IBM 2005 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report._1

Dear IBM Investor,

In my letters to you over the past several years, I have

described IBM’s view of how the information technology

industry is being radically reshaped by developments in

technology, its application in business and the onrush

of globalization. I have also reported on the actions we

have taken to capitalize on these shifts and to position

our company for long-term prosperity.

_1

AS A RESULT OF THESE ACTIONS, IBM has emerged

from this period a very different company. We are

much more focused on the high-value segments of

our industry, better balanced, more productive and

more profitable than just a few years ago. Our solid

results in 2005 are a consequence of this reposition-

ing, and of the innovation and marketplace execution

of more than 329,000 IBMers around the world.

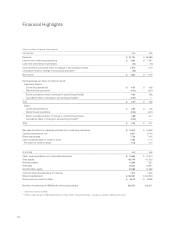

Our revenue in 2005 was $88.3billion, up

3percent, without our divested personal computer

business. Revenue as reported was $91.1billion,

down 5percent. Pre-tax earnings from continuing

operations were $12.2billion, an increase of 15 per-

cent; and diluted earnings per share were $4.91,

up 12 percent. Excluding non-recurring items, our

earnings per share increased 18 percent, to $5.32.

Particularly noteworthy was a rise of 3.2points in

IBM’s gross profit margin, to 40.1percent.

After investing $5.8billion in R&D, $3.5billion

in net capital expenditures and $1.5billion for acqui-

sitions, we ended the year with $13.7billion of cash,

including marketable securities. Over the past several

years, IBM has consistently generated return on

invested capital significantly above the average for the

S&P 500, and we did so again in 2005, with ROIC

of 24 percent, excluding Global Financing and non-

recurring items. We were able to return a record

of nearly $9billion to you

—

$7.7billion through

share repurchase and $1.2billion through dividends.

After lots of hard work to remix our portfolio of

businesses and to improve IBM’s overall competi-

tiveness, I believe the headwinds we faced entering

the decade are largely behind us. In this letter,

I will describe the performance of IBM’s three major

businesses. I will also describe why I believe that

our business model, based on the twin pillars of