IBM 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ManagementDiscussion

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_33

• ImprovedmarginsinGlobalServicesdrivenprimarilyby

benefits from the company’s restructuring, productivity

initiatives and a better overall contractprofile.

Totalrevenueinthefourthquarterdeclined11.7percentas

reported(8.5percentdecline adjusted forcurrency).The com-

pany’srevenueprofilewassignificantlyimpactedbythe divesti-

ture ofthePersonalComputingbusinessinthesecondquarterof

2005—excluding the Personal Computing business, the com-

pany’s fourth-quarter 2004 total revenue was $24,703 million.

When compared to this revised amount, total revenue in the

fourth-quarter2005decreased1.1 percent(increased2.5percent

adjusted forcurrency)drivenbyadeclineinGlobalServices.

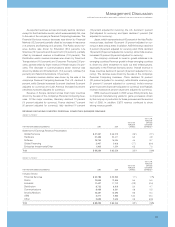

Thefollowingisananalysisoftheexternalsegmentresults.

Global Services revenue decreased 4.9 percent (0.9 per-

cent adjusted forcurrency).Thedeclinewasdrivenprimarilyby

weaknessinshort-termsigningsandadecreasein SO revenue.

Short-termsigningsweredown4percentandflatinthefourth

quarterandthirdquarter of2005,respectively,whencompared

with the same periods in 2004. Total SO signings declined 32

percentthisquarterandrevenuewasdown5.3percent.SOrev-

enue continues to be impacted by the high levels of backlog

erosionexperiencedin2004andthecumulativeeffectoflower

signingsstarting in2004 through the first quarter of 2005. ITS

revenue, excluding Maintenance, was down 5.4 percent and

signingsalsodeclinedthisquarter by 10percent. BCSrevenue

decreased 6.1 percent driven by declines in Asia Pacific and

Italy, while revenue in the Americas grew versus 2004. BCS

signingsincreasedby23percent,drivenbytheAmericasand

Europe, with significant growth (144 percent) in long-term

Business Transformation Outsourcing signings. Profitability

improved in Global Services as both gross margin (3.1 points)

and segment pre-tax (2.4points)margin increasedversus the

fourth quarter of 2004. Margin improvements were primarily

drivenbythe company’ssecond-quarterrestructuringactions,

improved resource utilization and a better contract profile.

GlobalServicessignings forthequarterwere $11.5 billion.

SystemsandTechnologyGrouprevenuegrew 6.3 percent

(9.8 percent adjusted for currency). zSeries server revenue

increased 5.5 percent, with strong MIPs growth of 28 percent

yeartoyear.zSeriesgrowthcontinuestobedrivenbynewwork-

loads,suchasLinuxandJava.iSeriesserverrevenuedeclined

18.2 percentas clients anticipatedtheearly2006announcement

of new POWER5+ products. pSeries server revenue grew 3.9

percent, driven by that brand’s POWER5+ product line refresh

whichbeganinthefourthquarter.xSeriesserversgrewvolumes

13percent,however,revenuewasflatduetocompetitivepricing

pressures. Blade Center product revenue grew 41.4 percent in

thequarter.Storageproductshadastrongquarterwithrevenue

growthof23.6percent,drivenbyTotaldisk(32.2percent)prod-

ucts. Microelectronics OEM revenue grew 48.1 percent year to

yearas300-millimeter-basedproducts,drivenbygameproces-

sors,grewover250percentversusthefourthquarter2004.

Software revenue increased 0.3 percent (3.3 percent

adjusted forcurrency).TheWebSpherefamilyof productsgrew

3.6 percent,whileInformationManagementsoftwareincreased

4.5percent,drivenbythecompany’scontentmanagementand

information integration product sets. Lotus revenue grew 1.6

percentandTivolirevenueincreased2.9percentdrivenbya17

percent growth in the brand’s storage software products.

Rational software revenue declined 2.0 percent—performance

wasgoodinAsiaPacificandEurope,butsome clients delayed

buying decisions in the Americas. In addition to the revenue

growth in the company’s key branded middleware, described

above, the profitability of the software business improved as

well,withthesegment’spre-taxmargingrowingby5.7pointsin

thefourthquarterversus2004.

GlobalFinancingrevenuedeclined 8.0 percent(5.6 percent

adjusted forcurrency)drivenprimarilyby lower client financing

revenueduetoadecliningassetbase,aswellaslowerexternal

usedequipment sales.

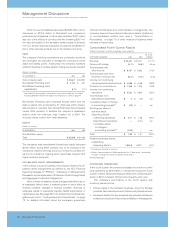

Thecompany’stotalgrossprofitmarginincreased 5.3points

inthefourth-quarter2005comparedtothefourth-quarter2004,

which included the divested Personal Computing business.

ExcludingthePersonal Computing business, thefourth-quarter

2004 gross profit margin was 41.9 percent, making the current

quarter’smargina2.2pointimprovementonacomparablebasis.

Total expense and other income decreased 7.4 percent

comparedtotheprior-yearperiod.Selling,generalandadmin-

istrativeexpensedecreased3.4percentyeartoyear,drivenpri-

marily by the divestiture of the Personal Computing business

andthecompany’srestructuringactions,offsetbya$267million

curtailment charge related to the announced changes in the

company’sU.S.definedbenefitpensionplans.RD&Eexpense

decreased 3.6 percent,whileIntellectualproperty andcustom

developmentincomealsodecreased23.7percentyeartoyear.

Other(income)andexpensewas$334millionofincomeinthe

fourthquarterof2005versus$4millionofincomeinthesame

periodlastyear. Thisimprovementwasdrivenbygains on cer-

tain real estate transactions (increase of $160 million) and the

favorableimpactofhedgingprograms(up approximately $150

million)versusthefourthquarterof2004.

Thecompany’s effectivetaxrate inthe fourth-quarter 2005

was 29.5 percent comparedwith 29.8 percent inthefourthquar-

ter of 2004. The nonrecurring pension curtailment charge

reduced thefourth-quarter2005effectivetaxrate by0.5points.

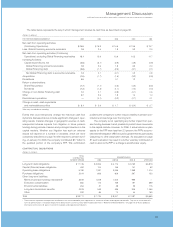

In the fourth quarter, the company recorded a $36 million

charge,netoftax,toreflectthe cumulativeeffectof a change

in accounting principle related to the adoption of FASB

Interpretation No. 47. See note B, “Accounting Changes,” on

pages61 and62 foradditionalinformation.

Sharerepurchasestotaledapproximately$1.0billioninthe

fourth quarter. The weighted-average number of diluted com-

monsharesoutstandinginthefourth-quarter2005was1,604.8

millioncomparedwith1,692.1 millioninthesameperiodof2004.

The company generated an increase of $1,395 million in

cashflow providedbyoperatingactivities.This increase reflects

theeffectsof prior-yearfundingoftheU.S.pensionplan($700

million) and improved inventory management ($327 million).

Also, net cash used in financing activities decreased signifi-

cantly—$2,417 million—primarily driven by a reduction in share

repurchasesinthequarterversusthefourth-quarter2004.