IBM 2005 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_29

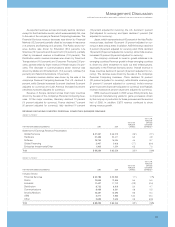

HARDWARE

(Dollarsinmillions)

YR. TOYR.

FORTHEYEARENDEDDECEMBER31: 2005 2004 CHANGE

Hardwarerevenue: $«23,857 $«30,710 (22.3) %

SystemsandTechnology

Group $«20,981 $«19,973 5.0%

zSeries (7.6)

iSeries 0.8

pSeries 14.6

xSeries 5.9

StorageSystems 15.3

Microelectronics 15.6

Engineering&

TechnologyServices 39.2

RetailStoreSolutions (23.0)

PrinterSystems (8.6)

PersonalComputingDivision 2,876 10,737 NM

NM—NotMeaningful

Microelectronicsrevenueincreasedduetoimprovedman-

ufacturingyieldsandvolumesforgameprocessors.Thefourth

quarterof2005wasthefirstfullquarterofproductionforthese

processors.Partiallyoffsettingthisincreasewasa softeningof

demandforsomeofthecompany’soldertechnology. E&TS rev-

enuecontinuedtoshowstronggrowthasitrepresentsaunique

opportunity for the company to leverage its deep capabilities,

expertise and assets in engineering design to benefit client

engineeringandR&Dprocesses.E&TSis akeycomponentof

thecompany’sbusinessesthataddresstheBPTSopportunity.

RetailStoresSolutionsrevenuedecreasedprimarilydueto

anumberoflargetransactions in2004anddemandfromthese

clients declined in 2005. Printer Systems revenue decreased

dueprimarilytolower hardwareandmaintenancesales.

PersonalComputingDivisionrevenuedecreasedasaresult

of the company divesting its Personal Computing business to

LenovoonApril30,2005. The2005resultshavefourmonthsof

revenue versus 12 months in 2004. See note C, “Acquisitions/

Divestitures,” onpages 66and67 foradditionalinformation.

SystemsandTechnologyGrouprevenueincreased5.0 percent

(5percent adjusted forcurrency)in2005versus2004. pSeries

serverrevenueincreasedwithdoubledigitgrowthinallgeogra-

phiesasclientscontinuetorecognizethestrengthandleader-

shipofthePOWERarchitecture.InearlyOctober,thecompany

announcedanewPOWER5+processorthatincludestheindus-

try’sfirstQuadCoreModule,whichputsfourprocessorcoreson

asinglepieceofceramic. AdditionalnewpSeries productswill

bedeliveredin2006. Thecompanyexpectstogainshareinthe

UNIX market when the 2005 external results are reported.

iSeries server revenue increased driven by broad demand for

thecompany’sPOWER5basedofferings. Demandinthefourth

quarter of 2005 fell off as clients anticipated the first-quarter

2006announcementofthenewPOWER5+ basedproducts. In

2005,iSeriesaddedover2,500new clients,reflectingacontin-

uedcommitmenttotheplatformfrom ISVs,resellersand clients.

Within xSeries, server revenue increased 7 percent despite

strongcompetitivepressuresdrivinglowerprices,particularlyin

EuropeandAsia.Thecompany’smomentuminBladesremains

strongwithrevenuegrowthof65percentin2005versus2004.

Thecompanyexpectstomaintainits market leadershipposition

inBladecenter. Although zSeriesserver revenuedeclined ver-

sus 2004, MIPS volumes grew 7 percent in 2005. The MIPS

growth was driven by the company’s new System z9 which

began shipping in late September 2005. The zSeries clients

continue to add new workloads to this platform as they build

their on demand infrastructure. These new workloads have

acceleratedJavaandLinuxadoptiononthezSeriesplatform.

TotalStoragerevenuegrowthwas driven by Totaldiskrev-

enuegrowthof19percent,while tape grew 9 percentin2005

versus2004. Within Externaldisk,mid-rangediskandenterprise

products both had strong revenue growth of approximately 24

percent in 2005 versus 2004. The company believes it gained

marketshareinexternaldiskandextendeditsmarketleadership

intape.

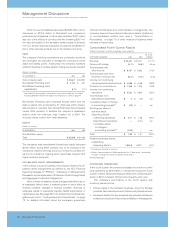

(Dollarsinmillions)

YR. TOYR.

FORTHEYEARENDEDDECEMBER31: 2005 2004 CHANGE

Hardware:

Grossprofit $«8,718 $«9,505 (8.3) %

Grossprofitmargin 36.5% 31.0% 5.5 pts.

Thedecreaseingrossprofitdollars for2005versus2004was

primarilyduetothesaleofthecompany’sPersonalComputing

business. Theincreaseingrossprofitmarginwasalsoprimarily

due to the divestiture of the Personal Computing business

(whichhadalowergrossprofitmarginthantheotherhardware

products) in the second quarter of 2005. This divestiture con-

tributed 3.8 pointsoftheimprovementintheHardwaremargin.

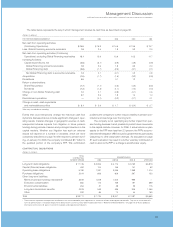

Systems and Technology Group gross profit margins

declined 1.2 points to 40.4 percent in 2005 versus 2004.

Microelectronicsmarginsimprovedandcontributed 0.6 points

of improvementasmanufacturingyieldsandvolumesincreased

on game processors. In addition, margin improvements in

pSeries contributed 0.5 points to the overall margin. These

improvements were more than offset by lower margins in

StorageSystemswhichimpactedtheoverallmarginby 1.1 points

primarilyduetointensifiedcompetitionresultinginproductdis-

countingand the mix to mid-range disk andtapeproducts.In

addition, zSeries,xSeries andiSeriesservers hadlowermargins

whichimpactedtheoverallmarginby 0.8points,0.2 pointsand

0.2 points,respectively.

Differences between the Hardware segment gross profit

marginandgrossprofitdollaramountsaboveandtheamounts

reportedonpage 25 (andderivedfrompage 48)primarilyrelate

totheimpactofcertainhedgingtransactions(see“Anticipated

Royalties and Cost Transactions” on page 72). The recorded

amountsfor thesetransactions areconsideredunallocatedcor-

porateamountsforpurposesofmeasuringthesegment’sgross

marginperformanceandthereforearenotincludedintheseg-

mentresults above.