IBM 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_45

SOURCES AND USES OF FUNDS

The primary use of funds in Global Financing is to originate

client andcommercialfinancingassets.Client financingassets

for end users consist primarily of IBM hardware, software and

services, but also include non-IBM equipment, software and

servicestomeetIBMclients’ totalsolutionsrequirements.Client

financingassetsareprimarilysales type,directfinancing, and

operatingleasesforequipment,aswellasloansforhardware,

software and services with terms generally for two to seven

years. GlobalFinancing’s client loansareprimarilyforsoftware

andservicesandareunsecured. Theseloansaresubjectedto

additionalcreditanalysisinordertomitigatetheassociatedrisk.

Unsecuredloanagreementsincludecreditprotectivelanguage,

securitydeposit advances,anddollarlimitson howmuchcan

befinancedinordertominimizecreditrisk. Client financingalso

includesinternalactivityasdescribedonpage 43.

Commercial financing receivables arise primarily from

inventory and accounts receivable financing for dealers and

remarketers of IBM and non-IBM products. Payment terms for

inventoryfinancinggenerallyrangefrom30to75days.Payment

termsforaccountsreceivablefinancinggenerallyrangefrom30

to 90 days. These short-term receivables are primarily unse-

cured andarealsosubjecttoadditionalcreditactionsinorder

tomitigatetheassociatedrisk.

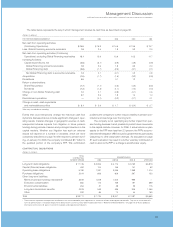

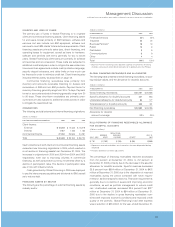

ORIGINATIONS

Thefollowingaretotalexternalandinternalfinancingoriginations.

(Dollarsinmillions)

FORTHEYEARENDEDDECEMBER31: 2005 2004 2003

Client finance:

External $«12,249 $«12,433 $«13,279

Internal 1,167 1,185 1,150

Commercialfinance 27,032 25,566 24,291

Total $«40,448 $«39,184 $«38,720

Cashcollectionsofboth client andcommercialfinancingassets

exceedednewfinancingoriginationsin2005,whichresultedin

anetdeclineinfinancingassetsfromDecember31,2004.The

increases inoriginationsin2005and2004from2004and2003

respectively, were due to improving volumes in commercial

financing,aswellasfavorablecurrencymovementsoffsetbya

declineinparticipationrates.Thedeclineinparticipationrates

wasinlinewithindustrytrends.

CashgeneratedbyGlobalFinancingin2005wasdeployed

topaytheintercompanypayables anddividendstoIBM,aswell

astoreducedebt.

FINANCING ASSETS BY SECTOR

Thefollowingarethepercentageofexternalfinancingassetsby

industrysector.

(Dollarsinmillions)

ATDECEMBER31: 2005 2004

FinancialServices 33% 30%

Industrial 20 20

BusinessPartners* 19 19

Public 10 9

Distribution 89

Communications 69

Other 44

Total 100% 100%

* BusinessPartners’ financingassetsrepresentaportionofcommercialfinancing

inventoryandaccountsreceivablefinancingfortermsgenerallylessthan90days.

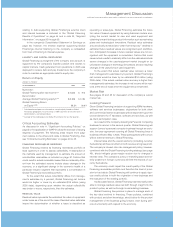

GLOBAL FINANCING RECEIVABLES AND ALLOWANCES

Thefollowingtablepresentsexternalfinancingreceivables,exclud-

ingresidualvalues,andtheallowancefordoubtfulaccounts.

(Dollarsinmillions)

ATDECEMBER31: 2005 2004

Grossfinancingreceivables $«23,197 $«26,836

Specificallowancefor doubtfulaccounts 421 654

Unallocatedallowancefordoubtfulaccounts 84 127

Totalallowancefordoubtfulaccounts 505 781

Netfinancingreceivables $«22,692 $«26,055

Allowancefordoubtful

accountcoverage 2.2% 2.9%

ROLL-FORWARD OF FINANCING RECEIVABLES ALLOWANCE

FOR DOUBTFUL ACCOUNTS

(Dollarsinmillions)

REDUCTIONS:

RESERVE BADDEBT DEC. 31,

JAN. 1,2005 USED* EXPENSE OTHER** 2005

$«781 $«(183) $«(35) $«(58) $«505

* Representsreservedreceivables,netofrecoveries,thatweredisposedofduring

theperiod.

** Primarilyrepresentstranslationadjustments.

The percentage of financing receivables reserved decreased

from 2.9 percent at December 31, 2004, to 2.2 percent at

December31,2005primarilyduetothedecreaseinthespecific

allowance for doubtful accounts. Specific reserves decreased

35.6 percent from $654 million at December 31, 2004 to $421

millionatDecember31,2005duetothedispositionofreserved

receivables during the period combined with lower require-

mentsforadditionalspecificreserves.Thislowerrequirementis

generally due to a decline in assets and improving economic

conditions, as well as portfolio management to reduce credit

risk. Unallocated reserves decreased 33.9 percent from $127

million at December 31, 2004 to $84 million at December 31,

2005 due to the decline in gross financing receivables com-

binedwithimprovedeconomicconditionsandimprovedcredit

quality of the portfolio. Global Financing’s bad debt expense

wasareductionof $35millionfortheyearendedDecember31,