IBM 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2005

Annual Report

Table of contents

-

Page 1

2005 Annual Report -

Page 2

..., its application in business and the onrush of globalization. I have also reported on the actions we have taken to capitalize on these shifts and to position our company for long-term prosperity. IBM has emerged from this period a very different company. We are much more focused on the high-value... -

Page 3

Samuel J. Palmisano Chairman, President and Chief Executive Officer 2_ -

Page 4

... of improvement in pSeries' market position. We expect to maintain our leadership in the fast-growing Blade server business, with a 2005 growth rate of 65 percent. In addition, our system storage business was up 15 percent for the year, driven by our mainstay disk and tape products. And our emerging... -

Page 5

... to address both our sales model and services cost structure last year, and we did so. We also took other actions to strengthen our services business - shifting thousands of employees into global delivery centers; rebalancing our Integrated Technology Services portfolio; and doubling the resources... -

Page 6

..., systems integration, application management services, infrastructure and system maintenance and Web hosting. IBM Global Services signings grew 9 percent in 2005. * Excludes 2Q restructuring charges and PCs. Software includes Enterprise Investments. The company has steadily shifted its business... -

Page 7

... In 2005, excluding PCs, the company grew in: Emerging Business Transformation Opportunities • Business Performance Transformation Services: an estimated $500 billion market for transforming operations such as supply chain management, engineering and design services, human resource management and... -

Page 8

... more toward higher value solutions and away from individual product sales. In large measure as a result of those changes, our gross profit margin is the best it's been since 1996, and the company is much better balanced in terms of profit Integrate to Innovate Each of our three major businesses is... -

Page 9

...lower the center of gravity" of our company. Starting in Europe, for instance, we implemented a new management system in 2005 that flattened the organizational structure and moved more clientfacing leaders out into local markets - the biggest such change there in nearly half a century. It used to be... -

Page 10

.... First, we formed a new group of IBM's seniormost leaders who will be accountable for the performance and execution of our business. Second, we created a broader group that will focus specifically on integrating IBM on the basis of our values. Both groups met for the first time about a month ago to... -

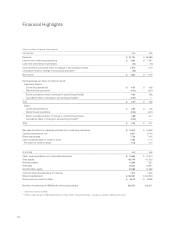

Page 11

... Stockholders' equity Common shares outstanding (in millions) Market capitalization Stock price per common share Number of employees in IBM/wholly owned subsidiaries * Does not total due to rounding. ** Reflects implementation of FASB Interpretation No. 47. See note B, "Accounting Changes," on pages... -

Page 12

... of Financials INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES Report of Management Report of Independent Registered Public Accounting Firm Management Discussion Road Map Forward-Looking and Cautionary Statements Management Discussion Snapshot Description of Business Year... -

Page 13

...BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES Management Responsibility for Financial Information Responsibility for the integrity and objectivity of the financial information presented in this Annual Report rests with IBM management. The accompanying financial statements... -

Page 14

Report of Independent Registered Public Accounting Firm INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES TO THE STOCKHOLDERS AND BOARD OF DIRECTORS OF INTERNATIONAL BUSINESS MACHINES CORPORATION : We have completed integrated audits of International Business Machines ... -

Page 15

... model is designed to allow for flexibility and periodic rebalancing. In 2005, 16 acquisitions were completed, primarily in software and services, at an aggregate cost of approximately $2 billion, and the company completed the sale of its Personal Computing business to Lenovo Group Limited... -

Page 16

... MACHINES CORPORATION AND SUBSIDIARY COMPANIES foreign currency exchange rates and therefore facilitates a comparative view of business growth. The percentages reported in the financial tables throughout the Management Discussion are calculated from the underlying whole-dollar numbers... -

Page 17

...associated with the sale of the company's Personal Computing business, a gain from a legal settlement with Microsoft, partially offset by the incremental restructuring charges recorded in the second quarter. Overall, retirement-related plan costs increased $993 million versus 2004, impacting both... -

Page 18

... returns to shareholders through dividends and common stock repurchases. The company's ability to meet these objectives depends on a number of factors, including those outlined on page 21 and on pages 76 to 78. Description of Business Please refer to IBM's Annual Report on Form 10-K filed... -

Page 19

... management, human capital, business strategy and change, and supply-chain management, as well as application innovation and the transformation of business processes and operations. BUSINESS PERFORMANCE MANAGEMENT (BPM). Commercial financing. Short-term inventory and accounts receivable... -

