IBM 2005 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

92_ NotestoConsolidatedFinancialStatements

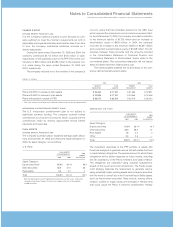

Forpurposes ofcalculatingthebenefitobligation,thedis-

count rate used in 2005 was 5.5 percent which was 25 basis

pointslowerthanthe2004rateof5.75percent.Thisdecrease

resulted in anincreaseinthebenefitobligationofapproximately

$1,272 million in2005.Thechangeindiscountratein2004from

6.0percentto5.75percentresultedinanincreasein the benefit

obligationin2004ofapproximately$1,193million.

FortheU.S.nonpensionpostretirementplan, the discount

rate changes did not have a material effect on net periodic

cost/(income) and the benefit obligation for the years ended

December31,2005and 2004.

EXPECTEDRETURNONPLANASSETS

Expected returns on plan assets take into account long-term

expectations for future returns and investment strategy. These

ratesaredevelopedbythecompanyinconjunctionwithexter-

naladvisors, are calculatedusinganarithmeticaverageand are

testedforreasonablenessagainstthehistoricalreturnaverage

by asset category, usually over a ten-year period. The use of

expectedlong-termratesofreturnonplanassetsmayresultin

recognized pension income that is greater or less than the

actualreturnsofthoseplanassetsinanygivenyear.Overtime,

however, the expected long-term returns are designed to

approximatetheactuallong-termreturnsandthereforeresultin

apatternofincomeandexpenserecognitionthatmoreclosely

matchesthepatternoftheservicesprovidedbytheemployees.

Differencesbetweenactualandexpectedreturns,acomponent

ofunrecognizedgains/losses, arerecognized overtheservice

lives of the employees in the plan, provided such amounts

exceedthresholdswhicharebasedupontheobligationorthe

valueofplanassets,asprovidedbyaccountingstandards.

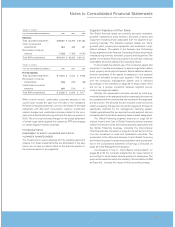

ForthePPP,theexpectedlong-termreturnonplanassets

did not change for the years ended December 31, 2005 and

2004and,asaresult,hadnoincrementalimpactonnetperiodic

cost/(income).

Forthenon-U.S.definedbenefitplans,thechangesinthe

expectedlong-term returnon plan assetsassumptions for the

yearended December 31,2005 whencomparedwith theyear

endedDecember 31, 2004resultedin an increasein netperi-

odicpensioncostof$140 million.Thechangesintheexpected

long-termreturnonplanassetsassumptionsfortheyearended

December31,2004forcertainnon-U.S.planswhencompared

withtheyearendedDecember31,2003resultedinanincrease

innetperiodicpensioncostof$54million.

For the U.S. nonpension postretirement benefit plan, the

companymaintainsanominal,highlyliquidtrustfundbalanceto

ensure payments are made timely. As a result, for the years

ended December 31, 2005 and 2004, the expected long-term

returnonplanassetsandtheactualreturnonthoseassetswere

notmaterial.

RATEOFCOMPENSATIONINCREASESANDMORTALITYRATE

Therateofcompensationincreasesandmortalityratesarealso

significant assumptions used in the actuarial model for pension

accounting.Therateofcompensationincreasesisdeterminedby

thecompany,baseduponitslong-termplansforsuchincreases.

Mortality rate assumptions are based on life expectancy and

deathratesfordifferenttypesofparticipants.Therewasnosignif-

icantimpacttotheprojectedbenefitobligationortonetperiodic

costasaresultofchangestotherateofcompensationincreases

or to mortality rate assumptions during the years ended

December31,2005and2004.

INTERESTCREDITINGRATE

BenefitsforcertainparticipantsinthePPParecalculatedusing

acashbalanceformula.Anassumptionunderlyingthisformula

isaninterestcreditingrate,whichimpactsbothnetperiodiccost

andtheprojected benefitobligation.Thisassumptionprovides

abasisforprojectingtheexpectedinterestratethatparticipants

willearnonthebenefitsthattheyare expectedtoreceiveinthe

following year and are based on the average, from August to

October of the one-year U.S. Treasury Constant Maturity yield

plusonepercent.

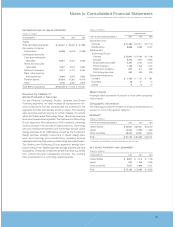

Forthe PPP, the changeinthe interest creditingrate from

2.3percentfortheyearendedDecember31,2004to3.1 percent

fortheyearendedDecember31,2005resultedinanincreaseto

netperiodiccostof$55million. Thechangeintheinterestcred-

iting rate from 2.7 percent for the year ended December 31,

2003 to 2.3 percent for the year ended December 31, 2004

resultedin a decreasetonetperiodiccostof$20 million.

HEALTHCARECOSTTRENDRATE

For nonpension postretirement plan accounting, the company

reviewsexternaldataanditsownhistoricaltrendsforhealthcare

coststodeterminethehealthcarecosttrendrates. However, the

healthcare cost trend rate has an insignificant effect on plan

costsandobligations asaresultofthetermsoftheplanwhich

limitthecompany’sobligationtotheparticipants.

Thecompanyassumesthatthe healthcarecost trendrate

for 2006 will be 9 percent. In addition, the company assumes

thatthesametrendratewilldecreaseto5percentoverthenext

4 years. A one-percentage point increase or decrease in the

assumedhealthcarecost trendratewouldnothavea material

effect upon net periodic cost or the benefit obligation as of

December31,2005.