IBM 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

44_ ManagementDiscussion

ResultsofOperations

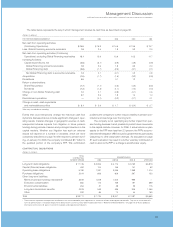

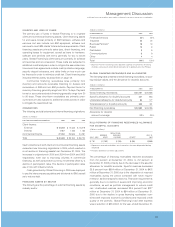

(Dollarsinmillions)

FORTHEYEARENDEDDECEMBER31: 2005 2004 2003

Externalrevenue $«2,401 $«2,607 $«2,827

Internalrevenue 1,506 1,287 1,300

Totalrevenue 3,907 3,894 4,127

Cost 1,648 1,540 1,846

Grossprofit $«2,259 $«2,354 $«2,281

Grossprofitmargin 57.8% 60.5% 55.3%

Pre-taxincome $«1,583 $«1,458 $«1,152

After-taxincome* $«1,032 $««««915 $««««746

Returnonequity* 33.2% 28.6% 22.1%

* Seepage 47 forthedetailsoftheAfter-taxincomeandtheReturnon equity calculation.

TotalGlobalFinancingrevenueincreased0.3 percentin2005as

comparedto2004,drivenbyInternal revenuegrowth.External

revenue decreased 7.9 percent (8.6 percent adjusted for cur-

rency) versus 2004 primarily driven by financing revenue of

$1,720millionin2005versus$1,899millionin2004,adecrease

of9.4percent,duetoloweraverageassetbalancesanddeclin-

ingassetyields.Internalrevenueincreased 17.0 percentversus

2004 driven by used equipment sales of $962 million in 2005

versus$716millionin2004,anincreaseof34.4percent,partially

offsetbyfinancingincomeof$544millionin2005versus$571

millionin2004,adecreaseof 4.7 percent.Theincreaseinused

equipmentsalesisduetohighersalestotheHardware segment,

aswellasearlyterminations ofinternal leases and the subse-

quentsaleofthisequipmenttoGlobalServices.

Total Global Financing revenue declined 5.6 percent in

2004ascomparedto2003.Externalrevenuedecreased7.8per-

cent(11.5percent adjustedfor currency)versus2003, primarily

drivenbyexternalusedequipmentsalesof$708millionin2004

versus$928millionin2003,adecreaseof23.7percent. Internal

revenuedecreased1.0percentin 2004 driven by remarketing

revenueof $783millionin2004versus$828million in 2003,a

decreaseof5.4percent,partiallyoffsetbycommercialfinancing

revenueof$269millionin2004versus$240millionin2003,an

increaseof12.2percent.

GlobalFinancinggrossprofitdollarsdecreased$95million

or 4.0 percent and gross profit margin declined 2.7 points in

2005versus2004.Thedecreaseingrossprofitdollarswaspri-

marily driven by the decline in financing revenue discussed

aboveandborrowingcostsof$641 millionin2005versus$608

millionin2004,anincreaseof5.5percentrelatedtotheinterest

rateenvironmentduringtheyear, partiallyoffsetby equipment

salesgrossprofitof$637millionin2005versus$492millionin

2004,anincreaseof 29.4percentdue to the increaseinused

equipmentsalesdiscussedabove.Thedecreaseingrossprofit

margin was driven by a mix change towards lower margin

remarketing sales and away from higher margin financing

income, and lower financing margins due to higher borrowing

costs related to the interest rate environment during the year,

partiallyoffsetbyanimprovementinequipmentsalesmargins.

GlobalFinancinggrossprofitdollarsincreased$73million

or 3.2 percent and gross profit margin increased 5.2 points in

2004versus2003.Theincreaseingrossprofitdollarswaspri-

marilydrivenbycostofsalesonremarketingequipmentof$932

millionin2004versus$1,168millionin2003,adecreaseof20.3

percentandborrowingcostsof$608millionin2004versus$678

million in 2003, a decrease of10.3 percent related to volumes

andtheinterestrateenvironmentduringtheyear,partiallyoffset

bythedecreaseinrevenuediscussedpreviously.Theincreasein

grossprofitmarginwasdrivenbyimprovedmarginsinfinancing

andequipmentsales,andamixchangetowardshighermargin

financingincome,andawayfromlowermarginequipmentsales.

Global Financing pre-tax income increased 8.6 percent in

2005 versus 2004, compared to an increase of 26.6 percent in

2004versus2003.Theincreasein2005wasdrivenbyadecrease

of$140millioninbaddebtexpense and adecreaseof$78million

in SG&A expense,offsetbythedecreaseingrossprofitof$95

milliondiscussedpreviously.Theincreasein2004versus2003

wasdrivenbyadecreaseof$101 millioninbaddebtexpense,a

decreaseof$17millionin SG&A expense,adecreaseof$100mil-

lioninothercharges primarilydrivenbyincomefrominternalsales,

andtheincreaseingrossprofitof$73milliondiscussedpreviously.

The decrease in bad debt expense in both 2005 and 2004 is

reflective of the improved general economic environment,

improvedcreditqualityoftheportfolio,andthedecliningsizeofthe

receivablesportfolio.(Alsoseepage 45 foranadditionaldiscus-

sionof GlobalFinancing ReceivablesandAllowances.)

Theincreaseinreturnonequityfrom2004to2005 and2003

to2004 wasprimarilyduetohigherearnings.

FinancialCondition

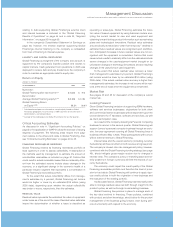

BALANCE SHEET

(Dollarsinmillions)

ATDECEMBER31: 2005 2004

Cash $«««1,292 $««««««850

Netinvestmentinsales-typeleases 9,876 11,141

Equipmentunderoperatingleases:

External clients 1,847 1,817

Internal clients(a)(b) 1,788 1,906

Client loans 8,486 9,889

Total client financingassets 21,997 24,753

Commercialfinancingreceivables 5,070 5,710

Intercompanyfinancingreceivables(a)(b) 1,968 2,172

Otherreceivables 127 223

Otherassets 711 881

Totalfinancingassets $«31,165 $«34,589

Intercompanypayables(a) $«««5,262 $«««6,531

Debt(c) 20,499 22,320

Otherliabilities 2,348 2,571

Totalfinancingliabilities 28,109 31,422

Totalfinancingequity 3,056 3,167

Totalfinancingliabilitiesandequity $«31,165 $«34,589

(a) AmountseliminatedforpurposesofIBM’sconsolidatedresultsandthereforedo

notappearonpage 49.

(b)Theseassets,alongwithallotherfinancingassetsinthistable,areleveraged

usingGlobalFinancingdebt.

(c) GlobalFinancingdebtincludesdebtofthecompanyandoftheGlobalFinancing

unitsthatsupporttheGlobalFinancingbusiness.