IBM 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

36_ ManagementDiscussion

initiatives also contributed to the company’s overall margin

improvement, however, the company has passed a portion of

the savings to clients to improve competitive leadership and

gainmarketshareinkeyindustrysectors.Inaddition,anincrease

in retirement-related plan costs of approximately $490 million

comparedto2003impactedoverallsegmentmargins.

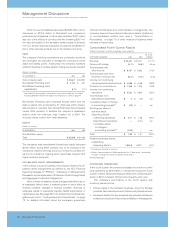

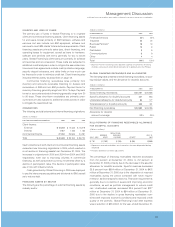

Totalexpenseandotherincomeincreased7.7percent(4.8

percent adjusted forcurrency)in2004versus2003.

TotalSG&A expense of $20,079millionincreased8.0per-

cent(4.6percent adjusted forcurrency)versus$18,601 millionin

2003.Theincreasewasprimarilydrivenbyincreasedexpense

forretirement-relatedplancosts of approximately $515million,

whichincludedaone-timechargeof$320millionrelatedtothe

partialsettlementofcertainlegalclaimsagainstthecompany’s

PPP,unfavorablecurrencytranslationof$626millionandprovi-

sion for certain litigation-related expenses of $125 million in

2004.Theseincreaseswerepartiallyoffsetbylowerworkforce

reductions of $122 million and lower Advertising and promo-

tional expense of $71 million. In addition, Bad debt expense

declined$72millionduetolowerreserverequirementsassoci-

ated with the improvement in economic conditions and

improvedcreditquality,aswellasthelowerassetbaseofGlobal

Financing’sreceivablesportfolio.

Other(income) and expensewasincomeof$23million in

2004versusexpenseof$238millionin2003.Theimprovement

wasprimarilydrivenbyincreasedgainsfromvariousassetsales

including certain real estate transactions ($87 million) in 2004

versus2003,additionalInterestincome($28million)generated

by the company in 2004 and other nonrecurring gains/settle-

mentsof$121 millionin2004comparedto2003.

Research,developmentandengineering (RD&E)expense

of$5,874millionincreased$560millionor10.5percentin2004

versus2003primarilytheresultofincreasedspending inmid-

dleware software including new acquisitions (approximately

$240 million). In addition, RD&E expense increased due to

spendingrelatedtothePOWER5technologyinitiatives(approx-

imately $140 million) and higher retirement-related plan costs

(approximately$77million).

Intellectualpropertyandcustomdevelopmentincome was

flatin2004versus2003andInterestexpensedeclined$6million

versus2003primarilyduetolowereffectiveinterestratesin2004.

Theprovisionfor income taxes resultedinaneffectivetax

rateof29.7percentfor2004,comparedwiththe2003effective

taxrateof30.0percent.The0.3pointdecreaseintheeffective

taxratein2004wasprimarilyduetothetaxeffectofthesettle-

mentofcertainpensionclaimsinthethirdquarterof2004.

WithregardtoAssets,approximately$3.6billionoftheyear-

to-year increase relates to the impact of currency translation.

TheremainingincreaseprimarilyconsistsofanincreaseinCash

andcashequivalents,anincreaseinGoodwillassociatedwith

recentacquisitionsandincreasedPrepaidpensionassets.The

increases were partially offset by lower financing receivables

andlowerdeferredtaxassets.

Global Financing debt decreased, but the company’s

GlobalFinancingdebt-to-equityratiowas7.0to1 for2004and

7.1 to1 for2003whichiswithinthecompany’stargetedrange.

DiscontinuedOperations

OnDecember31,2002,thecompanysolditsHDDbusinessto

Hitachiforapproximately$2billion.The final cash paymentof

$399millionwasreceivedonDecember30,2005. Inaddition,

thecompanypaidHitachi$80milliontosettlewarrantyobliga-

tions during 2005. These transactions were consistent with

the company’s previous estimates. The HDD business was

accountedforasadiscontinuedoperationwherebytheresults

ofoperationsandcashflowswereremovedfromthecompany’s

resultsfromcontinuingoperationsforallperiodspresented.

Thecompanyincurredalossfromdiscontinuedoperations

of $24 million in 2005, $18 million in 2004 and $30 million in

2003,netoftax. Theselosseswere primarilyduetoadditional

costs associated with parts warranty as agreed upon by the

companyandHitachi,underthetermsoftheagreementforthe

saleoftheHDDbusinesstoHitachi.

LookingForward

Thefollowingkeydriversimpactingthecompany’sbusinessare

discussedonpage 21:

• Economicenvironmentandcorporate spendingbudgets

• Internal business transformation and global integration

initiatives

• Innovation initiatives

• Openstandards

• Investingingrowth opportunities

With respect to the economic environment, in 2005 the global

economyslowedmodestlyfollowingtherecovery’speakayear

earlier. Looking forward, while uncertainties make it difficult to

predict future developments, the company anticipates similar

moderategrowthfortheeconomyandthetraditionalITindustry.

Several factors-including increasing complexity, globalization

andthepace of technologychange-aredriving clients to con-

tinue to transform their businesses. The deeper integration of

technologyintobusinessmodels,processesandpracticeshas

created new long-term opportunities for the company. IBM is

addressingtheseopportunitiesthroughits BPTS offerings.The

company expects continued double-digit revenue growth in

theseofferingsin2006.

With respect to business transformation and the continual

conversionofthecompanyintoanondemandbusiness,thecom-

pany’s supply-chain initiatives are expected to allow continued

flexibility to drive additional competitive advantages. Also, the

companywill leveragetheactionstakenin2005and continueto

focusonincreasedproductivityandefficiencyto accelerate the

globalizationandtransformationofitsglobalbusinessmodel.

Finally,withrespecttotechnology,in2005 thecompanyhas

againbeenawardedmoreU.S.patentsthananyothercompany

forthe thirteenth yearinarow.Thecompanycontinuestofocus

internaldevelopmentinvestmentsonhigh-growthopportunities

andtobroadenitsabilitytodeliverindustry-specificsolutions.