IBM 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NotestoConsolidatedFinancialStatements

INTERNATIONALBUSINESSMACHINESCORPORATION ANDSUBSIDIARYCOMPANIES

_75

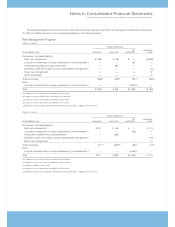

Thefollowingtableprovidesaroll-forwardofthecurrentandnon-currentliabilitiesassociatedwiththesespecialactions.Thecurrent

liabilitiespresentedinthetableareincludedinOtheraccruedexpensesandliabilitiesintheConsolidatedStatementofFinancialPosition.

(Dollarsinmillions)

LIABILITY ADDITIONS— LIABILITY

ASOF 2NDQTR. OTHER ASOF

DEC. 31,2004 2005ACTIONS PAYMENTS ADJUSTMENTS* DEC. 31,2005

Current:

Workforce $«139 $«1,335 $«(1,137) $««124 $«461

Space 86 59 (159) 76 62

Other 9 — (2) (1) 6

TotalCurrent $«234 $«1,394 «$«(1,298) $««199 $«529

Non-current

Workforce $«543 $««««239 $«««««««— $«(285) $«497

Space 244 82 — (90) 236

TotalNon-current $«787 $««««321 $«««««««— $«(375) $«733

* The Other Adjustmentscolumninthetableaboveprincipallyincludesthereclassificationofnon-currenttocurrentandforeigncurrencytranslationadjustments.Inaddition,

duringtheyearendedDecember31,2005,netadjustmentswererecordedtodecreasepreviouslyrecordedliabilitiesforchangesintheestimatedcostofemployeetermi-

nationsandvacantspaceforthe2002actions($2million),thesecond-quarter2005actions($34million)andtheactionstakenpriorto1999($5million),offsetbyincreases

inpreviouslyrecordedliabilitiesfortheHDD-relatedrestructuringin2002($1 million).Ofthe$40millionofnetreductionsrecordedduringtheyearendedDecember31,

2005,$28millionwasincludedin SG&A expense,$7millionwasrecordedOther(income)andexpense,offsetbychargesof$1 millionincludedinDiscontinuedOperations

(fortheHDD-relatedrestructuringactions)intheConsolidatedStatementofEarnings.Theremaining$6millionofnetreductionswererecordedtoGoodwillduringtheyear

endedDecember31,2005forchangestoestimatedvacantspaceassociatedwiththe2002actions.

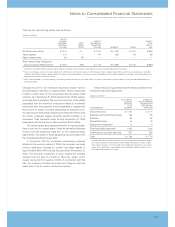

Theworkforceaccrualsprimarilyrelatetothecompany’sGlobal

Services business. The remaining liability relates to terminated

employees who are no longer working for the company, who

weregrantedannual payments tosupplementtheirincomes in

certain countries. Depending on the individual country’s legal

requirements,theserequiredpaymentswillcontinueuntilthefor-

mer employee begins receiving pension benefits or dies.

IncludedintheDecember31,2005workforceaccrualsaboveis

$48 million associated with the HDD divestiture discussed in

note A,“SignificantAccountingPolicies,” onpage 54.Thespace

accrualsareforongoingobligationstopayrentforvacantspace

thatcouldnotbesubletorspacethatwassubletatrateslower

thanthecommittedleasearrangement.Thelengthoftheseobli-

gationsvariesbyleasewiththelongestextendingthrough2019.

Otheraccrualsareprimarilytheremainingliabilities(otherthan

workforceorspace)associatedwiththe HDDdivestiture.

The company employs extensive internal environmental

protectionprogramsthatprimarilyarepreventiveinnature.The

company also participates in environmental assessments and

cleanupsatanumberoflocations,includingoperatingfacilities,

previouslyownedfacilitiesandSuperfundsites. Ourmaximum

exposure for all environmental liabilities cannot be estimated

andnoamountshavebeenrecordedfornon-AROenvironmental

liabilitiesthatarenotprobableorestimable.Thetotalamounts

accrued for non-ARO environmental liabilities, including

amountsclassifiedascurrentintheConsolidatedStatementof

FinancialPosition,thatdonotreflectactualoranticipatedinsur-

ance recoveries, were $254 million and $246 million at

December31,2005and2004,respectively.Estimatedenviron-

mentalcosts are not expectedto materially affecttheconsoli-

datedfinancialpositionorconsolidatedresultsofthecompany’s

operationsinfutureperiods.However,estimatesoffuturecosts

are subject to change due to protracted cleanup periods and

changingenvironmentalremediationregulations.

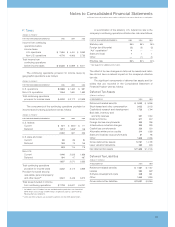

N.Stockholders’ EquityActivity

The authorized capital stock of IBM consists of 4,687,500,000

sharesofcommonstock,$.20parvalue,ofwhich 1,573,979,761

shareswereoutstandingatDecember31,2005and150,000,000

shares of preferred stock, $.01 par value, none of which were

outstandingatDecember31,2005.

StockRepurchases

Fromtimetotime,theBoardofDirectorsauthorizesthecompany

to repurchase IBM common stock. The company repurchased

90,237,800 commonsharesatacostof$7,671 million, 78,562,974

commonsharesatacostof$7,275 millionand49,994,514 com-

monsharesatacostof$4,403 millionin2005,2004 and2003,

respectively. The companyissued 2,594,786 treasury sharesin

2005, 2,840,648 treasurysharesin2004 and 2,120,293 treasury

shares in 2003, as a result of exercises of stock options by

employeesofcertainrecentlyacquiredbusinessesandbynon-

U.S.employees.AtDecember31,2005,$5,015 millionofBoard-

authorizedrepurchases wasstillavailable.Thecompanyplansto

purchase shares on the open market or in private transactions

fromtimetotime,dependingonmarketconditions.Inconnection

withtheissuanceofstockaspartofthecompany’sstock-based

compensationplans, 606,697 commonsharesatacost of $52

million, 422,338 common shares at a cost of $38 million and

291,921 commonsharesat a costof$24 millionin2005, 2004

and2003,respectively,wereremittedbyemployeestothecom-

pany in order to satisfy minimum statutory tax withholding

requirements.SuchamountsareincludedintheTreasurystock

balanceintheConsolidatedStatementofFinancialPositionand

theConsolidatedStatementofStockholders’ Equity.