IBM 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_27

general and administrative expense ($308 million); Research,

developmentandengineeringexpense($94million);and,Other

(income) and expense ($8 million). See note U, “Stock-Based

Compensation,” onpages 83 to 85 foradditionalinformation.

RETIREMENT-RELATED BENEFITS

Thefollowing table providesthe total pre-taxcostfor allretire-

ment-relatedplans.Costamountsareincludedasanadditionto

thecompany’scostandexpenseamountsintheConsolidated

Statement of Earnings within the caption (e.g., Cost, SG&A,

RD&E)relatingtothejobfunctionoftheindividualsparticipating

intheplans.

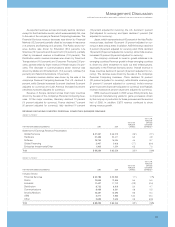

(Dollarsinmillions)

YR. TOYR.

FORTHEYEARENDEDDECEMBER31: 2005 2004 CHANGE

Retirement-relatedplanscost:

Definedbenefitandcontribution

pensionplanscost $«2,058 $«1,072 92.0%%

Nonpensionpostretirement

planscosts 379 372 1.9

Total $«2,437 $«1,444 68.8%

Overall,retirement-relatedplancostsincreased$993millionver-

sus 2004. The 2005 increase was driven by the amortization of

deferredcharges,aswellaschangesinthediscountrates,akey

assumption underlying the valuation of the plans. During 2005,

the company recognized approximately $1,100 million of previ-

ouslydeferredactuariallosses(asaresultoftheamortizationof

assumptionchanges)whichcontributedapproximately$700mil-

lionoftheincreaseinretirement-relatedexpensein2005.Inaddi-

tion,onDecember 31,2004,the company lowered the discount

rate assumption inanumberofcountries whichincreasedpre-tax

expense by approximately $300 million in 2005. Additionally,

during2005,thecompanyrecordedacurtailmentchargeof$267

million in the fourth quarter as a result of U.S. pension plan

amendments,aswellasa$65millionchargeinthesecondquar-

terrelatedtotherestructuringactions.Offsettingtheyear-to-year

effectsofthese one-time charges recordedin2005 was a one-

timechargeof $320millionrecordedin2004forthepartialsettle-

mentofcertainlegalclaimsagainsttheU.S.pensionplan.

The $993 million year-to-year increase impacted Cost,

SG&A, RD&EandOther(income)and expensebyapproximately

$648 million, $236 million, $95 million and $14 million, respec-

tively.Seenote V,“Retirement-RelatedBenefits,” onpages 85 to

95 for a detailed discussion of the company’s benefit plans

including a description of the plans, accounting policies, plan

financialinformationandassumptions.

INCOME TAXES

Theprovisionforincometaxesresultedinaneffectivetaxrateof

34.6 percentfor2005,comparedwiththe2004 effectivetaxrate

of 29.7 percent.The 4.9 point increaseintheeffectivetaxratein

2005 wasprimarilyduetothe third-quarter2005taxchargeasso-

ciated with the repatriation of $9.5 billion under the American

JobsCreationActof 2004. Seenote P, “Taxes,” onpage 80 for

additionalinformationconcerningthisrepatriationtaxcharge.

WEIGHTED-AVERAGE COMMON SHARES

YR. TOYR.

FORTHEYEARENDEDDECEMBER31: 2005 2004 CHANGE

Earningspershareof

commonstock:

Assumingdilution:

Continuingoperations $«««««4.91 $«««««4.39 11.8%

Discontinuedoperations «(0.01) «(0.01) 45.0

Cumulativeeffect

ofchangein

accountingprinciple** «(0.02) «««««— NM

Total $«««««4.87* $«««««4.38 11.2%

Basic:

Continuingoperations $«««««4.99 $«««««4.48 11.4%

Discontinuedoperations «(0.02) «(0.01) 44.6

Cumulativeeffect

ofchangein

accountingprinciple** «(0.02) ««««— NM

Total $«««««4.96* $«««««4.47 11.0%

Weighted-averageshares

outstanding(inmillions):

Assumingdilution «1,627.6 ««««1,707.2 (4.7) %

Basic 1,600.6 1,675.0 (4.4)

* Doesnottotalduetorounding.

** ReflectsimplementationofFASBInterpretationNo.47.Seenote B,“Accounting

Changes,” onpages61 and62 foradditionalinformation.

NM—NotMeaningful

Theaveragenumberofcommonsharesoutstandingassuming

dilutionwaslowerby 79.6 millionsharesin2005 versus 2004.

Thedecreasewasprimarilytheresultofthecompany’scommon

share repurchase program. See note N, “Stockholders’ Equity

Activity,” onpages 75 and 76 foradditionalinformationregard-

ingthecommonshareactivities.Alsoseenote S,“EarningsPer

ShareofCommonStock,” onpage 82.

SegmentDetails

The following is an analysis of the 2005 versus 2004 external

segmentresults.Theanalysisof2004versus2003externalseg-

mentresultsisonpages 34 to 36.

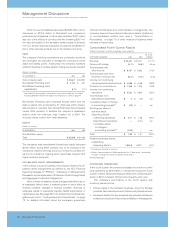

GLOBAL SERVICES

(Dollarsinmillions)

YR. TOYR.

FORTHEYEARENDEDDECEMBER31: 2005 2004 CHANGE

GlobalServicesrevenue: $«47,357 $«46,213 2.5%

StrategicOutsourcing $«19,766 $«19,309 2.4%

BusinessConsultingServices 14,185 13,767 3.0

IntegratedTechnologyServices 7,538 7,441 1.3

Maintenance 5,868 5,696 3.0

Global Services revenue increased 2.5 percent (2.1 percent

adjusted for currency) in 2005 versus 2004. Although SO rev-

enuecontinuedtogrow,itexperiencedaslowdowninitsrevenue