IBM 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_35

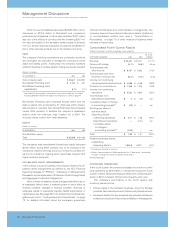

drivenbygrowthinBusinessContinuityandRecoveryServices

of29percent,partiallyoffsetbythereductionforsalesofthird-

party hardware in Japan. BCS revenue increased 6.3 percent

driven by strong growth in BTO. BCS continued to improve its

revenuegrowthrate whenadjustedfor currencyineveryquarter

oftheyear.Maintenancerevenueincreased4.4percentprimarily

drivenbyfavorableimpactsofcurrencymovements.

HARDWARE

SystemsandTechnologyGrouprevenueincreased7.9percent

(4.4percent adjusted forcurrency).zSeriesrevenueincreased

14.9percentduetoclientscontinuingtoaddnewworkloadson

the zSeries platform as they build their on demand infrastruc-

tures,aswellastakingadvantageofthecapabilitiesofthez990

server for consolidations. Mainframes remain the platform of

choice for hosting mission-critical transactions, as well as for

consolidationsandinfrastructuresimplification.Thetotaldeliv-

eryofzSeriescomputingpowerasmeasuredinMIPS increased

33percentin2004versus2003,offsettingpricedeclinesof23

percentperMIP.xSeriesserverrevenueincreased(24 percent)

due to strong growth in both high-end and1&2 Way Servers.

xSeries-related Blade-Center revenue had strong growth, up

over150 percent,as the companyisleading and shapingthe

blademarket. In the fourth quarter of 2004,the companysaw

strong demand for the new POWERBlade, which can run

Windows,LinuxandAIXondifferentserversintheBladeCenter.

pSeriesserverrevenueincreased7.3percent,reflectingclients’

very strong acceptance of the POWER5 systems. The new

pSeries high-end system started shipping in November 2004,

markingthecompletionofatop-to-bottomrefreshofthepSeries

serverproductlineinjustthreemonths.iSeriesserverrevenue

declineddrivenbylowersalesasthetransition to POWER5 is

takinglongerthaninpreviouscycles,as clients musttransition

theiroperatingenvironmenttothenewlevel.

Storage Systems revenue increased 1.6 percent due to

increaseddemandforexternalmidrangedisk(13percent)and

tapeproducts(9percent).Theseincreaseswerepartiallyoffset

bydecreasesinhigh-enddiskproducts(18percent)asclients

anticipatedtheshipmentofthecompany’snewPOWER5high-

endstorageproductwhichwillshipinthefirstquarterof2005.

E&TS hadstrongrevenuegrowthof 93 percentduetoincreased

design and technical services contracts and Microelectronics

revenueincreasedmodestly (1 percent) asyieldsinthe300-mil-

limeterplantimproved.

RetailStoreSolutionsrevenueincreased17.6percentdueto

strongdemandforthecompany’sproductsandtheacquisition

ofProductivitySolutionsInc.inNovember2003.Thisacquisition

drove 6.9 points of the unit’s revenue growth in 2004. Printing

Systems maintenance revenue declined due to lower annuity-

basedrevenueonadeclininginstalledbase.

Personal Computing Division revenue increased14.8 per-

cent (10.5 percent adjusted for currency). The increase was

driven by strong performance worldwide by the company’s

ThinkPad mobile computer (22 percent). Desktop personal

computer revenue increased (4 percent) in 2004 when com-

paredto2003dueprimarilytofavorablecurrencymovements.

SOFTWARE

Softwarerevenue increased5.5percent(0.6percentadjusted

for currency). Middleware revenue increased 6.5 percent (1.5

percentadjusted forcurrency).TheWebSpherefamily ofsoft-

wareofferingsrevenueincreased14percentwithgrowthinbusi-

nessintegrationsoftware(14 percent),WebSpherePortalsoft-

ware (12 percent) and application servers (20 percent). Data

Management revenue increased 7 percent with growth of 12

percentinDB2Databasesoftwareonboththehost(13percent)

and distributed platforms (11 percent), DB2 Tools (8 percent),

and distributed enterprise content management software (22

percent).Rationalsoftwarerevenueincreased(16 percent)with

growth across all product areas. Tivoli software revenue

increased(15percent),aidedbytheCandleacquisition,which

was completed in the second quarter of 2004. Tivoli systems

management, storage and security software all had revenue

growthin2004versus2003.Lotussoftwarerevenueincreased

3percentandOtherFoundationmiddlewareproductsrevenue

alsoincreased2percentduetofavorablecurrencymovements.

Operating system software increased 0.9 percent due to

growthinxSeriesandpSeries,whichcorrelatestotheincreases

intherelatedserverbrands.zSeriesoperatingsystemrevenue

declined1 percentdespitethegrowthinrelatedhardwarevol-

umesduetoongoing softwarepriceperformancedeliveredto

enterpriseclients.iSeriesoperatingsystemsoftwaredeclined6

percentinlinewithrelatedhardwarevolumes.Overall,operating

systems software revenue increased primarily as a result of

favorablecurrencymovements.

GLOBAL FINANCING

Seepage 44 foradiscussionofGlobalFinancing’srevenueand

grossprofit.

ENTERPRISE INVESTMENTS

Revenue from Enterprise Investments increased 10.7 percent

(4.2 percent adjusted for currency). Revenue for product life-

cyclemanagementsoftwareincreasedprimarilyintheautomo-

tiveandaerospaceindustries,partiallyoffsetbylowerhardware

revenue(48percent),primarilyfordocumentprocessors.

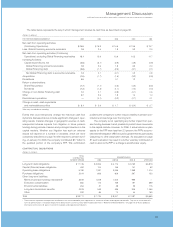

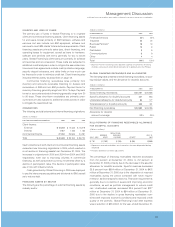

GlobalServicesgrossprofitmarginwasflatyeartoyearat

24.2 percentduetocontinuedinvestmentinondemand infra-

structure and business transformation capabilities, and less

contribution from the higher margin Maintenance business.

These declines were offset by improved profitability in BCS

drivenbyimprovedutilization,reducedoverheadstructureand

animprovedlabormix.

TheincreaseinHardwaremargins of0.8pointsto31.0per-

cent wasprimarilyduetoyieldimprovementsintheMicroelec-

tronicsbusiness andmarginimprovementsin zSeries servers,

xSeriesservers,storageproductsandpersonalcomputers,as

well as the impact of certain hedging transactions (see

“AnticipatedRoyaltiesandCostTransactions” onpage 72).

The Software margin at 87.2 percent increased 0.8 points

due to growth in Software revenue, as well as productivity

improvementsinthecompany’ssupportanddistributionmodels.

Thecostsavingsgeneratedbythecompany’ssupply-chain