IBM 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

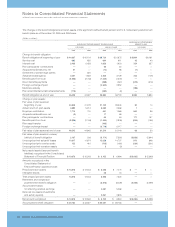

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_91

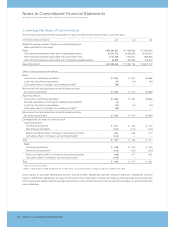

InDecember2005,thecompanyapproved amendments

to the PPP and the SERP which provided that active partici-

pantswillnolongeraccruebenefitsunderthese plans effec-

tive December31,2007.Asaresultofthisaction,thecompany

recordedacurtailmentchargeofapproximately$267millionin

the Consolidated Statement of Earnings for the year ended

December 31, 2005. In addition, the company recorded a

reductionin thePBObalances ofapproximately$775million

and $13 million at December 31, 2005 for the PPP and the

SERP,respectively.

Inaddition,inDecember2005,thecompanyamendedthe

IBMJapanPensionPlan,whichthecompanyconsidersoneof

itsmaterialnon-U.S.pension plans.Thisamendmentmodified

certainplantermsincludingachangeinthemethodofcalculat-

ingbenefitsforcertainparticipantsatDecember31,2005.This

amendmentdidnot impact netperiodiccost/(income),however,

theamendmentresultedina$561 millionreductiontothePBO

asofDecember31,2005.

The overall change in the Net prepaid pension asset bal-

ance from 2004 to 2005 of approximately $500 million was

causedbyanincreasein the prepaidpensionassetrelatedto

thePPPasofDecember31,2005, principallydueto a $1.7bil-

lioncontributionmadebythecompanyinJanuary2005which

increasedthefairvalueofplanassets.Inaddition,aportionof

theoverallincreaseintheprepaidpensionassetinthePPPwas

drivenbythereductionofthePBOasaresultofthe planamend-

mentthatcaused the curtailmentcharge previously discussed.

The reduction in the material non-U.S. plan prepaid pension

assetwasdrivenprincipallybythereductioninthePBOrelated

totheamendmentsmadetotheIBMJapanPensionPlan. The

increaseinthecompany’sPrepaidpensionassetbalancefrom

2003 to 2004 was primarily due to a $700 million contribution

madebythecompanytothePPPduring2004.

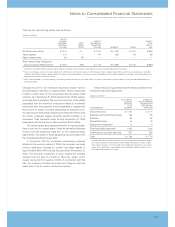

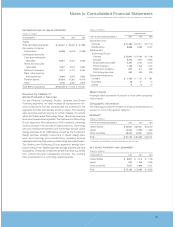

ASSUMPTIONS USED TO DETERMINE PLAN

FINANCIAL INFORMATION

Underlying both the calculation of the PBO and net periodic

cost/(income)areactuarialvaluations.Thesevaluationsusepar-

ticipant-specific information such as salary, age and years of

service,as well as certain assumptions, themostsignificant of

which include: estimates of discount rates, expected return on

plan assets, rate of compensation increases, interest crediting

ratesandmortalityrates.Thecompanyevaluatestheseassump-

tions,ataminimum,annually,andmakeschangesasnecessary.

Followingisinformationonassumptionswhichhadasignif-

icant impact on net periodic cost/(income) and the year-end

benefitobligations for definedbenefit pension plans and non-

pensionpostretirementbenefitplanswereasfollows:

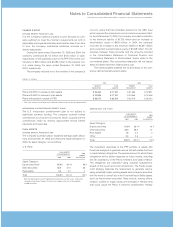

NONPENSIONPOSTRETIREMENT

SIGNIFICANTDEFINEDBENEFITPENSIONPLANS* BENEFITPLANS

U.S. PLANS NON-U.S. PLANS U.S. PLANS

2005 2004 2003 2005 2004** 2003** 2005 2004 2003

Weighted-average assumptions used

to determine netperiodic cost/(income)

fortheyearended December31:

Discountrate ««««5.75% «6.00% «6.75% «4.70% «5.20% «5.50% «5.75% «6.00% 6.75%

Expectedlong-termreturnonplanassets «8.00% «8.00% «8.00% «7.20% «7.50% «7.60% N/A N/A N/A

Rateofcompensationincrease «4.00% «4.00% «4.00% «3.00% 2.90% 3.20% N/A N/A N/A

Weighted-average assumptions

usedto determine benefit

obligationat December31:

Discountrate «5.50% «5.75% «6.00% «4.20% «4.70% «5.20% «««5.50% «5.75% «6.00%

Rateofcompensationincrease «4.00% «4.00% «4.00% «3.00% 3.10% 3.00% N/A N/A N/A

* SignificantdefinedbenefitplansconsistofthequalifiedportionoftheIBMPPPintheU.S.andthematerialnon-U.S.Plans.

** Prioryearamountshavebeenreclassifiedtoconformwithcurrentyearpresentation.

N/A—Notapplicable

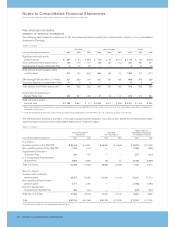

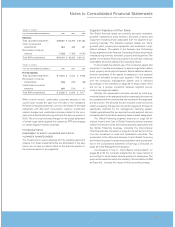

DISCOUNTRATE

Thediscount rate assumptions used forpension and nonpen-

sion postretirement benefit plan accounting reflect the yields

available on high-quality, fixed income debt instruments. For

U.S. discount rates, a portfolio of corporate bonds is con-

structed with maturities that match the expected timing of the

benefitobligationpayments.Inthenon-U.S.,wheremarketsfor

high-quality long-term bonds are not generally as well devel-

oped, long-term government bonds are used as a base, to

which a credit spread is added to simulate corporate bond

yieldsatthesematurities inthejurisdictionofeachplan,asthe

benchmarkfordevelopingtherespectivediscountrates.

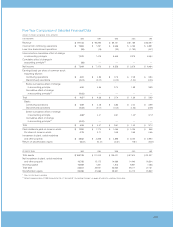

ForthePPP,thechangesinthediscountrateimpactedboth

netperiodiccostandbenefitobligation.Forpurposesofcalcu-

lating the 2005 net periodic cost, the discount rate changed

from6.0percentto5.75percentwhichresultedinanincreasein

net periodic cost of approximately $90 million. Similarly, the

2004changeindiscountratefrom6.75 percentto6.0 percent

increasednetperiodiccostbyapproximately$197million.