Page 20

... businesses include SO, BTO, and the federal content of C&SI. SYSTEMS AND TECHNOLOGY GROUP provides IBM's clients specific IT solutions supporting the Hardware, Software and Global Services segments of the company. Primary product lines include product life cycle management software... -

Page 21

...and telephone sales of standard hardware, software, services and financing for all size companies. BUSINESS PARTNERS ROUTES-TO-MARKET new technology is not strategic to IBM's business goals. A third group is both used internally and licensed externally. In addition to these IP income... -

Page 22

...systems, software and services changes, whether due to general economic conditions or a shift in corporate buying patterns, sales performance could be impacted. IBM's diverse portfolio of products and offerings is designed to gain market share in strong and weak economic climates. The company... -

Page 23

...for the company's Personal Computing business in 2005 versus 12 months in 2004. The company has presented a discussion on changes in reported revenues along with a discussion of revenue results excluding the divested Personal Computing business. A significant driver of the... -

Page 24

.... REVENUE EXCLUDING DIVESTED PERSONAL COMPUTING BUSINESS REVENUE (Dollars in millions) YR. TO YR. PERCENT CHANGE CONSTANT CURRENCY FOR THE YEAR ENDED DECEMBER 31: 2005 2004 YR. TO YR. PERCENT CHANGE Statement of Earnings Revenue Presentation: Global Services Hardware Software Global Financing... -

Page 25

...and business value in their IT decisions. Clients value the IBM solutions, including the Express offerings that the company takes to market through its strong network of business partners and ISVs. The Financial Services revenue increase was driven by Banking (3.8 percent) and Insurance (7.3 percent... -

Page 26

...sales. The cost savings generated by the company's continuing focus on supply-chain initiatives also contributed to the overall administrative expense: Selling, general and administrative-base Advertising and promotional expense Workforce reductions-ongoing Restructuring Retirement-related... -

Page 27

Management Discussion INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES actions and the Personal Computing business divestiture, lower stock-based compensation expense (see "Stock-Based Compensation" caption below for additional information) and lower ongoing... -

Page 28

.... The analysis of 2004 versus 2003 external segment results is on pages 34 to 36. GLOBAL SERVICES (Dollars in millions) FOR THE YEAR ENDED DECEMBER 31: 2005 2004 YR. TO YR. CHANGE Global Services revenue: Strategic Outsourcing Business Consulting Services Integrated Technology Services Maintenance... -

Page 29

... "2005 Actions," on pages 80 and 81 for additional information), improved utilization levels, primarily within BCS, and a better overall contract profile versus the prior In 2005, total Global Services signings increased 9 percent year to year, driven by a 19 percent increase in longer-term... -

Page 30

Management Discussion INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES HARDWARE (Dollars in millions) FOR THE YEAR ENDED DECEMBER 31: 2005 2004 YR. TO YR. CHANGE Hardware revenue: Systems and Technology Group zSeries iSeries pSeries xSeries Storage Systems ... -

Page 31

...company believes it gained market share in all five key middleware brands in 2005 and held market share in total Middleware. The WebSphere family of products revenue increased with growth in WebSphere Application Servers (15 percent) and WebSphere Portals (12 percent) software versus... -

Page 32

...$1,700 million funding of the IBM Personal Pension Plan (PPP) in the first quarter of 2005. Long-term debt increased $597 million due to new debt issuances. The company continually monitors its liquidity profile and interest rates, and manages its short- and long-term debt portfolios... -

Page 33

... 31, 2005 was within acceptable levels at 6.7 percent. Non-Global Financing debt increased versus 2004 primarily to facilitate the company's repatriation actions under the American Jobs Creation Act of 2004. The increase relates to short-term debt issuances. EQUITY (Dollars in... -

Page 34

... revenue in the Americas grew versus 2004. BCS signings increased by 23 percent, driven by the Americas and Europe, with significant growth (144 percent) in long-term Business Transformation Outsourcing signings. Profitability improved in Global Services as both gross margin... -

Page 35

... in Europe/Middle East/Africa, excluding currency benefits. Within SO, e-business Hosting Services, an offering that provides Web infrastructure and application management as an Internet-based service, continued its pattern of revenue growth. ITS revenue, which excludes Maintenance, increased... -

Page 36

...Royalties and Cost Transactions" on page 72). The Software margin at 87.2 percent increased 0.8 points due to growth in Software revenue, as well as productivity improvements in the company's support and distribution models. The cost savings generated by the company's supply-chain _35 -

