IBM 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

74_ NotestoConsolidatedFinancialStatements

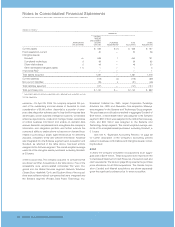

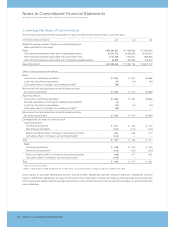

AccumulatedDerivativeGainsorLosses

AtDecember31,2005,inconnectionwithitscashflowhedges

of anticipated royalties and cost transactions, the company

recordedgainsof$271 million,netoftax,inAccumulatedgains

and (losses) not affecting retained earnings. Of that amount,

gainsofapproximately$237millionareexpectedtobereclassi-

fiedto net incomewithin the nextyear, providing an offsetting

economic impact against the underlying anticipated transac-

tions. At December 31, 2005, losses of approximately $33

million, net of tax, were recorded in Accumulated gains and

(losses)notaffectingretainedearningsinconnectionwithcash

flowhedgesofthecompany’sborrowings.

ThefollowingtablesummarizesactivityintheAccumulated

gainsand(losses)notaffectingretainedearningssectionofthe

Consolidated Statement of Stockholders’ Equity related to all

derivativesclassifiedascashflowhedges:

(Dollarsinmillions,netoftax)

DEBIT/(CREDIT)

December31,2002 $««363

Netlossesreclassifiedintoearnings

fromequityduring2003 (713)

Changesinfairvalueofderivativesin2003 804

December31,2003 454

Netlossesreclassifiedintoearningsfrom

equityduring2004 (463)

Changesinfairvalueofderivativesin2004 662

December31,2004 653

Netlossesreclassifiedintoearnings

fromequityduring2005 (104)

Changesinfairvalueofderivativesin2005 (787)

December31,2005 $«(238)

FortheyearsendingDecember31,2005,2004and2003,there

were no significant gains or losses recognized in earnings

representing hedge ineffectiveness or excluded from the

assessmentof hedge effectiveness(for fair valuehedgesand

cashflow hedges),orassociatedwithanunderlyingexposure

thatdidnotorwasnotexpectedtooccur(forcashflowhedges);

norarethereanyanticipatedinthenormalcourseofbusiness.

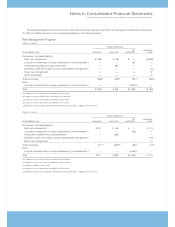

M.OtherLiabilities

(Dollarsinmillions)

ATDECEMBER31: 2005 2004

Deferred income $«2,437 $«2,222

Deferred taxes 1,616 1,770

Executivecompensationaccruals 1,023 1,163

Restructuringactions 733 787

Workforcereductions 434 562

Disabilitybenefits 420 357

Derivativesliabilities 314 434

Non-currentwarrantyaccruals 255 415

Environmentalaccruals 226 218

Other 836 890

Total $«8,294 $«8,818

Inresponsetochangingbusinessneeds,thecompanyperiodi-

callytakesworkforcerebalancingactionstoimproveproductivity

andcompetitiveposition.Thenon-currentcontractuallyobligated

futurepaymentsassociatedwith these activities arereflectedin

the Workforcereductions captioninthetableabove.

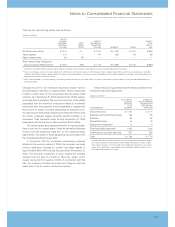

Inaddition,thecompanyexecuted certain special actions

asfollows: (1)thesecondquarterof2005(discussedinnote R,

“2005Actions,”onpages 80and81),(2)thesecond quarterof

2002 associated with the Microelectronics Division and rebal-

ancing of both the company’s workforce and leased space

resources, (3) the fourth quarter of 2002 associated with the

acquisition of the PricewaterhouseCoopers consulting busi-

ness,(4)the2002actionsassociatedwiththe HDD businessfor

reductionsinworkforce,manufacturingcapacityandspace,(5)

the actions taken in 1999, and (6) the actions that took place

priorto1994.