IBM 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_15

foreigncurrencyexchangeratesandthereforefacilitatesa

comparative view of business growth. The percentages

reportedinthefinancialtablesthroughouttheManagement

Discussionarecalculatedfromtheunderlyingwhole-dollar

numbers.See“CurrencyRateFluctuations” onpage 42 for

additionalinformation.

HelpfulHints

ORGANIZATION OF INFORMATION

• ThisManagementDiscussionsectionprovidesthereaderof

the financial statements with a narrative on the company’s

financialresults.Itcontainstheresultsofoperationsforeach

segment of the business, followed by a description of the

company’s financial position, as well as certain employee

data.ItisusefultoreadtheManagementDiscussionincon-

junction with note W, “Segment Information,” on pages 95

through 99.

• Pages 48 through 53 include the Consolidated Financial

Statements. These statements provide an overview of the

company’sincomeandcashflowperformanceanditsfinan-

cialposition.

• The notes follow the Consolidated Financial Statements.

Among other things, the notes contain the company’s

accountingpolicies(pages 54 to 61),detailedinformationon

specificitemswithinthefinancialstatements,certaincontin-

genciesand commitments (pages 76 through 78),and the

resultsofeachIBMsegment(pages 95 through 99).

2004AnnualReport

EffectiveJanuary1,2005,thecompanyadoptedtheprovisionsof

StatementofFinancialAccountingStandards(SFAS)No.123(R),

“Share-BasedPayment,” (“SFAS123(R)”).Thecompanyelected

toadoptthemodifiedretrospectiveapplicationmethodprovided

bySFAS123(R).Thismethodpermitstherestatementofhistorical

financialstatementamounts.Seenote A,“SignificantAccounting

Policies,” on pages 58 and 59 and note U, “Stock-Based

Compensation,” onpages 83 to 85 foradditionalinformation.

In addition, as a result of the divestiture of the Personal

Computingbusinessin2005,thecompanyreviseditsoperating

segments in the second quarter. See note W, “Segment

Information,” onpage 95 foradditionalinformation.Accordingly,

asaresultoftheseactions,thecompanyfiledarestated2004

Annual Report with the Securities and Exchange Commission

(SEC) onForm8-KonJuly27,2005.

DiscontinuedOperations

On December 31, 2002, the company sold its hard disk drive

(HDD) business to Hitachi, Ltd. (Hitachi). The HDD business

wasaccountedforasadiscontinuedoperationunder generally

acceptedaccountingprinciples (GAAP) whichrequiresthatthe

incomestatement and cashflowinformationbereformattedto

separatethedivestedbusinessfromthecompany’scontinuing

operations.Seepage 36 foradditionalinformation.

Forward-LookingandCautionaryStatements

CertainstatementscontainedinthisAnnualReportmayconsti-

tuteforward-lookingstatementswithinthemeaningofthePrivate

Securities Litigation Reform Act of 1995. These statements

involve a number of risks, uncertainties and other factors that

could cause actual results to be materially different, as dis-

cussed more fully elsewhere in this Annual Report and in the

company’s filings with the SEC, including the company’s 2005

Form10-KfiledonFebruary28,2006.

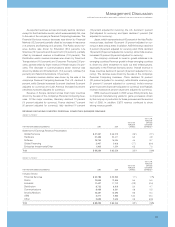

ManagementDiscussionSnapshot

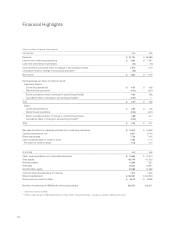

(Dollarsandsharesinmillionsexceptpershareamounts)

YR. TOYR.

PERCENT/

MARGIN

FORTHEYEARENDEDDECEMBER31: 2005 2004 CHANGE

Revenue $««91,134 $««96,293 (5.4) % *

Grossprofitmargin «40.1% «36.9% 3.2 pts.

Totalexpenseand

otherincome $««24,306 $««24,900 (2.4) %

Totalexpenseandother

incometorevenueratio «26.7% «25.9% 0.8 pts.

Incomefromcontinuing

operationsbefore

incometaxes $««12,226 $««10,669 14.6%

Provisionforincometaxes $««««4,232 $««««3,172 33.4%

Incomefromcontinuing

operations $««««7,994 $««««7,497 6.6%

Earningspershareof

commonstock:

Assumingdilution:

Continuingoperations $««««««4.91 $««««««4.39 11.8%

Discontinuedoperations «(0.01) (0.01) 45.0%

Cumulativeeffect

ofchangein

accountingprinciple++ «(0.02) «— NM

Total $««««««4.87 +$««««««4.38 11.2%

Weighted-averageshares

outstanding:

Diluted «1,627.6 «1,707.2 (4.7) %

Assets** «$105,748 «$111,003 (4.7) %

Liabilities** «$««72,650 «$««79,315 (8.4) %

Equity** «$««33,098 «$««31,688 4.4%

* (5.8) percentadjusted forcurrency.

** AtDecember31

+ Doesnottotalduetorounding.

++ReflectsimplementationofFASBInterpretationNo.47.Seenote B,“Accounting

Changes,”onpages61 and62 foradditional information.

NM—NotMeaningful

ContinuingOperations

In 2005, the company delivered solid growth in earnings and

cashgeneration—balancedacrossitsportfolio—andexecuteda

series of actions to improve productivity and to reallocate

resourcestothefastergrowingareasofthebusiness.