IBM 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_47

relating to debt supporting Global Financing’s external client

and internal business is included in the “Global Financing

Results of Operations” on page 44 and in note W, “Segment

Information,” onpages 95 through 99.

In the company’s Consolidated Statement of Earnings on

page 48, however, the interest expense supporting Global

Financing’s internal financing to the company is reclassified

fromCostoffinancingtoInterestexpense.

LIQUIDITY AND CAPITAL RESOURCES

GlobalFinancingisasegmentofthecompanyandassuch,is

supported by the company’s liquidity position and access to

capitalmarkets. Cash generatedfromoperations in 2005 was

deployedtoreducedebtandpaydividendstothecompanyin

ordertomaintainanappropriatedebt-to-equityratio.

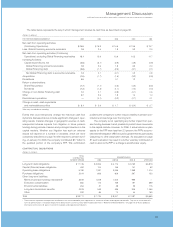

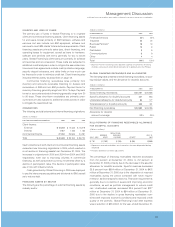

ReturnonEquity

(Dollarsinmillions)

ATDECEMBER31: 2005 2004

Numerator:

GlobalFinancingaftertaxincome(a)*$«1,032 $««««915

Denominator:

AverageGlobalFinancingequity(b)** $«3,109 $«3,194

GlobalFinancingReturn

onEquity(a)/(b) 33.2% 28.6%

* CalculatedbaseduponanestimatedtaxrateprincipallybasedonGlobal

Financing’sgeographicmixofearningsasIBM’sprovisionforincometaxesis

determinedonaconsolidatedbasis.

** AverageoftheendingequityforGlobalFinancingforthelastfivequarters.

CriticalAccountingEstimates

As discussed in note A, “Significant Accounting Policies,” on

page 54,theapplicationofGAAPinvolvestheexerciseofvarying

degrees of judgment. The following areas require more judg-

mentrelativetotheothersandrelatetoGlobalFinancing.Also

see“CriticalAccountingEstimates” onpages40to42.

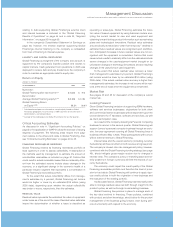

FINANCING RECEIVABLES RESERVES

Global Financing reviews its financing receivables portfolio at

leastquarterlyinorderto assess collectibility.Adescriptionof

the methods used by management to estimate the amount of

uncollectible receivables is included on page 61. Factors that

couldresultinactualreceivablelossesthataremateriallydiffer-

ent from the estimated reserve include sharp changes in the

economy, or a significant change in the economic health of a

particular industry segment that represents a concentration in

GlobalFinancing’sreceivablesportfolio.

Totheextentthatactualcollectibilitydiffersfrommanage-

ment’s estimates by 5 percent, Global Financing net income

would be higher or lower by an estimated $16 million (using

2005 data), depending upon whether the actual collectibility

wasbetterorworse,respectively,thantheestimates.

RESIDUAL VALUE

Residualvaluerepresentstheestimatedfairvalueofequipment

underleaseasoftheendofthelease.Residualvalueestimates

impact the determination of whether a lease is classified as

operating or sales-type. Global Financing estimates the future

fairvalueofleasedequipmentbyusinghistoricalmodels,ana-

lyzing the current market for new and used equipment and

obtainingforward-lookingproductinformationsuchasmarketing

plans and technological innovations. Residual value estimates

areperiodicallyreviewedand “otherthantemporary” declinesin

estimatedfutureresidualvaluesarerecognizeduponidentifica-

tion.Anticipatedincreasesinfutureresidualvalues arenotrec-

ognized until the equipment is remarketed. Factors that could

causeactualresultstomateriallydifferfromtheestimatesinclude

severe changes in the used-equipment market brought on by

unforeseenchangesintechnologyinnovationsandanyresulting

changesintheusefullivesofusedequipment.

To the extent that actual residual value recovery is lower

thanmanagement’sestimatesby5percent,GlobalFinancing’s

netincomewould be lower by anestimated$16 million(using

2005data).Iftheactualresidualvaluerecoveryishigherthan

management’sestimates,theincreaseinnetincomewillbereal-

izedattheendofleasewhentheequipmentisremarketed.

MarketRisk

See pages 42 and 43 for discussion of the company’s overall

marketrisk.

LookingForward

GivenGlobalFinancing’smissionofsupportingIBM’shardware,

software and services businesses, originations for both client

andcommercialfinancebusinesseswillbedependentuponthe

overalldemandforIThardware,softwareandservices,aswell

as client participationrates.

AsaresultofthecompanydivestingitsPersonalComputing

businesstoLenovointhesecondquarter,GlobalFinancingwill

supportLenovo’s personalcomputer businessthroughanexclu-

sive, five-yearagreementcoveringallGlobal Financing linesof

businesseffectiveMay1,2005.TheseparticipationswithLenovo

willbeexternalrevenuetoGlobalFinancing.

Interestratesandtheoveralleconomy(includingcurrency

fluctuations)willhaveaneffectonbothrevenueandgrossprofit.

Thecompany’s interestrateriskmanagement policy, however,

combinedwiththeGlobalFinancingfundingstrategy(seepage

46), should mitigate gross margin erosion due to changes in

interestrates.Thecompany’spolicyofmatchingassetandlia-

bilitypositionsinforeigncurrencieswilllimittheimpactsofcur-

rencyfluctuations.

TheeconomycouldimpactthecreditqualityoftheGlobal

Financingreceivablesportfolioandthereforethelevelofprovi-

sionforbaddebts.GlobalFinancingwillcontinuetoapplyrigor-

ouscreditpoliciesinboththeoriginationofnewbusinessand

theevaluationoftheexistingportfolio.

Asdiscussedabove,GlobalFinancinghashistoricallybeen

abletomanageresidualvalueriskboththroughinsightintothe

productcycles,aswellasthroughitsremarketingbusiness.

GlobalFinancing haspoliciesinplacetomanage eachof

the key risks involved in financing. These policies, combined

withproductand client knowledge,shouldallowfortheprudent

managementofthebusinessgoing forward,evenduringperi-

odsofuncertaintywithrespecttotheeconomy.