Page 37

... overall margin improvement, however, the company has passed a portion of the savings to clients to improve competitive leadership and gain market share in key industry sectors. In addition, an increase in retirement-related plan costs of approximately $490 million compared to... -

Page 38

...the company's equity-based compensation programs. The anticipated decline, however, will not be at a rate consistent with the decline from 2004 to 2005, given the effect changes in the company's employee stock purchase plan had on the 2004 to 2005 expense decrease. The amount of IP and... -

Page 39

...from continuing operations and the company's continued focus on working capital and supply-chain management. The company returned over 100 percent of net income in 2005 to shareholders in dividend payments and share repurchases. Over the past five years, the company generated over $60.8 billion in... -

Page 40

...to stockholders' equity. PAYMENTS DUE IN 2006 2007-08 2009-10 AFTER 2010 Long-term debt obligations Capital (finance) lease obligations Operating lease obligations Purchase obligations Other long-term liabilities: Minimum pension funding (mandated)* Executive compensation Environmental liabilities... -

Page 41

... life cycles and anticipated competitor actions. To the extent that Microelectronics' actual useful lives differ from management's estimates by 10 percent, consolidated net The expected long-term return on plan assets is used in calculating the net periodic pension (income)/cost. See page... -

Page 42

... reduction in discount rate discussed on page 40) and plan assets as of December 31, 2005. Impacts of these types of changes on the pension plans in other countries will vary depending upon the status of each respective plan. COSTS TO COMPLETE SERVICE CONTRACTS The company enters into... -

Page 43

Management Discussion INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES amount of the restructuring charges could be materially impacted. See note R, "2005 Actions" on pages 80 and 81 for a description of restructuring actions. Currency Rate Fluctuations Changes in ... -

Page 44

Management Discussion INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES FOREIGN CURRENCY EXCHANGE RATE RISK At December 31, 2005, a 10 percent weaker U.S. dollar against foreign currencies, with all other variables held constant, would result in a decrease in the fair value... -

Page 45

... of Global Financing Receivables and Allowances.) The increase in return on equity from 2004 to 2005 and 2003 to 2004 was primarily due to higher earnings. Financial Condition BALANCE SHEET (Dollars in millions) AT DECEMBER 31: 2005 2004 Cash Net investment in sales-type leases Equipment under... -

Page 46

... include non-IBM equipment, software and services to meet IBM clients' total solutions requirements. Client financing assets are primarily sales type, direct financing, and operating leases for equipment, as well as loans for hardware, software and services with terms generally for two... -

Page 47

...," on page 61 for the company's accounting policy for residual values. Global Financing optimizes the recovery of residual values by selling assets sourced from end of lease, leasing used equipment to new clients, or extending lease arrangements with current clients. Sales of equipment... -

Page 48

...on Equity (Dollars in millions) AT DECEMBER 31: 2005 2004 operating or sales-type. Global Financing estimates the future fair value of leased equipment by using historical models, analyzing the current market for new and used equipment and obtaining forward-looking product information... -

Page 49

Consolidated Statement of Earnings INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES (Dollars in millions except per share amounts) FOR THE YEAR ENDED DECEMBER 31: NOTES 2005 2004 2003 Revenue: Global Services Hardware Software Global Financing Enterprise Investments/Other... -

Page 50

... of Financial Position INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES (Dollars in millions except per share amounts) AT DECEMBER 31: NOTES 2005 2004 Assets Current assets: Cash and cash equivalents Marketable securities Notes and accounts receivable-trade (net of... -

Page 51

...rental machines and other property Investment in software Purchases of marketable securities and other investments Proceeds from disposition of marketable securities and other investments Divestiture of businesses, net of cash transferred Acquisition of businesses, net of cash acquired Net Cash Used... -

Page 52

...Statement of Stockholders' Equity INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES (Dollars in millions) COMMON STOCK AND ADDITIONAL PAID-IN CAPITAL ACCUMULATED GAINS AND (LOSSES) NOT AFFECTING RETAINED EARNINGS RETAINED EARNINGS TREASURY STOCK TOTAL 2003 Stockholders... -

Page 53

...Statement of Stockholders' Equity INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES (Dollars in millions) COMMON STOCK AND ADDITIONAL PAID-IN CAPITAL ACCUMULATED GAINS AND (LOSSES) NOT AFFECTING RETAINED EARNINGS RETAINED EARNINGS TREASURY STOCK TOTAL 2004 Stockholders... -

