IBM 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_95

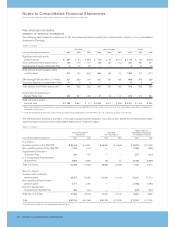

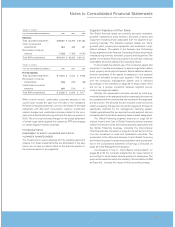

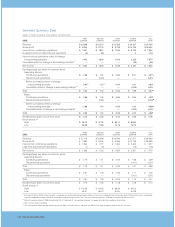

NONPENSIONPOSTRETIREMENTBENEFITPLANEXPECTEDPAYMENTS

Thefollowingtablereflectsthetotalexpectedbenefitpaymentstodefinedbenefit nonpensionpostretirement planparticipants,as

wellastheexpectedreceiptofthecompany’sshareoftheMedicaresubsidydescribed below.Thesepaymentshavebeenestimated

basedonthesameassumptionsusedtomeasurethecompany’s benefitobligation atyear end.

(Dollarsinmillions)

LESS: U.S. PLANS TOTAL

EXPECTED EXPECTED

U.S. PLANS MEDICARE BENEFIT

PAYMENTS SUBSIDY PAYMENTS

2006 $««««539 $«29 $««««510

2007 525 32 493

2008 510 35 475

2009 496 38 458

2010 482 40 442

2011-2015 «2,287 «««42 «2,245

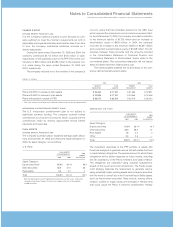

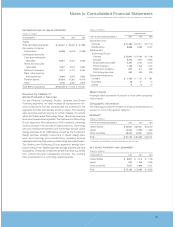

MedicarePrescriptionDrugAct

InconnectionwiththeMedicarePrescriptionDrugImprovement

and Modernization Act of 2003, the company is expected

to receive a federal subsidy of approximately $400 million to

subsidizetheprescriptiondrugcoverageprovidedbytheU.S.

nonpensionpostretirementbenefitplanoveraperiodofapprox-

imately 6 years beginning in 2006. The company will use the

subsidytoreducebothcompanyandparticipantcontributions

for prescription drug related coverage. Accordingly, approxi-

mately$216millionofthesubsidywillbeusedbythecompany

toreduceitsobligationandexpenserelatedtotheU.S.nonpen-

sion postretirement benefit plan. Further, the company will

contributetheremainingsubsidy of $184milliontothisplanin

ordertoreducecontributionsrequiredbytheparticipants.The

companyexpectstobeginreceivingthesubsidyin2006.

InaccordancewiththeprovisionofFASBStaffPositionFSP

FAS106-2,“AccountingandDisclosureRequirementsRelated

to the Medicare Prescription Drug, Improvement and

Modernization Act of 2003,” the company has included the

impactofitsportionofthesubsidyinthedeterminationofaccu-

mulated postretirement benefit obligation for the U.S. nonpen-

sionpostretirementbenefitplanfortheperiodendedDecember

31, 2005, the measurement date. The impact of the subsidy

resultedinareductioninthe benefitobligationofapproximately

$188million withnoresultingimpactto2005netperiodiccost.

However, theimpact of thesubsidy will decrease net periodic

costoverthetermofthesubsidy.

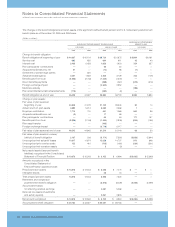

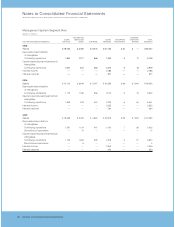

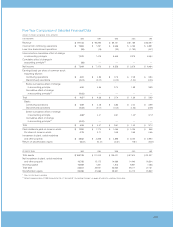

W.SegmentInformation

ThecompanyusesbusinessinsightanditsportfolioofITcapa-

bilities to create client- and industry-specific information solu-

tions.Thecompanyoperatesprimarilyinasingleindustryusing

several segments that create value by offering solutions that

include,eithersingularlyorinsomecombination,services,soft-

ware,hardwareandfinancing.

Organizationally,thecompany’smajoroperationscomprisea

GlobalServices segment;aSoftwaresegment;a predominantly

hardware product segment—Systems and Technology Group; a

Global Financing segment; and an Enterprise Investments seg-

ment.The segments representcomponents of thecompany for

whichseparatefinancialinformationisavailablethatisutilizedon

aregularbasisbythechiefexecutiveofficerindetermininghow

toallocate thecompany’sresourcesandevaluateperformance.

Thesegmentsaredeterminedbasedonseveralfactors,including

clientbase,homogeneityofproducts,technology,deliverychan-

nelsandsimilareconomiccharacteristics.

Informationabouteachsegment’sbusinessandtheprod-

ucts and services that generate each segment’s revenue is

located in the “Description of Business” section of the

ManagementDiscussiononpage 19and“SegmentDetails,”on

pages 27 to 30.

In2003,thecompanyrenamedallofitsHardwaresegments

withoutchangingtheorganizationofthesesegments.TheEnter-

priseSystemssegmentwasrenamedtheSystemsGroupseg-

ment,thePersonalandPrintingSystemssegmentwasrenamed

the Personal Systems Group segment and the Technology

segmentwasrenamedtheTechnologyGroupsegment.

In2004,the company combinedthe Systems Groupseg-

ment and the Technology Group segment and formed the

SystemsandTechnologyGroupsegment.

In the second quarter of 2005, the company sold its

PersonalComputingbusiness whichwaspreviouslyapartofthe

Personal Systems Group. The two remaining units of the

Personal Systems Group, Retail Store Systems and Printing

Systems, were combined with the Systems and Technology

Group. Personal Computing Division financial results are dis-

playedaspartofthesegmentdisclosures,inamannerconsis-

tentwiththesegmentdisclosures. Previouslyreportedsegment

informationhasbeenrestatedforallperiodspresentedtoreflect

thechangesinthecompany’sreportablesegments.

Segmentrevenueandpre-taxincomeincludetransactions

between the segments that are intended to reflect an arm’s-

lengthtransferprice.Hardwareandsoftwarethatisusedbythe

Global Services segment in outsourcing engagements are

mostly sourced internally from the Systems and Technology

Groupand Softwaresegments.FortheinternaluseofITserv-

ices,the Global Services segmentrecoverscost,aswell as a