IBM 2005 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_57

fromfuture revenue. Costs to support or servicelicensed pro-

gramsarechargedtosoftwarecostasincurred.

Thecompanycapitalizescertaincoststhatareincurredto

purchase or to create and implement internal-use computer

software, which includes software coding, installation, testing

and certain data conversion. Capitalized costs are amortized

on a straight-line basis over two years and are recorded in

Selling, general and administrative expense. See note I,

“IntangibleAssets IncludingGoodwill” onpage 68 and 69.

ProductWarranties

The company offers warranties for its hardware products that

rangeuptofouryears,withthemajoritybeingeitheroneorthree

years. Estimated costs from warranty terms standard to the

deliverable are recognized when revenue is recorded for the

relateddeliverable. Thecompany estimates itswarranty costs

standardtothe deliverable based onhistoricalwarranty claim

experienceandappliesthisestimatetotherevenuestreamfor

productsunderwarranty.Futurecostsforwarrantiesapplicable

torevenuerecognizedinthecurrentperiodarechargedtocost

ofrevenue.Thewarrantyaccrualisreviewedquarterlytoverify

that it properly reflects the remaining obligation based on the

anticipated expenditures over the balance of the obligation

period. Adjustments are made when actual warranty claim

experience differs from estimates. Costs from fixed-price sup-

port or maintenance contracts, including extended warranty

contracts, are recognized asincurred.

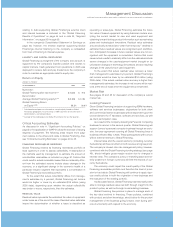

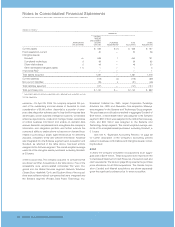

Changes in the company’s warranty liability balance are

presented inthefollowingtable:

(Dollarsinmillions)

ATDECEMBER31: 2005 2004

BalanceatJanuary1 $«944 $«780

Current period accruals 622 924

Accrual adjustmentsto reflect

actual experience 19 42

Charges incurred (831) (802)

BalanceatDecember31 $«754 $«944

Thedecreaseinthebalancewasprimarilydrivenby the divesti-

tureofthecompany’sPersonalComputing business toLenovo

GroupLimited(Lenovo) inApril2005.

ShippingandHandling

Costsrelatedtoshippingandhandlingareincludedin Cost in

theConsolidatedStatementofEarnings.

ExpenseandOtherIncome

SELLING,GENERAL AND ADMINISTRATIVE

Selling,generalandadministrative(SG&A)expenseischarged

toincomeasincurred.Expensesofpromotingandsellingprod-

uctsandservicesareclassifiedassellingexpenseandinclude

such items as advertising, sales commissions and travel.

Generalandadministrativeexpenseincludessuchitemsasoffi-

cers’ salaries,officesupplies,non-incometaxes,insuranceand

office rental. In addition, general and administrative expense

includesotheroperatingitemssuchasaprovisionfordoubtful

accounts, workforce accruals for contractually obligated pay-

ments to employees terminated in the ongoing course of busi-

ness,amortizationofcertainintangibleassetsandenvironmental

remediationcosts.Certainspecialactionsdiscussedinnote R,

“2005Actions,” onpages 80 and 81 arealsoincludedinSG&A.

ADVERTISING AND PROMOTIONAL EXPENSE

The company expenses advertising and promotional costs

when incurred. Cooperative advertising reimbursements from

vendors are recorded net of advertising and promotional

expensein the periodthe relatedadvertising and promotional

expense is incurred. Advertising and promotional expense,

whichincludes media, agency and promotionalexpense, was

$1,284 million, $1,335 million and $1,406 million in 2005, 2004

and2003,respectively,andisrecordedinSG&Aexpenseinthe

ConsolidatedStatementofEarnings.

RESEARCH,DEVELOPMENT AND ENGINEERING

Research, development and engineering (RD&E) costs are

expensedasincurred.

INTELLECTUAL PROPERTY AND CUSTOM

DEVELOPMENT INCOME

Aspartofthecompany’sbusinessmodelandasaresultofthe

company’s ongoing investment in research and development,

thecompanylicensesandsellstherightstocertainofitsintel-

lectual property (IP) including internally developed patents,

tradesecretsandtechnologicalknow-how.Certaintransfersof

IPtothirdpartiesarelicensing/royalty-basedandothertransfers

aretransaction-basedsalesandothertransfers.Licensing/roy-

alty-based fees involve transfers in which the company earns

the income over time, or the amount of income is not fixed or

determinableuntilthelicenseesellsfuturerelatedproducts(i.e.,

variable royalty, based upon licensee’s revenue). Sales and

othertransferstypicallyincludetransfersofIPwherebythecom-

panyhasfulfilleditsobligationsandthefeereceivedisfixedor

determinable. The company also enters into cross-licensing

arrangementsofpatents,andincomefromthesearrangements

isrecordedonlytotheextentcashisreceived.Furthermore,the

companyearnsincomefromcertaincustomdevelopmentproj-

ectsforstrategictechnologypartnersandspecificclients.The

companyrecordstheincomefromtheseprojectswhenthefee

is realizedorrealizableand earned,isnotrefundable,andisnot

dependentuponthesuccessoftheproject.

OTHER (INCOME)AND EXPENSE

Other (income) and expense includes interest income (other

than from the company’s Global Financing external business

transactions), gains and losses on certain derivative instru-

ments,gainsandlossesfromsecuritiesandotherinvestments,

gains and losses from certain real estate activity, foreign cur-

rencytransaction gainsandlosses,gainsandlossesfromthe

sale of businesses, and amounts related to accretion of asset

retirementobligations.Certainspecialactionsdiscussedinnote

R,“2005Actions” onpages 80 and 81 arealsoincludedinOther

(income)andexpense.