURITIES 2005 2004

U.S.Dollars:

Debentures:

5.875% 2032 $««««««600 $««««««600

6.22% 2027 469 469

6.5% 2028 313 313

7. 0 % 2025 600 600

7. 0 % 2045 150 150

7.125% 2096 850 850

7. 5 % 2013 532 532

8.375% 2019 750 750

3.43%convertiblenote* 2007 238 278

Notes:5.4%average 2006–2013 2,713 2,724

Medium-termnote

program:4.4%average 2006–2018 5,620 3,627

Other: 4.1%average** 2006–2011 1,833 1,555

14,668 12,448

Othercurrencies(average

interestrateatDecember

31,2005,inparentheses):

Euros(3.1%) 2006–2010 1,280 1,095

Japaneseyen(1.4%) 2006–2015 1,450 3,435

Canadiandollars(7.7%) 2008–2011 59

Swissfrancs(1.5%) 2008 378 220

Other(6.1%) 2006–2011 406 513

18,187 17,720

Less:Netunamortizeddiscount 45 49

Add:SFASNo.133fair

valueadjustment+271 765

18,413 18,436

Less:Currentmaturities 2,988 3,608

Total $«15,425 $«14,828

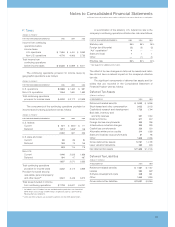

* Aspartofthecompany’s2002acquisitionof PricewaterhouseCoopers’Global

BusinessConsultingandTechnologyServicesUnit(PwCC),thecompanyissued

convertiblenotesbearinginterestatastatedrateof3.43percentwithafacevalue

ofapproximately$328milliontocertainoftheacquiredPwCCpartners.Thenotes

areconvertibleinto4,764,543sharesofIBMcommonstockattheoptionofthe

holdersatanytimebasedonafixedconversionpriceof$68.81 pershareofthe

company’scommonstock.AsofDecember31,2005,atotalof1,172,578shares

hadbeenissuedunderthisprovision.

** Includes$318 millionand$249millionofdebtcollateralizedbyfinancingreceiv-

ablesatDecember31,2005and2004,respectively.Seenote J,“Securitizationof

Receivables” above forfurtherdetails.

+ InaccordancewiththerequirementsofSFASNo.133,theportionofthecompany’s

fixedratedebtobligationsthatishedgedisreflectedintheConsolidatedStatement

ofFinancialPositionasanamountequaltothesumofthedebt’scarryingvalueplus

anSFASNo. 133fairvalueadjustmentrepresentingchanges inthefairvalueofthe

hedgeddebtobligationsattributabletomovementsin benchmark interestrates.