Page 54

...Statement of Stockholders' Equity INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES (Dollars in millions) COMMON STOCK AND ADDITIONAL PAID-IN CAPITAL ACCUMULATED GAINS AND (LOSSES) NOT AFFECTING RETAINED EARNINGS RETAINED EARNINGS TREASURY STOCK TOTAL 2005 Stockholders... -

Page 55

...31, 2002, the International Business Machines Corporation (IBM and/or the company) sold its hard disk drive (HDD) business to Hitachi, Ltd. (Hitachi). The HDD business was part of the company's Systems and Technology Group reporting segment. The HDD business was accounted for as... -

Page 56

... from application management services, technology infrastructure and system maintenance, and Web hosting contracts is recognized on a straight-line basis over the term of the contract. Revenue from time-and-material contracts is recognized at the contractual rates as labor... -

Page 57

... set-up costs related to the installation of systems and processes and are amortized on a straight-line basis over the expected period of benefit, not to exceed the term of the contract. Additionally, fixed assets associated with outsourcing contracts are capitalized and depreciated... -

Page 58

... BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES from future revenue. Costs to support or service licensed programs are charged to software cost as incurred. The company capitalizes certain costs that are incurred to purchase or to create and implement internal-use... -

Page 59

... Statements INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES Business Combinations and Intangible Assets Including Goodwill The company accounts for business combinations using the purchase method of accounting and accordingly, the assets and liabilities of the acquired... -

Page 60

... paid-in capital exists from previous awards). See note U, "Stock-Based Compensation" on pages 83 to 85 for additional information. acquired the assets or liabilities. All other assets and liabilities are translated at year-end exchange rates. Cost of sales and depreciation... -

Page 61

...-term debt, standard market conventions and techniques such as discounted cash flow analysis, option pricing models, replacement cost and termination cost are used to determine fair value. Dealer quotes are used for the remaining financial instruments. All methods of assessing fair value... -

Page 62

Notes to Consolidated Financial Statements INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES FINANCING Financing receivables include sales-type leases, direct financing leases, and loans. Below are the methodologies the company uses to calculate both its specific ... -

Page 63

... of their fair values. The company will continue to assess its ability to estimate fair values at each future reporting date. The related liability will be recognized once sufficient additional information becomes available. In June 2005, the FASB issued FASB Staff Position... -

Page 64

... costs associated with the retirement of long-lived assets for which a legal obligation exists. The asset is required to be depreciated over the life of the related equipment or facility, and the liability is required to be accreted each year using a risk-adjusted interest rate... -

Page 65

...Systems and Technology Group segment. The overall weighted average useful life of the intangible assets purchased, excluding Goodwill, is 3.1 years. See note A, "Significant Accounting Policies," on page 58 for further description of the company's accounting policies related to business... -

Page 66

... Financial Statements INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES (Dollars in millions) CANDLE ORIGINAL AMOUNT DISCLOSED IN SECOND QTR. 2004 AMORTIZATION LIFE (IN YEARS) PURCHASE ADJUSTMENTS* TOTAL ALLOCATION MAERSK OTHER ACQUISITIONS Current assets Fixed assets... -

Page 67

... stock options with an estimated fair value of $71 million to Rational employees for a total purchase price of $2, 163 million. Rational provides open, industrystandard tools and best practices and services for developing business applications and building software products... -

Page 68

... provide maintenance, warranty and financing services to Lenovo. The company retained the warranty liability for all Personal Computing business products sold prior to the closing date. Lenovo will have the right to use certain IBM Trademarks under a Trademark License Agreement for a term of... -

Page 69

... on pages 71 to 74 for the fair value of all derivatives reported in the Consolidated Statement of Financial Position. I. Intangible Assets Including Goodwill The following table details the company's intangible asset balances by major asset class: (Dollars in millions) AT DECEMBER 31, 2005 GROSS... -

Page 70

... Financial Statements INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES (Dollars in millions) AT DECEMBER 31, 2004 GROSS CARRYING AMOUNT NET CARRYING AMOUNT INTANGIBLE ASSET CLASS ACCUMULATED AMORTIZATION Capitalized software Client-related Completed technology... -

Page 71

...Consolidated Financial Statements INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES J. Securitization of Receivables The company periodically sells receivables through the securitization of trade receivables, loans, and leases. The company retains servicing rights in... -

