IBM 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_25

revenuedeclined,MIPS(millionsofinstructionspersecond)vol-

umesincreased7percentin2005versus2004.

PersonalComputingDivisionrevenuedecreasedasaresult

of the company divesting its Personal Computing business

toLenovo.The2005resultshavefourmonthsofrevenueversus

12 months of revenue in 2004. See note C, “Acquisitions/

Divestitures,” onpages 66 to 67 foradditionalinformation.

Softwarerevenue increased in 2005 versus2004 driven by

growthinthecompany’skeybrandedMiddlewareofferings,par-

tiallyoffsetbylowerOperatingSystemsrevenue.TheMiddleware

revenue growth was driven by Tivoli software offerings, the

WebSpherefamilyofproducts andLotussoftwareofferings.

Global Financing revenue declined due to a continued

decline in the income-generating asset base and yields. See

pages 43 through 47 for additional information regarding

GlobalFinancing.

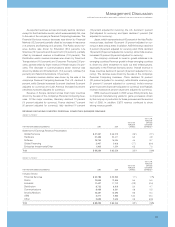

The following table presents each revenue category as a

percentageofthecompany’stotal:

FORTHEYEAR ENDEDDECEMBER31: 2005 2004

GlobalServices 52.0% 48.0%

Hardware 26.7 32.3

Software 17.3 15.7

GlobalFinancing 2.6 2.7

EnterpriseInvestments/Other 1.4 1.3

Total 100.0% 100.0%

margin improvement and permitted the company to improve

pricecompetitivenessinkeymarkets.Inaddition,anincreasein

retirement-relatedplancostsofapproximately$648 million par-

tiallyoffsetbyadecreaseinstock-basedcompensationcostsof

approximately $133 million compared to 2004 also impacted

overallsegmentmargins.See“Segment Details”discussionon

pages 27 to 30 forfurtherdetailsongrossprofit.

Totalexpenseandotherincomedecreased2.4percent(2.9per-

cent adjusted for currency) in 2005 versus 2004. Overall, the

decrease was primarily due to the gain associated with the

divestiture ofthePersonalComputingbusiness ($1,108million),

againfromalegalsettlement withMicrosoft($775million) par-

tiallyoffsetbyincrementalrestructuringcharges ($1,706 million)

recordedinthesecondquarterof2005.Theexpense-to-revenue

ratio increased 0.8 points to 26.7 percent in 2005, as revenue

declined5.4percentandexpensedeclined2.4percentin2005

versus2004.Foradditionalinformationregardingthedecrease

inTotalexpenseand otherincome,seethefollowing analyses

bycategory:

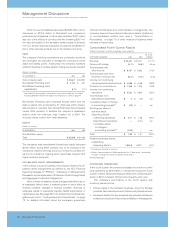

SELLING,GENERALANDADMINISTRATIVE(SG&A)

(Dollarsinmillions)

YR. TOYR.

FORTHEYEARENDEDDECEMBER31: 2005 2004* CHANGE

Selling,generaland

administrativeexpense:

Selling,generaland

administrative—base $«16,845 $«16,690 0.9%

Advertisingand

promotionalexpense 1,284 1,335 (3.8)

Workforcereductions—ongoing 289 397 (27.2)

Restructuring 1,475 —NM

Retirement-relatedexpense 846 610 38.7

Stock-basedcompensation 606 914 (33.7)

Baddebtexpense (31) 133 (123.3)

Total $«21,314 $«20,079 6.1%

* Reclassifiedtoconformwith2005presentation.

NM—NotMeaningful

Total SG&A expense increased 6.1 percent (5.7 percent

adjustedforcurrency).Theincreasewasprimarilydrivenbythe

restructuringchargesrecordedin thesecondquarterof2005.

Seenote R,“2005 Actions” onpages 80 and81 foradditional

information.Inaddition,retirement-relatedexpensesincreased

in2005.Seethe“Retirement-RelatedBenefits” captiononpage

27 foradditionalinformation.Theseincreaseswerepartiallyoff-

setbyloweroperationalexpensesasaresultoftherestructuring

GROSS PROFIT

YR. TOYR.

FORTHEYEARENDEDDECEMBER31: 2005 2004 CHANGE

GrossProfitMargin:

GlobalServices 25.9% 24.2% 1.7 pts.

Hardware 35.1 29.5 5.6

Software 87.5 87.2 0.3

GlobalFinancing 54.7 59.9 (5.2)

EnterpriseInvestments/Other 46.5 40.2 6.3

Total 40.1% 36.9% 3.2 pts.

EXPENSE

(Dollarsinmillions)

YR. TOYR.

FORTHEYEARENDEDDECEMBER31: 2005 2004 CHANGE

Totalexpenseand

otherincome $«24,306 $«24,900 (2.4) %%

ExpensetoRevenue(E/R) 26.7% 25.9% 0.8 pts.

TheincreaseinGlobalServicesgrossprofitmarginwasprima-

rily due to benefits from the restructuring actions taken in the

secondquarterof2005,improvedutilization/productivityanda

betteroverallcontractprofile.TheincreaseinHardwaremargin

wasprimarilyduetothe divestiture ofthePersonalComputing

business(whichhadalowergrossprofitmarginthantheother

hardwarebusinesses)inthesecondquarterof2005.Thissale

contributed 3.8 points to the increase in the 2005 margin.

Microelectronics’ marginsincreasedduetoimprovingyields.

ThedecreaseinGlobalFinancinggrossprofitmarginwas

driven by declining financing margins primarily due to the

changing interest rate environment and a mix towards lower

marginremarketingsales.

The cost savings generated by the company’s continuing

focusonsupply-chaininitiativesalsocontributedtotheoverall