IBM 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

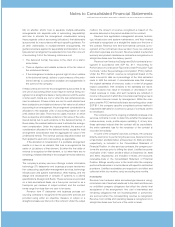

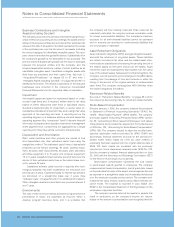

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

60_ NotestoConsolidatedFinancialStatements

each period. For hedges of interest rate risk, the fair value

adjustments are recorded as adjustments to Interest expense

andCostofGlobalFinancingintheConsolidatedStatementof

Earnings.Forhedgesofcurrencyriskassociatedwithrecorded

financial assets or liabilities, derivative fair value adjustments

are recognized in Other (income) and expense in the

ConsolidatedStatementofEarnings.Changesinthefairvalue

of a derivative that is designated as a cash flow hedge are

recorded,netofapplicabletaxes,intheAccumulatedgainsand

(losses) not affecting retained earnings, a component of

Stockholders’ equity. When netincomeisaffectedbythevari-

ability of the underlying cash flow, the applicable offsetting

amountofthegainorlossfromthederivativethatisdeferredin

Stockholders’ equityisreleasedtonetincomeandreportedin

Interestexpense, Cost, SG&A expenseor Other(income)and

expense in the Consolidated Statement of Earnings based on

thenatureoftheunderlyingcashflowhedged.Effectivenessfor

net investment hedging derivatives is measured on a spot-to-

spotbasis.Theeffectiveportionofchangesinthefairvalueof

netinvestmenthedgingderivativesandothernon-derivativerisk

managementinstrumentsdesignatedasnetinvestmenthedges

arerecordedasforeigncurrencytranslationadjustments,netof

applicable taxes, in the Accumulated gains and (losses) not

affecting retained earnings section of the Consolidated

StatementofStockholders’ Equity.Changesinthefairvalueof

theportionofanetinvestmenthedgingderivativeexcludedfrom

theeffectivenessassessmentarerecordedinInterestexpense.

When the underlying hedged item ceases to exist, all

changes in the fair value of the derivative are included in net

income each period until the instrument matures. When the

derivativetransactionceasestoexist,ahedgedassetorliability

is no longer adjusted for changes in its fair value except as

requiredunderotherrelevantaccountingstandards.Derivatives

thatarenotdesignatedashedges,aswellaschangesinthefair

valueofderivativesthatdonoteffectivelyoffsetchangesinthe

fair value of the underlying hedged item throughout the desig-

natedhedgeperiod(collectively,“ineffectiveness”),arerecorded

innetincome eachperiodandarereportedinOther(income)

andexpense.

The company reports cash flows arising from the com-

pany’sderivativefinancialinstrumentsconsistentwiththeclas-

sification of cash flows from the underlying hedged items that

the derivatives are hedging. Accordingly, the majority of cash

flows associated with the company’s derivative programs are

classified in Cash flows from operating activities in the

Consolidated Statement of Cash Flows. For currency swaps

designated as hedges of foreign currency denominated debt

(includedinthecompany’sdebtriskmanagementprogramas

addressedinnote L,“DerivativesandHedgingTransactions” on

pages 71 to 74),cashflowsdirectlyassociatedwiththesettle-

ment of the principal element of these swaps are reported in

PaymentstosettledebtintheCashflowfromfinancingactivities

sectionoftheConsolidatedStatementofCashFlows.

FinancialInstruments

In determining fair value of its financial instruments, the com-

panyusesavarietyofmethodsandassumptionsthatarebased

onmarket conditionsandrisksexistingat eachbalancesheet

date. For the majority of financial instruments, including most

derivatives, long-term investments and long-term debt, stan-

dard market conventions and techniques such as discounted

cashflowanalysis,optionpricingmodels,replacementcostand

terminationcostareusedtodeterminefairvalue.Dealerquotes

areusedfortheremainingfinancialinstruments.Allmethodsof

assessingfairvalueresultinageneralapproximationofvalue,

andsuchvaluemayneveractuallyberealized.

Cash Equivalents

Allhighlyliquidinvestmentswithmaturitiesofthreemonthsorless

atthedateofpurchaseare consideredtobecashequivalents.

Marketable Securities

Debtsecurities includedinCurrentassetsrepresentsecurities

thatareexpectedtoberealizedincashwithinoneyearofthe

balance sheet date. Long-term debt securities that are not

expected to be realized in cash within one year and alliance

equity securities that are within the scope of SFAS No. 115,

“Accounting for Certain Investments in Debt and Equity

Securities,” are included in Investments and sundry assets.

Those securities are considered available for sale and are

reported at fair value with unrealized gains and losses, net of

applicabletaxes,recordedinAccumulatedgainsand(losses)

not affecting retained earnings within Stockholders’ equity.

Realizedgainsandlossesarecalculatedbasedonthespecific

identificationmethod.Other-than-temporarydeclinesinmarket

value from original cost are charged to Other (income) and

expenseintheperiodinwhichthelossoccurs.Indetermining

whether an other-than-temporary decline in the market value

has occurred, the company considers the duration that, and

extent to which, fair value of the investment is below its cost.

RealizedgainsandlossesalsoareincludedinOther(income)

andexpenseintheConsolidatedStatementofEarnings.

Inventories

Rawmaterials,workinprocessandfinishedgoodsarestatedat

thelower of averagecostormarket. InaccordancewithSFAS

No. 95, “StatementofCashFlows,” cashflowsrelatedtothesale

ofthecompany’sinventories arereflectedin Netcashfromoper-

ating activities from continuing operations in the Consolidated

StatementofCashFlows.

AllowanceforUncollectibleReceivables

TRADE

An allowance for uncollectible trade receivables is estimated

basedonacombinationofwrite-offhistory,aginganalysis,and

anyspecific,knowntroubledaccounts.