Page 72

... of business, the company is exposed to the impact of interest rate changes and foreign currency fluctuations, and to a lesser extent equity price changes and client credit risk. The company limits these risks by following established risk management policies and procedures, including the use... -

Page 73

... hedge the exposures related to its employee compensation obligations. The derivatives are linked to the total return on certain broad equity market indices or the total return on the company's common stock. They are recorded at fair value with gains or losses also reported in SG&A expense... -

Page 74

... MACHINES CORPORATION AND SUBSIDIARY COMPANIES The following tables summarize the net fair value of the company's derivative and other risk management instruments at December 31, 2005 and 2004 (included in the Consolidated Statement of Financial Position). Risk Management Program (Dollars... -

Page 75

...not affecting retained earnings section of the Consolidated Statement of Stockholders' Equity related to all derivatives classified as cash flow hedges: (Dollars in millions, net of tax) DEBIT/(CREDIT) assessment of hedge effectiveness (for fair value hedges and cash flow hedges), or... -

Page 76

... costs are subject to change due to protracted cleanup periods and changing environmental remediation regulations. N. Stockholders' Equity Activity The authorized capital stock of IBM consists of 4,687,500,000 shares of common stock, $.20 par value, of which 1,573,979,761 shares... -

Page 77

... in the company taking a one-time charge of $320 million in the third quarter of 2004. This agreement ends the litigation on all claims except the two claims associated with IBM's cash balance formula. The company continues to believe that its pension plan formulas are fair and legal... -

Page 78

..., the company paid Dollar General $11 million for certain used equipment as part of a sale of IBM replacement equipment in Dollar General's 2000 fourth fiscal quarter. Under the SEC's procedures, the company responded to the SEC staff regarding whether any action should be... -

Page 79

...Financial Statements INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES company also agreed, subject to certain limitations, that it will not assert antitrust claims for damages related to its server hardware and server software businesses for two years and, in any case, will... -

Page 80

... Financial Statements INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES P. Taxes (Dollars in millions) FOR THE YEAR ENDED DECEMBER 31: 2005 2004 2003 A reconciliation of the statutory U.S. federal tax rate to the company's continuing operations effective tax rate is... -

Page 81

... eligible dividends received from non-U.S. subsidiaries by the end of 2005. In order to benefit from this incentive, the company must reinvest the qualifying dividends in the U.S. under a domestic reinvestment plan approved by the Chief Executive Officer (CEO) and Board of Directors (BOD... -

Page 82

... Japan, which closed during the third quarter of 2005. In connection with this sale, the company recorded an impairment charge to write the asset down to its fair value in the second quarter. These restructuring activities had the following effect on the company's reportable segments: (Dollars in... -

Page 83

... Interpretation No. 47. See note B, "Accounting Changes," on pages 61 and 62 for additional information. Stock options to purchase 165,615,293 common shares in 2005, 133,220,730 common shares in 2004 and 124,840,510 common shares in 2003 were outstanding, but were not included in the... -

Page 84

... Accounting Policies" on pages 58 and 59, effective January 1, 2005, the company adopted the fair value recognition provisions for stock-based awards granted to employees using the modified retrospective application method provided by SFAS 123(R). Stock-based compensation cost... -

Page 85

... market price of IBM stock on the grant date. In addition, these executives have the opportunity to receive at-the-money options by agreeing to defer a certain percentage of their annual incentive compensation into IBM equity, where it is held for three years or until retirement... -

Page 86

... day of each offering period or 85 percent of the average market price on the last business day of each pay period. Effective April 1, 2005, the company modified the terms of the plan such that eligible participants may purchase full or fractional shares of IBM common stock under the ESPP... -

Page 87

... reporting period based on changes in the company's stock price. The total participants receiving benefit payments under this plan were 384 and 356 as of December 31, 2005 and 2004, respectively. NONPENSION POSTRETIREMENT BENEFIT PLANS IBM Savings Plan U.S. regular, full-time and part... -

Page 88

... is the actuarial present value of benefits expected to be paid upon retirement based upon estimated future compensation levels. The fair value of plan assets represents the current market value of cumulative company contributions made to an irrevocable trust fund, held for the sole... -

Page 89

... BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES Plan Financial Information SUMMARY OF FINANCIAL INFORMATION The following table presents a summary of the total retirement-related benefit plan cost/(income) included in the Consolidated Statement of Earnings: (Dollars... -

