IBM 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

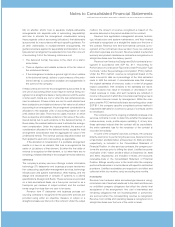

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

58_ NotestoConsolidatedFinancialStatements

BusinessCombinationsandIntangible

AssetsIncludingGoodwill

Thecompanyaccountsforbusinesscombinationsusingthepur-

chasemethodofaccountingandaccordingly,theassetsandlia-

bilitiesoftheacquiredentitiesarerecordedattheirestimatedfair

valuesatthedateofacquisition.Goodwillrepresentstheexcess

ofthepurchasepriceoverthefairvalueofnetassets, including

theamountassignedtoidentifiableintangibleassets.Thecom-

panydoesnotamortizethegoodwillbalance.Substantiallyallof

thecompany’sgoodwillisnotdeductiblefor taxpurposes.The

primarydriversthatgenerategoodwillarethevalueofsynergies

between the acquired entities and the company and the

acquiredassembledworkforce,neitherofwhichqualifiesasan

identifiable intangible asset. Identifiable intangible assets with

finite lives are amortized over their useful lives. See note C,

“Acquisition/Divestitures” on pages 63 to 67 and note I,

“IntangibleAssetsIncludingGoodwill,” onpages 68 and 69,for

additionalinformation. Theresultsofoperationsoftheacquired

businesses were included in the company’s Consolidated

FinancialStatementsfromtherespectivedatesofacquisition.

Impairment

Amortizable assets are tested for impairmentbased on undis-

countedcash flowsand,ifimpaired,written downtofair value

based on either discounted cash flows or appraised values.

Goodwillis testedannuallyforimpairment,orsoonerwhencir-

cumstancesindicateanimpairment mayexist,usingafairvalue

approach at the reporting unit level. A reporting unit is the

operatingsegment,orabusiness, whichisonelevelbelowthat

operatingsegment(the“component” level)ifdiscretefinancial

informationispreparedandregularlyreviewedbymanagement

atthe segment level. Componentsareaggregatedasasingle

reportingunitiftheyhavesimilareconomiccharacteristics.

DepreciationandAmortization

Plant, rental machines and other property are carried at cost

and depreciated over their estimated useful lives using the

straight-linemethod.Theestimatedusefullivesof depreciable

properties are as follows: buildings, 50 years; building equip-

ment,20years;landimprovements,20years;plant,laboratory

andofficeequipment,2to15years;andcomputerequipment,

1.5to5years.Leaseholdimprovementsareamortizedoverthe

shorteroftheirestimatedusefullivesortherelatedleaseterm,

nottoexceed25 years.

Capitalizedsoftwarecostsincurredoracquiredaftertech-

nological feasibility has been established are amortized over

periodsupto 3 years.Capitalizedcostsforinternal-usesoftware

are amortized on a straight-line basis over 2 years. (See

“SoftwareCosts” onpages 56and57 foradditionalinformation).

Otherintangibleassetsareamortized over periods between 3

and 7years.

Environmental

Thecostofinternalenvironmentalprotectionprogramsthatare

preventative in nature are expensed as incurred. When a

cleanup program becomes likely, and it is probable that

thecompany will incurcleanup costs andthose costs canbe

reasonablyestimated,thecompanyaccruesremediationcosts

for known environmental liabilities. The company’s maximum

exposure for all environmental liabilities cannot be estimated

and no amounts are recorded for environmental liabilities that

arenotprobableorestimable.

AssetRetirementObligations

Assetretirementobligations(ARO) arelegalobligationsassoci-

ated with the retirement of long-lived assets. These liabilities

areinitially recordedatfairvalueand the relatedasset retire-

mentcostsarecapitalizedbyincreasingthecarryingamountof

the related assets by the same amount as the liability. Asset

retirementcostsaresubsequentlydepreciatedovertheuseful

livesoftherelatedassets. Subsequenttoinitial recognition,the

companyrecordsperiod-to-periodchangesintheAROliability

resulting from the passage of time and revisions to either the

timingor the amount of the original estimate of undiscounted

cash flows. The company derecognizes ARO liabilities when

therelatedobligationsaresettled.

Retirement-RelatedBenefits

Seenote V,“Retirement-RelatedBenefits,” onpages 85 to95 for

thecompany’saccountingpolicyforretirement-relatedbenefits.

Stock-BasedCompensation

EffectiveJanuary1,2005,thecompanyadoptedtheprovisions

of Statement of Financial Accounting Standards (“SFAS”) No.

123(R), “Share-Based Payment” (SFAS 123(R)). The company

previouslyappliedAccountingPrinciplesBoard(APB)Opinion

No.25,“AccountingforStockIssuedtoEmployees,” andrelated

Interpretationsandprovidedtherequiredproformadisclosures

ofSFASNo.123,“AccountingforStock-BasedCompensation”

(SFAS123).Thecompanyelectedto adoptthemodifiedretro-

spective application method provided by SFAS 123(R) and

accordingly, financial statement amounts for the periods pre-

sented herein reflect results as if the fair value method of

expensinghadbeenappliedfromtheoriginaleffectivedateof

SFAS 123. Such results are consistent with the previously

reported pro forma disclosures required under SFAS No. 123.

Seethecompany’s restated financial statements filed onJune

22,2005withtheSecuritiesandExchangeCommission(SEC)

fortheeffectofthischangeonpriorperiods.

Stock-based compensation represents the cost related

to stock-based awards granted to employees. The company

measuresstock-basedcompensationcostatgrantdate,based

ontheestimatedfairvalueoftheaward,andrecognizesthecost

asexpenseonastraight-linebasis(netofestimatedforfeitures)

overtheemployeerequisiteserviceperiod. Thecompanyesti-

matesthefairvalueofstockoptionsusingaBlack-Scholesval-

uation model. The expense is recorded in Cost, SG&A, and

RD&EintheConsolidatedStatementofEarningsbasedonthe

employees’ respectivefunctions.

Thecompanyrecordsdeferredtaxassets forawardsthat

result in deductions on the company’s income tax returns,

basedontheamountofcompensationcostrecognizedandthe