IBM 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

86_ NotestoConsolidatedFinancialStatements

based upon specified criteria used to determine each partici-

pant’seligibility.Thefirstmethod usesafiveyear,finalpayfor-

mulathatdeterminesbenefitsbasedonsalary,yearsofservice,

mortality and other participant-specific factors. The second

method isacashbalanceformulathat calculatesbenefitsusing

apercentageofemployees’ annualsalary,aswellasaninterest

creditingrate.

InDecember2005,thecompanyapprovedaplanamend-

ment which provides that benefits under the PPP will stop

accruingforactiveparticipantseffectiveDecember31,2007.

U.S.SupplementalExecutiveRetentionPlan

The company also has a non-qualified U.S. Supplemental

ExecutiveRetentionPlan(SERP).TheSERP,whichisunfunded,

providesdefinedbenefitpensionbenefitsinadditiontothePPP

toeligibleexecutivesbasedonaverageearnings,yearsofserv-

iceand age atretirement.EffectiveJuly1,1999,the company

adoptedtheSERP(whichreplacedthepreviousSupplemental

ExecutiveRetirementPlan).SomeparticipantsofthepriorSERP

willstillbeeligibleforbenefitsunderthat prior planifthoseben-

efitsaregreaterthanthebenefitsprovidedunderthenewplan.

Certain former partners of PwCC also participate in the SERP

undertwoseparatebenefitformulas. Thenumberofindividuals

receiving benefitpayments underthisplanwere354 and309as

ofDecember31,2005and2004,respectively.

InDecember2005,thecompany also approvedan amend-

ment to the SERP which provides that no further benefits will

accrue effective December31,2007.

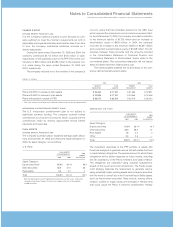

DEFINEDCONTRIBUTIONPLANS

IBM SavingsPlan

U.S. regular, full-time and part-time employees are eligible to

participate in the IBM Savings Plan, which is a tax-qualified

defined contribution plan under section 401(k) of the Internal

RevenueCode. For employees hiredpriorto January1, 2005,

thecompanymatches50percentoftheemployee’scontribution

uptothefirst6percentoftheemployee’seligiblecompensation.

For employees hired or rehired after December 31, 2004 who

havealsocompletedoneyearofservice,thecompanymatches

100percentoftheemployee’scontributionuptothefirst6per-

cent of eligible compensation. All contributions, including the

companymatch,aremadeincash,inaccordancewiththepar-

ticipants’ investmentelections.Therearenominimumamounts

that must be invested in company stock, and there are no

restrictionsontransferringamountsoutofthecompany’sstock

toanotherinvestmentchoice.Thenumberofemployeesreceiv-

ing distributions under this plan were 2,786 and 2,659 as of

December31,2005and2004,respectively.

In January 2006, the company announced its intention to

amend the plan effective January 1, 2008. The announced

change willconsist oftwocomponentsincludingan automatic

contribution for all eligible U.S. employees and an increase in

the amount of company matching contribution for all eligible

U.S.employeeshiredonorbeforeDecember31,2004.

IBMExecutive Deferred CompensationPlan

The company also maintains an unfunded, non-qualified,

defined contribution plan, the IBM Executive Deferred

CompensationPlan(EDCP),whichallowseligible executivesto

defer compensation, and to receive company matching contri-

butionsundertheapplicableIBMSavingsPlanformula(depend-

ing on the date of hire as described above), with respect to

amountsinexcessofIRSlimitsfortax-qualifiedplans. Amounts

contributedtotheplanasaresultofdeferredcompensation,as

wellascompanymatchingcontributionsarerecordedasliabili-

ties.Deferredcompensationamountsmaybedirectedbypar-

ticipantsintoanaccountthatreplicatesthereturnthatwouldbe

receivedhadtheamountsbeeninvestedinsimilarIBMSavings

Plan investment options. Company matching contributions,

whichareprovidedin the “Plan Financial Information” section,

aredirectedtoparticipantaccountsandappreciateordepreci-

ateeachreportingperiodbasedonchangesinthecompany’s

stock price. The total participants receiving benefit payments

underthisplanwere 384 and 356 asofDecember31,2005and

2004,respectively.

NONPENSIONPOSTRETIREMENTBENEFITPLANS

U.S.NonpensionPostretirementPlan

Thecompanyhasadefinedbenefitnonpensionpostretirement

planthatprovidesmedicalanddentalbenefits foreligibleU.S.

retireesandeligibledependents, aswellaslifeinsuranceforeli-

gible U.S. retirees. Effective July1,1999, the company estab-

lisheda“FutureHealthAccount” (FHA)foremployeeswhowere

morethanfiveyearsawayfromretirementeligibility.Employees

who were within five years of retirement eligibility are covered

underthecompany’spriorretireehealthbenefitsarrangements.

UndereithertheFHAorthepriorretireehealthbenefitarrange-

ments,thereisamaximumcosttothecompanyforretireehealth

benefits.ForemployeeswhoretiredbeforeJanuary1,1992,that

maximumbecameeffectivein2001.Forallotheremployees,the

maximumiseffectiveuponretirement.EffectiveJanuary1,2004,

the company amended its nonpension postretirement plan to

providethatnewhires,asofthatdateorlater,willnolongerbe

eligible for company subsidized benefits. As of December 31,

2005 and 2004, the total participants receiving benefit pay-

ments underthisplanwere 115,921 and 113,716, respectively.

NON-U.S.PLANS

MostsubsidiariesandbranchesoutsidetheUnitedStateshave

defined benefit and/or defined contribution plans that cover

substantially all regular employees. The company deposits

funds under various fiduciary-type arrangements, purchases

annuitiesundergroupcontractsorprovidesreservesforthese

plans. Benefits under the defined benefit plans are typically

basedeitheronyearsofserviceandtheemployee’scompensa-

tion (generally during a fixed number of years immediately

beforeretirement)oronannualcredits.Therangeof assump-

tionsthatareusedforthenon-U.S.definedbenefitplansreflects

thedifferenteconomicenvironmentswithinvariouscountries.