Page 90

... Financial Statements INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES DEFINED BENEFIT PENSION AND NONPENSION POSTRETIREMENT BENEFIT PLAN FINANCIAL INFORMATION The following represents financial information for the company's significant (1) defined benefit pension... -

Page 91

... Financial Statements INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES The changes in the benefit obligations and plan assets of the significant defined benefit pension and U.S. nonpension postretirement benefit plans as of December 31, 2005 and 2004 were: (Dollars in... -

Page 92

...: estimates of discount rates, expected return on plan assets, rate of compensation increases, interest crediting rates and mortality rates. The company evaluates these assumptions, at a minimum, annually, and makes changes as necessary. Following is information on assumptions which... -

Page 93

...expected long-term return on plan assets and the actual return on those assets were not material. Benefits for certain participants in the PPP are calculated using a cash balance formula. An assumption underlying this formula is an interest crediting rate, which impacts both net periodic cost and... -

Page 94

... Statement of Stockholders' Equity relate to the non-material plans. This accounting transaction did not impact 2005 and 2004 retirement related plans cost. The following table presents the funded status of the company's defined benefit pension plans. (Dollars in millions) 2005 BENEFIT... -

Page 95

... Financial Statements INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES increasing their dependence on contributions from the company. Within each asset class, careful consideration is given to balancing the portfolio among industry sectors, geographies, interest rate... -

Page 96

...formed the Systems and Technology Group segment. In the second quarter of 2005, the company sold its Personal Computing business which was previously a part of the Personal Systems Group. The two remaining units of the Personal Systems Group, Retail Store Systems and Printing... -

Page 97

...length leases at prices equivalent to market rates with the Global Financing segment to facilitate the acquisition of equipment used in services engagements. Generally, all internal transaction prices are reviewed and reset annually, if appropriate. The company uses shared... -

Page 98

...on page 46 of the Management Discussion. As discussed in note U, "Stock-Based Compensation" on pages 83 to 85, the company adopted the fair value method of accounting for stock-based awards granted to employees. The deferred tax asset line within the following "Reconciliation to IBM as Reported... -

Page 99

...BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES Management System Segment View (Dollars in millions) GLOBAL SERVICES SYSTEMS AND TECHNOLOGY GROUP GLOBAL FINANCING ENTERPRISE INVESTMENTS PERSONAL COMPUTING DIVISION TOTAL SEGMENTS FOR THE YEAR ENDED DECEMBER 31: SOFTWARE 2005: Assets... -

Page 100

... Financial Statements INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES RECONCILIATIONS OF IBM AS REPORTED (Dollars in millions) AT DECEMBER 31: 2005 2004 2003 (Dollars in millions) CONSOLIDATED FOR THE YEAR ENDED DECEMBER 31: 2005 2004 2003 Assets: Total reportable... -

Page 101

... INTERNATIONAL BUSINESS MACHINES CORPORATION AND SUBSIDIARY COMPANIES X. Subsequent Events On February 15, 2006, the company completed the acquisition of Micromuse for approximately $865 million. Micromuse is a publicly traded software company that provides network management... -

Page 102

...Before cumulative effect of change in accounting principle Cumulative effect of change in accounting principle** Total Cash dividends paid on common stock Per share of common stock Investment in plant, rental machines and other property Return on stockholders' equity $«««91,134 $«««««7,994... -

Page 103

... of FASB Interpretation No. 47. See note B, "Accounting Changes," on pages 61 and 62 for additional information. + Does not total due to rounding. ++The stock prices reflect the high and low prices for IBM's common stock on the New York Stock Exchange composite tape for the last two years. 102_... -

Page 104

...Officer American Express Company JUERGEN DORMANN Senior Corporate Advisor and former Chairman Mitsubishi Corporation LUCIO A. NOTO Chairman and Chief Executive Officer Eli Lilly and Company CHARLES M. VEST Chairman of the Board ABB Ltd MICHAEL L. ESKEW Managing Partner Midstream Partners... -

Page 105

... Business Machines Corporation New Orchard Road Armonk, New York 10504 (914) 499-1900 The IBM Annual Report is printed on recycled paper and is recyclable. AIX, BladeCenter, Blue Gene, Candle, DB2, Domino, eServer, IBM, iSeries, Lotus, pSeries, POWER5, POWER5+, PowerPC, Rational, System z9, Tivoli...