IBM 2005 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.resources to the opportunities we see in collaborative

innovation. There is large and growing demand

across engineering-intensive industries

—

from auto-

motive and aerospace to telecommunications and

medical equipment

—

to leverage the technologies

and research prowess of partners. This is not

outsourced R&D, but true shoulder-to-shoulder

collaboration. The ability to extend IBM’s legendary

technology strengths to clients to accelerate their

own product and service R&D is a powerful proposi-

tion that no one in our industry can easily match.

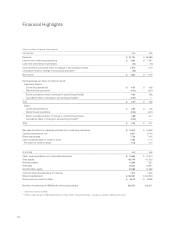

SOFTWARE: Software revenues totaled $15.8billion

in 2005, an increase of 4percent. We believe we

improved our competitive position in all five of our

key middleware brands. Indeed, 2005 marked a

milestone for our software business. As I’ve reported

to you for several years, we have been focusing our

internal software R&D and acquisition efforts on the

high-growth middleware segment of the software

opportunity. Last year, for the first time, more than

half of our software revenue came from strategic

middleware products vs. the slower growth host or

legacy platforms.

In software, as in systems, the technology bets we

made several years ago are paying off. Companies are

seeking to dissolve barriers that impede the flow of

information within the enterprise by deploying open,

standards-based middleware to integrate their IT sys-

tems and to maximize digital assets in all their forms.

There is a significant shift underway in the world of

software toward what is called service-oriented archi-

tecture (SOA), which allows companies to be much

more flexible and responsive. As the worldwide

leader in middleware, IBM is in a strong position to

capitalize on the SOA market, which some analysts

expect to more than double, to $143 billion, by 2008.

Our WebSphere middleware family grew 10 per-

cent in 2005, with particular strength in Application

Servers and Portals, which grew 15 percent and

12 percent, respectively. Information management

software grew 8percent, fueled by our content

management and information integration products

—

a

set of offerings that we are enhancing with a $1billion

investment in a new “information on demand”

practice we announced this February, including

advanced tools and 10,000 additional practitioners

located in centers of excellence around the world.

Our Rational software tools grew 4percent for the

year, and Tivoli 11 percent

—

including 24 percent

growth for Tivoli storage software, as clients

continued their strong adoption of our virtualization

technologies. In addition, our 2005 acquisitions

of companies such as Ascential, Bowstreet, SRD

and DWL have strengthened our hand in other

high-growth areas, including business integration

and Web-enabled software.

GLOBAL SERVICES: IBM Global Services remains

the leading IT services company in the world, with

more than twice the revenue of our nearest rival.

We are ranked as the number-one service provider

in IT outsourcing, Web hosting and consulting

& systems integration. Revenues from Global

Services in 2005 totaled $47.4billion, an increase of

2percent. Our backlog is estimated at $111 billion,

the same as a year ago.

We’ve been seeing a transition in services over

the past few years, a shift to smaller deals of shorter

duration. These are good opportunities

—

if you

can recalibrate your sales model to capture them in

addition to the traditional “mega-deals.” And the

profitability of these kinds of deals is very attractive,

if your global cost structure is competitive. We had

to address both our sales model and services cost

structure last year, and we did so. We also took other

actions to strengthen our services business

—

shifting

thousands of employees into global delivery centers;

rebalancing our Integrated Technology Services

portfolio; and doubling the resources dedicated to

integrated solutions, which we expect will account

for 70 percent of the total IT opportunity by 2008.

These changes give us a platform for increasing

growth in 2006.

I want to call out in particular our continuing

progress in the high-growth market we call Business

Performance Transformation Services. This is where

4_ Chairman’s Letter