IBM 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

30_ ManagementDiscussion

SOFTWARE

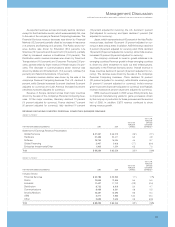

(Dollarsinmillions)

YR. TOYR.

FORTHEYEARENDEDDECEMBER31: 2005 2004* CHANGE

Softwarerevenue: $«15,753 $«15,094 4.4%

Middleware $«12,552 $«11,968 4.9%

WebSpherefamily 10.2

Information Management 8.2

Lotus 9.7

Tivoli 11.5

Rational 3.6

Othermiddleware (1.4)

Operatingsystems 2,426 2,474 (2.0)

Other 775 652 18.8

* Reclassifiedtoconformwith2005presentation.

Softwarerevenueincreased4.4percent(3.7percentadjusted

for currency) in 2005 versus 2004 as the software market

remains highly competitive. The company believes it gained

marketshareinallfivekeymiddlewarebrandsin2005andheld

marketshareintotalMiddleware.

TheWebSpherefamilyofproductsrevenueincreasedwith

growth in WebSphere Application Servers (15 percent) and

WebSphere Portals (12 percent) software versus 2004. The

WebSphere family provides the foundation technologies for

clients implementingbusinessprocessesandapplicationsina

ServicesOrientedArchitecture(SOA).Asclients’ interestinSOA

has increased, so has the demand for highly scalable, robust

infrastructureplatforms,suchasWebSphere.

Information Management software revenue increased

drivenbygrowthincontentmanagementandinformationinte-

grationproductsets.

Lotus software revenue increased as clients continue to

demonstratestrongresponsetotheDominoVersion7product

line, as well as very high interest in Workplace software.

Workplacesoftwaremorethandoubleditsrevenuein2005ver-

sus2004.

Tivolisoftwarerevenueincreasedwithstronggrowthinstor-

agesoftwareasclients’ adoptionofthecompany’svirtualization

technologiescontinuedtogaintraction. Tivolisystemsmanage-

ment and security software offerings also had good revenue

growthin2005versus2004. Thesecurityproductsrevenuewas

drivenbythecompany’snewSOASecurityofferingswhichwere

wellreceivedinthesecondhalfof2005.

Rationalsoftwarerevenueincreasedin2005 versus 2004,

however,lateinthefourthquarterof2005, client buyingdefer-

ralspreventedstrongerperformance.

Revenue from Other middleware products, including host

software products such as compilers, certain tools and Other

StorageandPrintersoftwaredeclinedversus2004.

OperatingSystemssoftwarerevenuedeclinedin2005ver-

sus2004,primarilyduetolowerzSeriesandpSeriesrevenue,

partiallyoffsetbyincreasediSeriesandxSeriesrevenue.

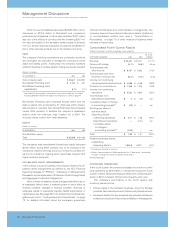

(Dollarsinmillions)

YR. TOYR.

FORTHEYEARENDEDDECEMBER31: 2005 2004 CHANGE

Software:

Grossprofit $«13,781 $«13,161 4.7%

Grossprofitmargin 87.5% 87.2% 0.3 pts.

TheincreaseintheSoftwaregrossprofitdollarsandgrossprofit

marginwasprimarilydrivenbygrowthinSoftwarerevenue and

reducedexternalroyaltycosts.

GLOBAL FINANCING

Seepage 44 foradiscussionofGlobalFinancing’srevenueand

grossprofit.

ENTERPRISE INVESTMENTS

RevenuefromEnterpriseInvestmentsincreased1.9percentto

$1,203million(1.6percent adjusted forcurrency)in2005versus

2004.Therevenueincreasewasattributabletohigher product

life-cyclemanagementsoftwarerevenueprimarilyfor Industrial

(5percent)and Small&MediumBusiness clients (2percent).

Grossprofitdollarsincreased8.0percentto$563millionin

2005versus2004. Thegrossprofitmarginincreased2.6points

to46.8percentin2005versus2004.Theincreaseingrossprofit

dollarsandgrossprofitmarginin2005wasprimarilydrivenby

theincreasedproductlife-cyclemanagementsoftwarerevenue.

FinancialPosition

DYNAMICS

The assets and debt associated with the company’s Global

Financingbusinessareasignificantpartofthecompany’sfinan-

cial position. Thefinancialpositionamountsappearingbelowand

on pages 31 and 32 are the company’s consolidated amounts

including Global Financing. However, to the extent the Global

Financingbusinessisamajordriveroftheconsolidatedfinancial

position, this narrative section will refer to the separate Global

Financing section in this Management Discussion on pages 43

through 47. The amounts appearing in the separate Global

Financingsectionaresupplementarydatapresentedtofacilitate

anunderstandingofthecompany’sGlobalFinancingbusiness.

WORKING CAPITAL

(Dollarsinmillions)

ATDECEMBER31: 2005 2004

Currentassets $«45,661 $«47,143

Currentliabilities 35,152 39,786

Workingcapital $«10,509 $«««7,357

Currentratio 1.30 1.18

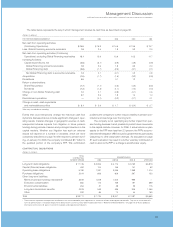

Current assets decreased $1,482 million due to declines of

$3,708 million in short-term receivables primarily driven by

declinesof: $1,100million in financingreceivablesascollections

exceededneworiginations,approximately$300million intrade

receivables due to the divestiture of the Personal Computing

business, approximately $375 million in non-client receivables