IBM 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

46_ ManagementDiscussion

sales-typeandoperatingleasesatDecember31,2004and2005.

Inaddition,thetable below presentstheresidualvalueasaper-

centageoftheoriginalamountfinanced,andarunoutofwhenthe

unguaranteedresidualvalue assignedtoequipment on leases at

December31,2005 isexpectedtobereturnedtothecompany.In

addition to the unguaranteed residual value below, on a limited

basis,GlobalFinancingwillobtainguaranteesofthefuturevalue

oftheequipment tobereturnedatendoflease.Thesethird-party

guaranteesareincludedinminimumleasepaymentsasprovided

forbyaccountingstandardsinthedeterminationoflease classifi-

cationsforthecoveredequipmentandprovideprotectionagainst

risk of loss arising from declines in equipment values for these

assets. Theresidualvalueguaranteeincreasestheminimum lease

payments that are utilized in determining the classification of a

leaseasasales-typeleaseoranoperatinglease.Revenuefrom

a sales-type lease is recorded at the inception of the lease,

wherebyrevenueonanoperatingleaseisrecognizedoverthelife

ofthelease. Theaggregateassetvalueassociatedwiththeguar-

antees was $651 million and $700 million for financing transac-

tionsoriginatedduringtheyearsendedDecember31,2005and

2004,respectively.In2005,theresidualvalueguaranteeprogram

resultedinthecompanyrecognizing approximately$543million

ofrevenuethatwould otherwisehavebeenrecognizedinfuture

periodsasoperatingleaserevenue.Ifthecompanyhadchosen

tonot participate in a residualvalueprogramin2005 and prior

years,overall revenueswould nothavebeenmateriallyaffected

duetotherelativelyconstantyear-to-yearaggregateassetvalue

associated with the residual value guarantees. The associated

aggregateguaranteedfuturevalueatthescheduledendoflease

was $27 million and $36 million for financing transactions origi-

nated during the same time periods, respectively. The cost of

guaranteeswas$4.3millionforyearendedDecember31,2005,

and$5.7millionforyearendedDecember31,2004.

2005, compared with an addition of $105 million for the year

endedDecember31,2004.Thedeclinewasprimarilyattributed

totheoverallreductioninthefinancingassetportfolio,aswellas

the improvement in economic conditions and improved credit

qualityoftheportfolioin2005ascomparedwith2004.

RESIDUAL VALUE

Residual value is a risk unique to the financing business, and

management of this risk is dependent upon the ability to accu-

ratelyprojectfutureequipmentvalues atleaseinception.Global

Financing has insight into product plans and cycles for the IBM

products under lease. Based upon this product information,

GlobalFinancingcontinuallymonitorsprojectionsoffutureequip-

mentvaluesandcomparesthemwiththeresidualvaluesreflected

inthe portfolio. See note A, “Significant Accounting Policies,” on

page 61 forthecompany’saccountingpolicyforresidualvalues.

GlobalFinancingoptimizestherecoveryofresidualvaluesby

sellingassetssourcedfromendoflease,leasingusedequipment

to new clients, or extending lease arrangements with current

clients. Sales of equipment, which are primarily sourced from

equipmentreturnedatendoflease,represented42.1 percentof

GlobalFinancing’srevenuein2005and36.6percentin2004.The

increase is driven primarily by higher internal used equipment

sales, due to higher sales to the Hardware segment, as well as

earlyterminationsofinternalleasesandsubsequentsaleofequip-

menttoGlobalServices.Thegrossmarginonthesesaleswas38.7

percentand34.5percent in 2005 and2004,respectively. The

increaseingrossmarginwasprimarilyduetothe increaseininter-

nal equipment sales. In addition to selling assets sourced from

endoflease,GlobalFinancingoptimizestherecoveryofresidual

values by leasing used equipment to new clients or extending

leasingarrangements with current clients.The following table

presentstherecordedamountofunguaranteedresidualvaluefor

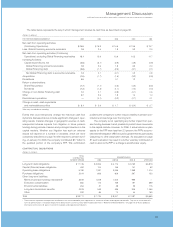

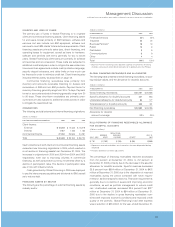

UNGUARANTEED RESIDUAL VALUE

(Dollarsinmillions)

TOTAL RUNOUT OF2005BALANCE

2009AND

2004* 2005 2006 2007 2008 BEYOND

Sales-typeleases $««««««836 $««««««792 $«238 $«250 $«226 $«««78

Operatingleases 197 214 64 73 50 27

Totalunguaranteedresidualvalue $«««1,033 $«««1,006 $«302 $«323 $«276 $«105

Relatedoriginalamountfinanced $«25,982 $«23,397

Percentage 4.0% 4.3%

* Restatedtoconformwith2005presentation.

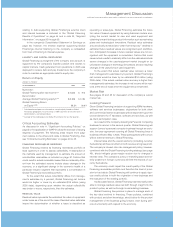

DEBT

ATDECEMBER31: 2005 2004

Debt-to-equityratio 6.7x7.0x

Global Financing funds its operations primarily through borrow-

ingsusingadebt-to-equityratioofapproximately7to1.Thedebt

isusedtofundGlobalFinancingassets and iscomposedofinter-

companyloansandexternaldebt.Thetermsoftheintercompany

loansaresetbythecompanytosubstantiallymatchthetermand

currencyunderlyingthereceivable.Theintercompanyloansare

based on arm’s-length pricing. Both assets and debt are pre-

sentedintheGlobalFinancingBalanceSheetonpage 44.

The company’s Global Financing business provides fund-

ing predominantly for the company’s external clients but also

providesintercompanyfinancingforthecompany(internal),as

describedinthe“DescriptionofBusiness” onpage 43.Aspre-

viouslystated,thecompany measuresGlobalFinancingasifit

were a standalone entity and accordingly, interest expense