IBM 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

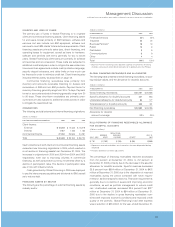

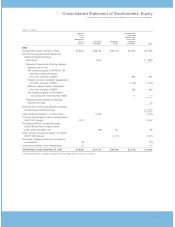

ConsolidatedStatementofCashFlows

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

(Dollarsinmillions)

FORTHEYEARENDEDDECEMBER31: 2005 2004* 2003*

CashFlowfromOperatingActivitiesfromContinuingOperations:

Netincome $«««7,934 $«««7,479 $«««6,558

Lossfromdiscontinuedoperations 24 18 30

Adjustmentstoreconcileincomefromcontinuingoperations

tocashprovidedbyoperatingactivities:

Depreciation 4,147 3,959 3,961

Amortizationofintangibles 1,041 956 955

Stock-basedcompensation 1,043 1,578 1,573

Deferredincometaxes 2,185 1,794 790

Netgainonasset salesandother (1,525) (420) (275)

Otherthantemporarydeclinesinsecuritiesandotherinvestments 920 50

Changeinoperatingassetsandliabilities,netofacquisitions/divestitures:

Receivables(includingfinancingreceivables) 2,219 2,613 2,024

Inventories 202 (291) 293

Pensionassets (1,562) (1,284) (1,409)

Otherassets (584) (200) (567)

Accountspayable (536) 411 617

Pensionliabilities (166) (584) (286)

Otherliabilities 483 (700) 223

NetCashProvidedbyOperatingActivitiesfromContinuingOperations 14,914 15,349 14,537

CashFlowfromInvestingActivitiesfromContinuingOperations:

Paymentsforplant,rentalmachinesandotherproperty (3,842) (4,368) (4,393)

Proceedsfromdispositionofplant,rentalmachinesandotherproperty 1,107 1,311 1,039

Investmentinsoftware (792) (688) (581)

Purchasesofmarketablesecuritiesandotherinvestments (4,526) (8,718) (6,471)

Proceedsfromdispositionofmarketablesecuritiesandotherinvestments 4,180 8,830 7,023

Divestitureofbusinesses,netofcashtransferred 932 25 97

Acquisitionofbusinesses,netofcash acquired (1,482) (1,738) (1,836)

NetCashUsedinInvestingActivitiesfromContinuingOperations (4,423) (5,346) (5,122)

CashFlowfromFinancingActivitiesfromContinuingOperations:

Proceedsfromnewdebt 4,363 2,438 1,573

Short-term(repayments)/borrowings lessthan90days—net (232) 1,073 777

Paymentstosettledebt (3,522) (4,538) (5,831)

Commonstocktransactions—net (6,506) (5,361) (3,200)

Cashdividendspaid (1,250) (1,174) (1,085)

NetCashUsedinFinancingActivitiesfromContinuingOperations (7,147) (7,562) (7,766)

Effectofexchangeratechangesoncashandcashequivalents (789) 405 421

Netcashusedindiscontinuedoperations from: (Revised—seenoteA)

Operatingactivities (40) (83) (164)

Investingactivities ——2

Netchangeincashandcashequivalents 2,515 2,763 1,908

CashandcashequivalentsatJanuary1 10,053 7,290 5,382

CashandCashEquivalentsatDecember31 $«12,568 $«10,053 $«««7,290

SupplementalData:

Incometaxes paid $«««1,994 $«««1,837 $«««1,707

Interestpaid $««««««866 $««««««705 $««««««853

Capitalleaseobligations $««««««287 $««««««110 $««««««««27

Equitysecuritiesreceivedasdivestitureconsideration** $««««««430 $««««««««— $««««««««—

* Reclassifiedtoconformwith2005presentation.

** Lenovoequityvaluedat$542millionnetoflock-upprovisionsof$112million. SeenoteC,“Acquisitions/Divestitures,”onpages66and67foradditionalinformation.

Theaccompanyingnotesonpages 54 through 100 areanintegralpartofthefinancialstatements.

50_ ConsolidatedStatements