IBM 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

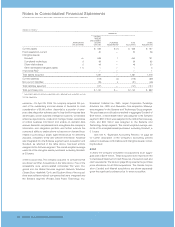

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

54_ NotestoConsolidatedFinancialStatements

A.SignificantAccountingPolicies

BasisofPresentation

On December 31, 2002, the International Business Machines

Corporation(IBMand/orthecompany)sold itsharddiskdrive

(HDD) business to Hitachi, Ltd. (Hitachi). The HDD business

was part of the company’s Systems and Technology Group

reportingsegment.TheHDDbusinesswasaccountedforasa

discontinued operation under accounting principles generally

acceptedintheUnitedStatesofAmerica(GAAP)andtherefore,

the HDD results of operations and cash flows have been

removed from the company’s results of continuing operations

and cash flows for all periods presented in this document. In

2005,thecompanyhasseparatelydisclosedtheoperating and

investing portionsofthecashflowsattributedtoitsdiscontinued

operations,whichinpriorperiods were reportedonacombined

basisasasingleamount.

For the years 2005, 2004 and 2003, the financial results

reported as discontinued operations are primarily additional

costs associated with parts warranty as agreed upon by the

companyandHitachi.

PrinciplesofConsolidation

TheConsolidatedFinancialStatementsincludetheaccountsof

IBManditscontrolledsubsidiaries,whichare generally majority

owned. The accounts of variable interest entities (VIEs) as

defined by the Financial Accounting Standards Board (FASB)

Interpretation No. 46(R) (FIN 46(R)), are included in the

ConsolidatedFinancialStatements,ifapplicable.Investmentsin

business entities in which the company does not have control,

buthastheabilitytoexercisesignificantinfluenceoveroperating

andfinancialpolicies,areaccountedforusingtheequitymethod

and the company’s proportionate share of income or loss is

recordedinOther (income) and expense.Theaccountingpolicy

forotherinvestmentsinequitysecuritiesisdescribedonpage 60

within“MarketableSecurities.” Equityinvestmentsinnon-publicly

traded entities are accounted for using the cost method.

Intercompanytransactionsandaccountshavebeeneliminated.

UseofEstimates

The preparation of Consolidated Financial Statements in con-

formitywithGAAPrequiresmanagementtomakeestimatesand

assumptionsthataffecttheamountsofassets,liabilities,revenue

and expenses that are reported in the Consolidated Financial

Statementsandaccompanyingdisclosures,includingthedisclo-

sure of contingent assets and liabilities. These estimates are

basedonmanagement’sbestknowledgeofcurrentevents,his-

toricalexperience, actions thatthecompany may undertake in

thefuture,andonvariousotherassumptionsthatarebelievedto

be reasonable under the circumstances. As a result, actual

resultsmaybedifferentfromtheseestimates.Seepages 40 to42

foradiscussionofthecompany’scriticalaccountingestimates.

Revenue

Thecompanyrecognizesrevenuewhen itisrealizedorrealiz-

ableandearned. The companyconsidersrevenuerealizedor

realizable and earned when it has persuasive evidence of an

arrangement,deliveryhasoccurred,thesalespriceisfixedor

determinable,andcollectibilityisreasonablyassured.Delivery

does not occur until products have been shipped or services

havebeenprovidedtotheclient,riskoflosshastransferredto

the client and client acceptance has been obtained, client

acceptanceprovisionshavelapsed,orthecompanyhasobjec-

tiveevidencethatthecriteriaspecifiedintheclientacceptance

provisions have been satisfied. The sales price is not consid-

eredtobefixedordeterminableuntilallcontingenciesrelatedto

thesalehavebeenresolved.

The company recognizes revenue on sales to solution

providers, resellers and distributors (herein referred to as

“resellers”) when the reseller has economic substance apart

fromthecompany,creditrisk,titleandriskoflosstotheinven-

tory, the fee to the company is not contingent upon resale or

payment by theend user, the company has no further obliga-

tionsrelatedtobringingabout resaleor delivery,andall other

revenue recognitioncriteriahavebeenmet.

Thecompanyreducesrevenueforestimatedclientreturns,

stock rotation, price protection, rebates and other similar

allowances. (SeeScheduleII,“ValuationandQualifyingAccounts

andReserves” includedinthecompany’sAnnualReportonForm

10-K).Revenueisrecognizedonlyiftheseestimatescanbereli-

ablydetermined.Thecompanybasesitsestimatesonhistorical

results taking into consideration the type of client, the type of

transaction and the specifics of each arrangement. Payments

madeundercooperativemarketingprogramsarerecognizedas

anexpenseonlyifthecompanyreceivesfromtheclientaniden-

tifiablebenefitsufficientlyseparablefromtheproductsalewhose

fairvaluecanbereasonablyestimated.Ifthecompanydoesnot

receive an identifiable benefit sufficiently separable from the

product salewhosefairvaluecanbereasonablyestimated,such

paymentsarerecordedasareductionofrevenue.

Revenuefromsalesofthird-partyvendorproductsorserv-

ices is recorded net of costs when the company is acting as

an agent between the client and vendor and gross when the

company is a principal to the transaction. Several factors are

considered to determine whether the company is an agent or

principal, most notably whether the company is the primary

obligortotheclient,hasinventoryriskoraddsmeaningfulvalue

tothevendor’sproductorservice. Considerationisalsogivento

whetherthecompanywasinvolvedintheselectionoftheven-

dor’s product or service, has latitude in establishing the sales

price,orhascreditrisk.

Inaddition totheaforementionedgeneralpolicies,thefol-

lowingarethespecificrevenuerecognitionpoliciesformultiple-

elementarrangementsandforeachmajorcategoryofrevenue.

MULTIPLE-ELEMENT ARRANGEMENTS

The company enters into multiple-element revenue arrange-

ments,whichmayincludeanycombinationofservices,software,

hardwareand/orfinancing.Totheextentthata deliverable in a

multiple-element arrangement is subject to specific guidance

(likesoftwarethatissubjecttotheAmericanInstituteofCertified

Public Accountants (AICPA) Statement of Position (SOP) No.

97-2,“SoftwareRevenue Recognition,” see “Software” onpage