IBM 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

26_ ManagementDiscussion

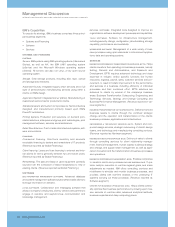

OTHER(INCOME)ANDEXPENSE

(Dollarsinmillions)

YR. TOYR.

FORTHEYEARENDEDDECEMBER31: 2005 2004* CHANGE

Other(income)andexpense:

Foreigncurrency

transactionlosses $«««««170 $««381 (55.4) %

Interestincome (307) (180) 70.6

Netrealizedgainsonsalesof

securitiesandotherinvestments (111) (59) 88.1

Netrealized(gains)/lossesfrom

certainrealestateactivities (179) (71) 152.1

Restructuring 231 —NM

Lenovo/Microsoftgains (1,883) —NM

Other (43) (94) (54.3)

Total $«(2,122) $«««(23) NM

* Reclassifiedtoconformwith2005presentation.

NM—NotMeaningful

Other(income) and expense wasincome of $2,122 millionand

$23 millionin2005and2004,respectively.Theincreasewaspri-

marilydrivenbythegainonthesaleofthecompany’sPersonal

Computing business. The pre-tax gain associated with this

transaction was $1,108 million. See note C, “Acquisitions/

Divestitures” on pages 66 to 67 for additional information. In

addition, the company settled certain antitrust issues with the

MicrosoftCorporationandthegainfromthissettlementwas$775

million;additionalInterestincomegeneratedbythecompanyin

2005;andlowerforeigncurrencytransactionlosseswhichrelate

tolossesoncertainhedgecontractsoffsetby settlementoffor-

eign currency receivables and payables. See “Currency Rate

Fluctuations,” on page 42 for additionaldiscussion of currency

impacts on the company’s financial results. The company also

hadadditionalgainsfromthesaleofcertainrealestatetransac-

tionsin 2005 versus 2004.These gainswerepartially offset by

real-estaterelatedrestructuringchargesrecordedinthesecond

quarterof2005.Seenote R,“2005Actions” onpages 80 and81

foradditionalinformation.

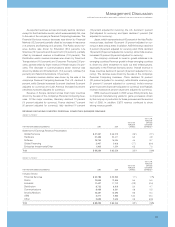

RESEARCH,DEVELOPMENTANDENGINEERING

(Dollarsinmillions)

YR. TOYR.

FORTHEYEARENDEDDECEMBER31: 2005 2004 CHANGE

Research,development

andengineering:

Total $«5,842 $«5,874 (0.6) %

ThedeclineinResearch, developmentand engineering(RD&E)

was driven by the sale of the company’s Personal Computing

businessinthesecondquarterof2005($93million)andlower

spending in Microelectronics ($93 million) and Software ($25

million). These decreases were partially offset by increased

spendinginSystemsandTechnologyforserverproducts($171

million).Included in RD&Eexpense was increasedretirement-

relatedexpenseof$95 million andadecreaseof$94millionfor

stock-basedcompensationexpensein2005versus2004.

INTELLECTUALPROPERTYANDCUSTOMDEVELOPMENTINCOME

(Dollarsinmillions)

YR. TOYR.

FORTHEYEARENDEDDECEMBER31: 2005 2004 CHANGE

Intellectualpropertyand

customdevelopmentincome:

Salesandothertransfers

ofintellectualproperty $«236 $««««466 (49.4) %%

Licensing/royalty-basedfees 367 393 (6.6)

Customdevelopmentincome 345 310 11.3

Total «$«948 $«1,169 (19.0) %

Thedecreasein Sales andothertransfersofintellectualprop-

erty was primarily due to Applied Micro Circuits Corporation’s

(AMCC) acquisition of the company’s IP associated with its

embeddedPowerPC4xxstandardproductsfor$208millionin

2004. ThetimingandamountofSalesandothertransfersofIP

may vary significantly from period to period depending upon

timing of divestitures, industry consolidation, economic condi-

tionsandthetimingofnewpatentsandknow-howdevelopment.

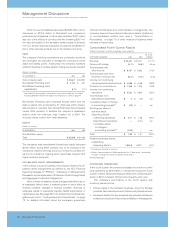

actions and the Personal Computing business divestiture,

lower stock-based compensation expense (see “Stock-Based

Compensation” caption below for additional information) and

lower ongoing workforce reductions. In addition, Bad debt

expensedeclinedprimarilydueto decreasedspecificreserve

requirements, an overallreductioninthefinancingassetportfo-

lio(seeGlobalFinancingReceivablesandAllowancesonpage

45 for additional information), the improvement in economic

conditionsandimprovedcreditquality.

INTERESTEXPENSE

(Dollarsinmillions)

YR. TOYR.

FORTHEYEARENDEDDECEMBER31: 2005 2004 CHANGE

Interestexpense:

Total $«220 $«139 58.6%%

The increase in Interest expense was primarily driven by higher

average non-Global Financing debt and higher effective interest

ratesin2005versus2004.InterestexpenseispresentedinCostof

GlobalFinancingintheConsolidatedStatementofEarningsonlyif

the related external borrowings are to support the Global

Financingexternalbusiness.Seepages 46 and 47 foradditional

informationregardingGlobalFinancingdebtandinterestexpense.

STOCK-BASED COMPENSATION

Total pre-tax stock-based compensation expense of $1,035 mil-

lion decreased $543 million compared to 2004. This decrease

wasprincipallytheresultofchangesinthecompany’sequitypro-

grams, primarily driven by: (1) a reduction in the level and fair

value ofstockoptiongrants($306million)and(2)changestothe

terms of the company’s employee stock purchase plan, which

renderedit non-compensatory in thesecond quarter of 2005 in

accordancewiththeprovisionsofSFAS 123(R)($186million).The

year-to-year reductions in pre-tax compensation expense were

reflectedinthefollowingcategories:Cost($133million);Selling,