IBM 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_65

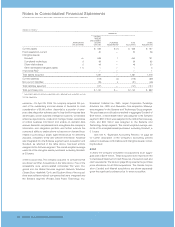

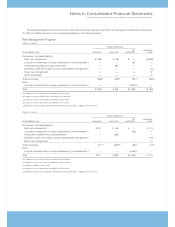

(Dollarsinmillions)

CANDLE

ORIGINAL

AMOUNT

DISCLOSEDIN

AMORTIZATION SECOND PURCHASE TOTAL OTHER

LIFE(INYEARS) QTR. 2004 ADJUSTMENTS* ALLOCATION MAERSK ACQUISITIONS

Currentassets $«202 $««(2) $«200 $«319 $«««191

Fixedassets/non-current 82 (19) 63 123 176

Intangibleassets:

Goodwill NA 256 39 295 426 711

Completedtechnology 2–323—231129

Clientrelationships 3–7 65 — 65 100 50

Otheridentifiable

intangibleassets 56—6213

Totalassetsacquired 634 18 652 981 1,170

Currentliabilities (119) (22) (141) (145) (198)

Non-currentliabilities (80) — (80) (44) (84)

Totalliabilitiesassumed (199) (22) (221) (189) (282)

Totalpurchaseprice $«435 $««(4) $«431 $«792 $«««888

* Adjustmentsprimarilyrelatetoacquisitioncosts,deferredtaxesandotheraccruals.

NA—NotApplicable

CANDLE –OnJune7,2004,thecompanyacquired100percentof

theoutstandingcommonsharesofCandle forcashconsidera-

tionof$431 million.Candleprovidesservicestodevelop,deploy

andmanageenterpriseinfrastructure.Theacquisition allows the

companytoprovideitsclientswithanenhancedsetofsoftware

solutionsformanaginganondemandenvironmentandcomple-

ments the company’s existing middleware solutions. Candle

wasintegratedintotheSoftwaresegmentuponacquisitionand

Goodwill, as reflected in the table above, has been entirely

assignedto the Software segment. The overall weighted-aver-

agelifeoftheidentifiedamortizableintangibleassetsacquired,

excludingGoodwill, is5.9years.

MAERSKDATA/DMDATA – OnDecember1,2004,thecompanypur-

chased100percentoftheoutstandingcommonstockofMaersk

Data and 45 percent of the outstanding common stock of

DMdatafor$792million. MaerskDataownedtheremaining55

percentof DMdata’soutstanding commonstock. Maersk Data

andDMdataarelocatedinDenmark.MaerskDataisaprovider

ofITsolutionsandoffersconsultancy,applicationdevelopment

and operation and support to companies and organizations.

DMdata is a provider of IT operations and its core business

areasincludetheoperationofcentralizedanddecentralizedIT

systems,networkestablishmentandoperation,aswellasprint

andsecuritysolutionsforclientsinanumberofdifferentindus-

tries.Theseacquisitions significantly increased thecompany’s

BusinessPerformanceTransformationServices(BPTS)capabil-

itiesinservingclientsinthetransportationandlogisticsindustry

globally, whilealsoenhancingitscapabilitiesin areassuchas

financial services, public sector, healthcare and the food and

agricultureindustries.BothMaerskDataandDMdatawereinte-

gratedintothe GlobalServicessegmentuponacquisitionand

Goodwill, as reflected in the table above, has been entirely

assignedtotheGlobalServicessegment. Theoverallweighted-

average life of the identified amortizable intangible assets

acquired,excludingGoodwill, is 4.7years.

OTHER ACQUISITIONS –The company acquired 12 other compa-

nies that are shown as Other Acquisitions in the table above.

Sevenoftheacquisitionswereforservices-relatedcompanies,

whichwereintegratedintotheGlobalServicessegmentandfive

were for software companies, which were integrated into the

Software segment. The purchase price allocations resulted in

aggregate Goodwill of $711 million, of which $329 million was

assigned to the Software segment and $382 million was

assignedto the Services segment. The overall weighted-aver-

agelifeoftheintangibleassetspurchased,excludingGoodwill,

is4.8years.

2003

In2003,thecompanycompletednineacquisitionsatanaggre-

gatecostof $2,536 million. Theseacquisitionsarereportedin

theConsolidatedStatementofCashFlowsnetofacquiredcash

andcashequivalents.Thetable onpage66 representsthepur-

chase price allocation for all 2003 acquisitions. The Rational

Software Corporation(Rational)acquisitionisshownseparately

givenitssignificantpurchaseprice.