IBM 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

Thecashtaxratediffersfromthe company’seffective tax rate

duetoanumberofvariablesincluding,butnotlimitedto, certain

items of income and expense that are recognized in different

yearsforfinancialreportingpurposesthanforincometaxpur-

poses,differencesin currency ratesusedinthetranslationofthe

non-U.S.income tax provision and incometax payments, and

current-year cash tax payments or refunds that are related to

prioryears. Thecompanyanticipatesthatits cashtaxratewill

approximate the upper end of this range for the near term.

However, once thecompany fullyutilizes its alternativeminimum

taxcredits or losscarryforwards, the possibilityexists that the

cashtaxratecouldincrease.

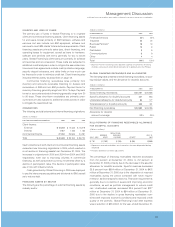

LiquidityandCapitalResources

Thecompanygeneratesstrongcashflowfromoperations,pro-

vidingasourceoffundsrangingbetween$13.7 billionand$15.3

billionperyearoverthepastfiveyears.Thecompanyprovides

for additional liquidity through several sources; a sizable cash

balance,accesstoglobalfundingsources,acommittedglobal

creditfacilityandin2004,thecompanyconvertedareceivables

securitization facility from an “uncommitted” to a “committed”

facility, adding an additional source of liquidity. (See note J,

“SecuritizationofReceivables” onpage 70 foradditionalinforma-

tion). The table below provides a summary of these major

sources of liquidity for the years ended December 31, 2001

through 2005.

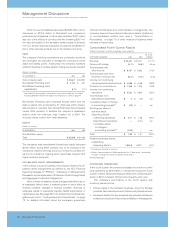

CASH FLOW AND LIQUIDITY TRENDS

(Dollarsinbillions)

2005 2004 2003 2002 2001

Netcashfrom

operating activities $«14.9 $«15.3 $«14.5 $«13.8 $«13.7

Cashandmarketable

securities $«13.7 $«10.6 $«««7.6 $«««6.0 $«««6.4

Sizeofglobal

creditfacilities $«10.0 $«10.0 $«10.0 $«12.0 $«12.0

Tradereceivables

securitizationfacility $«««0.5 $«««0.5 $««««— $««««— $««««—

Themajorratingagencies’ ratingsonthecompany’sdebtsecu-

ritiesatDecember31,2005 appearinthe following table andre-

mainunchangedoverthepastfiveyears.Thecompanyhasno

contractualarrangementsthat,intheeventofachangeincredit

rating,wouldresultinamaterialadverse effectonits financial

positionorliquidity.

STANDARD MOODY’S

AND INVESTORS FITCH

POOR’S SERVICE RATINGS

Seniorlong-termdebt A+ A1 AA-

Commercialpaper A-1 Prime-1 F1+

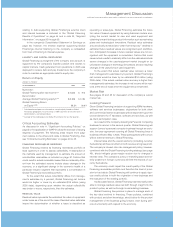

The company prepares its Consolidated Statement of Cash

Flows in accordance with SFAS No. 95, “Statement of Cash

Flows,” onpage 50 andhighlightscausesandeventsunderly-

ingsourcesandusesofcashinthatformatonpage 31.Forpur-

posesofrunningitsbusiness,thecompanymanages,monitors

andanalyzescashflowsinadifferentformat.

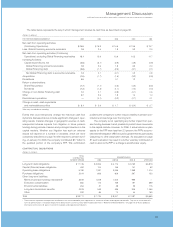

Asdiscussedonpage 43,oneofthecompany’stwoprimary

objectivesofitsGlobalFinancingbusinessistogeneratestrong

return on equity. Increasing receivables is the basis for growth

in a financing business. Accordingly, management considers

GlobalFinancingreceivablesasaprofit-generatinginvestment-

not as working capital that should be minimized for efficiency.

After classifying the Global Financing accounts receivables as

aninvestment,theremainingnetcashflowisviewedbythecom-

panyastheCashavailableforinvestmentandfordistributionto

shareholders.Withrespecttothecompany’scashflowanalysis

for internal management purposes (see the first table on page

39),Global Financing accountsreceivablesarecombined with

Global Financing debt to represent the Net Global Financing

debttoaccountsreceivable (aprofit-generatinginvestment).

From the perspective of how management views cash

flows, in 2005, net cash from operating activities, excluding

GlobalFinancing receivables, was$13.1 billion, an increaseof

$0.2 billion compared to 2004. This cash performance was

driven primarily by the growth in net income from continuing

operationsandthecompany’scontinuedfocusonworkingcap-

italandsupply-chainmanagement.Thecompanyreturnedover

100percentofnetincomein2005toshareholdersindividend

paymentsandsharerepurchases.

Overthepastfiveyears,thecompanygeneratedover$60.8

billion in Cash available for investment and for distribution to

shareholders. As a result, during the period the company

invested $20.6 billionofnetcapitalexpenditures,invested$9.1

billioninstrategicacquisitions,received$2.2 billionfromdivesti-

tures and returned $34.1 billion to shareholders through divi-

dends and share repurchases. The amount of prospective

Returns to shareholders in the form of dividends and share

repurchases will vary based upon several factors including

affordability, namely each year’s operating results, capital

expenditures,researchanddevelopment,andacquisitions,as

well as the factors discussed immediately following the first

table onpage39.

The company’s Board of Directors meets quarterly to

consider thedividendpayment. Thecompanyexpectstofund

dividendpaymentsthroughcashfromoperations.

38_ ManagementDiscussion