IBM 2005 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

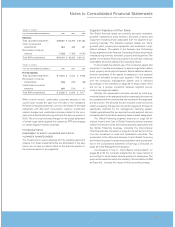

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

94_ NotestoConsolidatedFinancialStatements

increasingtheirdependenceoncontributionsfromthecompany.

Withineachassetclass,carefulconsiderationisgiventobalanc-

ing the portfolio among industry sectors, geographies, interest

ratesensitivity,dependenceoneconomicgrowth,currencyand

otherfactorsthataffectinvestmentreturns.

Theassetsaremanagedbyprofessionalinvestmentfirms,

aswellasbyinvestmentprofessionalswhoareemployeesofthe

company.Theyareboundbyprecisemandatesandaremeas-

ured against specific benchmarks. Among these managers,

considerationisgiven, butnotlimitedto, balancingsecuritycon-

centration,issuerconcentration,investmentstyle,andreliance

onparticularactiveinvestmentstrategies.Marketliquidityrisks

are tightly controlled, with only a small percentage of the PPP

portfolioinvestedinprivatemarketassetsconsistingofprivate

equitiesandprivaterealestateinvestments,whicharelessliq-

uid than publicly traded securities. The PPP included private

marketassetscomprisingapproximately 10.5 percentand10.1

percentoftotalassetsatDecember31,2005and2004,respec-

tively.Thetargetallocationforprivatemarketassetsin2006is

10.5 percent.AsofDecember31,2005,theFundhas$3,702mil-

lionincommitmentsforfutureprivatemarketinvestmentstobe

made over a number of years. These commitments are

expectedtobefulfilledfromplanassets.Derivativesareprima-

rily used to hedge currency, adjust portfolio duration, and

reducespecificmarketrisks.

EquitysecuritiesincludeIBMcommonstockintheamounts

of $139 million (0.3 percent of total PPP plan assets) at

December31,2005and$1,376million(3.1 percentoftotalPPP

planassets)atDecember31,2004.

OutsidetheU.S.,theinvestmentobjectivesaresimilar,sub-

jecttolocalregulations.Insomecountries,ahigherpercentage

allocation to fixed income securities is required. In others, the

responsibility for managing the investments typically lies with a

board thatmayincludeupto50percentofmemberselectedby

employeesandretirees.Thiscanresultinslightdifferencescom-

paredwiththestrategiesdescribedabove.Generally,thesenon-

U.S.fundsarenotpermitted to investin illiquid assets,suchas

privateequities,andtheiruse of derivatives is usuallylimitedto

passivecurrencyhedging.Therewasnosignificantchangeinthe

investmentstrategiesoftheseplansduringeither2005or2004.

NONPENSIONPOSTRETIREMENTBENEFITPLANS

The U.S. nonpension postretirement plan is not subject to

significant advance funding. The company currently makes

contributionstoatrustfundinamounts,whichcoupledwiththe

contributionsmadebyretirees,approximateannualbenefitpay-

mentsandexpense. Thecompany maintainsanominal,highly

liquidfund balance toensurepaymentsaremade ona timely

basis.FortheyearsendedDecember31,2005,2004and2003,

the plan assets of $66 million, $50 million and $14 million,

respectively, were invested in short-term highly liquid fixed

income securities, and as a result, the expected long-term

returnonplanassetsandtheactualreturnonthoseassetswere

notmaterialforthoseyears.

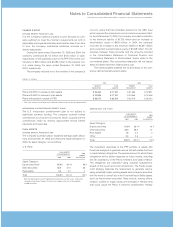

EXPECTED CONTRIBUTIONS

Thecompanyreviewseachdefinedbenefitpensionplansepa-

rately in order to determine the amount of company contribu-

tions,ifany.In2006,thecompanyisnotlegallyrequiredtomake

any contributions to the PPP. However, depending on market

conditions,thecompanymayelecttomakediscretionarycontri-

butionstothequalifiedportionofthePPPduringtheyear.

In2006,thecompanyestimatescontributionstoitsnon-U.S.

planstobe approximately$1.8 billion ofwhich,approximately$1

billionwillbemadetotheU.K.pensionplaninthefirstquarterof

2006.Thecompanycouldelecttocontributemoreorlessthan

the anticipated $1.8 billion based on market conditions. The

legallymandatedminimumcontributionstothecompany’snon-

U.S.plansareexpectedtobe$842 million.

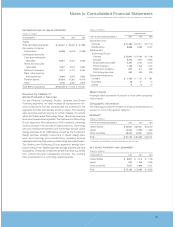

EXPECTED BENEFIT PAYMENTS

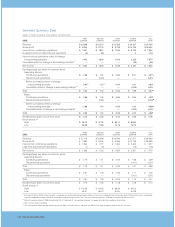

DEFINEDBENEFITPENSIONPLANEXPECTEDPAYMENTS

Thefollowingtablereflectsthetotalexpectedbenefitpayments

to defined benefit pension plan participants. These payments

havebeenestimatedbasedonthesameassumptionsusedto

measurethecompany’sPBOatyear endandincludebenefits

attributabletoestimatedfuturecompensationincreases.

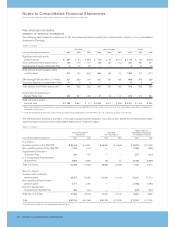

(Dollarsinmillions)

TOTAL

QUALIFIED NON-QUALIFIED QUALIFIED NON-QUALIFIED EXPECTED

U.S. PLANS U.S. PLANS NON-U.S. PLANS NON-U.S. PLANS BENEFIT

PAYMENTS PAYMENTS PAYMENTS PAYMENTS PAYMENTS

2006 $««3,008 $«««71 $«1,459 $««275 $«««4,813

2007 3,151 73 1,506 276 5,006

2008 3,040 76 1,539 284 4,939

2009 3,060 80 1,594 275 5,009

2010 3,108 85 1,623 276 5,092

2011-2015 «16,107 «514 «7,890 «««1,418 25,929