IBM 2005 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

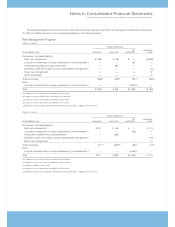

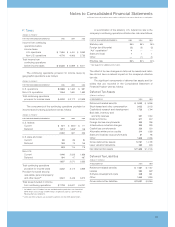

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

80_ NotestoConsolidatedFinancialStatements

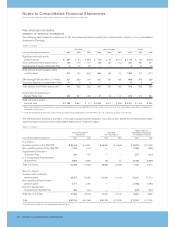

Thevaluation allowance atDecember31, 2005,principally

appliesto certainforeign, stateandlocal,andcapital losscarry-

forwardsthat,intheopinionofmanagement,aremorelikelythan

nottoexpireunutilized.However,to theextentthattaxbenefits

relatedtothesecarryforwardsarerealizedinthefuture,thereduc-

tion inthevaluationallowancewillreduceincometaxexpense.

Forincometaxreturnpurposes,thecompanyhasforeign,

stateandlocal,andcapitallosscarryforwards,thetaxeffectof

which is $662 million. Substantially all of these carryforwards

areavailableforatleastthreeyearsorhaveanindefinitecarry-

forward period. The company also has available alternative

minimum taxcreditcarryforwardsofapproximately$214million

whichhaveanindefinitecarryforwardperiod.

Withlimitedexception,thecompanyisnolongersubjectto

U.S. federal, stateandlocalornon-U.S.incometaxauditsbytax

authoritiesforyearsbefore1999.Theyearssubsequentto1998

containmattersthatcouldbesubjecttodifferinginterpretations

ofapplicabletaxlawsandregulationsasitrelatestotheamount

and/ortimingofincome,deductionsand tax credits.Although

the outcome of tax audits is always uncertain, the company

believesthatadequateamounts of taxandinteresthavebeen

provided for any adjustments that are expected to result for

theseyears.

TheIRScommenceditsauditofthecompany’sU.S.income

taxreturnsfor2001 through2003inthefirstquarterof2005.Asof

December 31, 2005, the IRS has not proposed any significant

adjustments.Thecompanyanticipatesthatthisauditwillbecom-

pletedbytheendof2006.Whileitisnotpossibletopredictthe

impact ofthisaudit onincome tax expense, the companydoes

notanticipatehavingtomakeasignificantcashtaxpayment.

On October 22, 2004, the President signed the American

JobsCreationActof2004(the“Act”).TheActcreated atempo-

raryincentiveforthecompanytorepatriateearningsaccumu-

lated outside the U.S. by allowing the company to reduce its

taxable income by 85 percent of certain eligible dividends

receivedfromnon-U.S.subsidiariesbytheendof2005.Inorder

to benefit from this incentive, the company must reinvest the

qualifyingdividendsintheU.S.underadomesticreinvestment

planapprovedbythe Chief Executive Officer (CEO) and Board

of Directors (BOD). Duringthe thirdquarter of 2005,the com-

pany’sCEOandBODapprovedadomesticreinvestmentplanto

repatriate $9.5 billion of foreign earnings under the Act.

Accordingly, the company recorded income tax expense of

$525millionassociatedwiththisrepatriation.Theadditionaltax

expenseconsistsoffederaltaxes($493million),statetaxes,net

offederalbenefit($22million)andnon-U.S.taxes($10million).

Therepatriationaction resulted inacashtax liability ofapproxi-

mately$225 millionandtheutilizationofexistingalternativemin-

imumtaxcredits.

Thecompanyrepatriated$3.1 billionundertheActinthethird

quarterandtheremaining$6.4billioninthefourthquarterof2005.

Uses of the repatriated funds included domestic expenditures

relatingtoresearchanddevelopment,capitalassetinvestments,

aswellasotherpermittedactivitiesundertheAct.

Thecompanyhasnotprovideddeferredtaxeson$10.1 bil-

lion of undistributed earnings of non-U.S. subsidiaries at

December31,2005,asitisthecompany’spolicytoindefinitely

reinvest these earnings in non-U.S. operations. However, the

companyperiodicallyrepatriatesaportionoftheseearningsto

the extent that it does not incur an additional U.S. tax liability.

Quantificationofthedeferredtaxliability,ifany,associatedwith

indefinitelyreinvestedearningsisnotpracticable.

Foradditionalinformationonthetrendsrelatedtothecom-

pany’songoing effectivetaxrate,aswellasthecompany’scash

tax position, refer to the “Looking Forward” section of the

ManagementDiscussiononpages 37 and38.

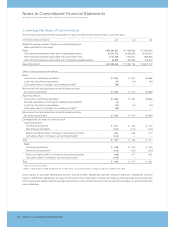

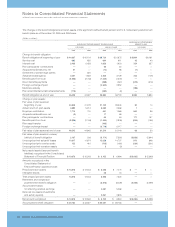

Q.Research,DevelopmentandEngineering

RD&E expense was $5,842 million in 2005, $5,874 million in

2004and$5,314millionin2003.

The company incurred expense of $5,379 million in 2005,

$5,339 million in 2004 and $4,814 million in 2003 for scientific

researchandtheapplicationofscientificadvancestothedevel-

opmentofnewandimprovedproductsandtheiruses,aswellas

services and their application. Of these amounts, software-

relatedexpensewas$2,689 million,$2,626millionand$2,393

million in 2005, 2004 and 2003, respectively. Included in the

expensewasachargeof$1 millionand$9millionin 2005and

2003,respectively, foracquiredin-processR&D.

Expense for product-related engineering was $463 million,

$535millionand$500millionin2005,2004and2003,respectively.

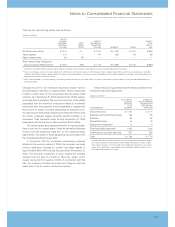

R.2005Actions

InMay2005,managementannounceditsplanstoimplementa

series of restructuring actions designed to improve the com-

pany’s efficiencies, strengthen its client-facing operations and

capture opportunities in high-growth markets. The company’s

actions primarily included voluntary and involuntary workforce

reductions, with the majority impacting the Global Services

segment,primarilyinEurope,aswellascostsincurredincon-

nectionwiththevacatingofleasedfacilities.Theseactionswere

inadditiontothecompany’s ongoing workforcereductionand

rebalancingactivitiesthatoccureachquarter.Thetotalcharges

expectedto be incurred in connection withallsecond-quarter

2005initiativesisapproximately$1,799million($1,776millionof

which has been recorded cumulatively through December 31,

2005)andtheseinitiativesareexpectedtobecompletedwithin

one year. Approximately $1,625 million of the total charges

require cash payments, of which approximately $1,066 million

havebeenmadeasofDecember31,2005and$391 millionare

expectedtobemadeoverthenext 12 months.