Holiday Inn 2015 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Independent Auditor’s UK Report continued

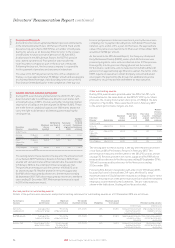

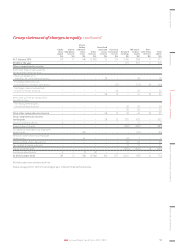

The charts below illustrate the coverage obtained from the work

performed by our audit teams.

60%

19%

21%

12%

29%

59%

RevenueProfit before tax adjusted for

pre-tax exceptional items

Full scope components

Specific scope components

Other procedures

Changes from the prior year

We have made the following changes to our scope:

• Following its disposal in May 2015, the income statement of

InterContinental Paris – Le Grand, for the period to the date

of disposal, was subject to review procedures performed by

the Primary Team (2014: full scope).

• Following its disposal in September 2015, InterContinental

Hong Kong was designated specific scope (2014: full scope).

• IHG acquired Kimpton Hotels & Restaurants Group, LLC

in January 2015. The purchase price allocation was subject to

full scope audit procedures performed by the Primary Team.

In addition, the Kimpton component was designated a review

scope with procedures performed by the Primary Team.

Involvement with component teams

In establishing our overall approach to the Group audit, we determined

the type of work that needed to be undertaken at each of the

components by us, as the Primary Team, or by component auditors

from other EY global network firms operating under our instruction.

Of the 19 full scope components, audit procedures were performed on

three of these directly by the Primary Team and 16 by component audit

teams. Of the 20 specific scope components, audit procedures were

performed on these by component audit teams. We determined the

appropriate level of involvement with the component teams to enable

us to determine that sufficient audit evidence had been obtained as a

basis for our opinion on the Group as a whole.

The Primary Team continued to follow a programme of planned visits

that has been designed to ensure that the Senior Statutory Auditor, or

her delegate, visits each of the key locations at both the interim and

year-end stages of the audit process. During the current year’s audit

cycle, visits were undertaken, at least twice, by the Primary Team to

the component teams at key locations in the United States and IHG’s

global accounting centre in India.

These visits involved discussing the audit approach with the

component team and any issues arising from their work, meeting

with local management, and reviewing key audit working papers

on the Group risk areas. The Primary Team interacted regularly with

the component teams, where appropriate, during various stages of

the audit, reviewed key working papers and were responsible for

the scope and direction of the audit process. This, together with the

additional procedures performed at Group level, gave us appropriate

evidence for our opinion on the Group Financial Statements.

Our application of materiality

We apply the concept of materiality in planning and performing the

audit, in evaluating the effect of identified misstatements on the audit

and in forming our audit opinion.

Materiality

The magnitude of an omission or misstatement that, individually or in

the aggregate, could reasonably be expected to influence the economic

decisions of the users of the Financial Statements. Materiality provides

a basis for determining the nature and extent of our audit procedures.

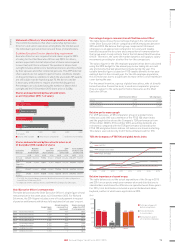

We determined materiality for the Group to be $30 million (2014: $28

million), which is 5% (2014: 5%) of profit before tax adjusted for pre-tax

exceptional items. We believe that profit before tax adjusted for pre-tax

exceptional items provides us with a consistent year-on-year basis for

determining materiality and is the most relevant performance measure

to the stakeholders of the entity. Detailed audit procedures are

performed on material exceptional items.

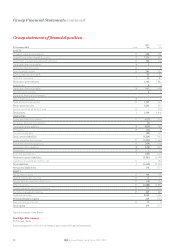

Adjust for pre-tax exceptional items of $819m

to determine adjusted profit before tax

Adjustment

Totals $593m (materiality basis)

Materiality of $30m (5% of materiality basis)

Materiality

Profit before tax $1,412m

Starting basis

During the course of our audit, we reassessed initial materiality and

the only change in final materiality was to reflect the actual reported

performance of the Group in the year.

Performance materiality

The application of materiality at the individual account or balance level.

It is set at an amount to reduce to an appropriately low level the probability

that the aggregate of uncorrected and undetected misstatements

exceeds materiality.

On the basis of our risk assessments, together with our assessment

of the Group’s overall control environment, our judgement was that

performance materiality was 75% (2014: 75%) of our planning

materiality, namely $23m (2014: $21m). We have set performance

materiality at this percentage to ensure that the total uncorrected

and undetected audit differences in all accounts did not exceed

our materiality.

Audit work at component locations for the purpose of obtaining audit

coverage over significant financial statement accounts is undertaken

based on a percentage of total performance materiality. The

performance materiality set for each component is based on the

relative scale and risk of the component to the Group as a whole

and our assessment of the risk of misstatement at that component.

In the current year, the range of performance materiality allocated

to components was $1m to $23m (2014: $1m to $21m).

Reporting threshold

An amount below which identified misstatements are considered as being

clearly trivial.

We agreed with the Audit Committee that we would report to them all

uncorrected audit differences in excess of $1.5m (2014: $1.4m), which

is set at 5% of planning materiality, as well as differences below that

threshold that, in our view, warranted reporting on qualitative grounds.

We evaluate any uncorrected misstatements against both the

quantitative measures of materiality discussed above and in light

of other relevant qualitative considerations in forming our opinion.

84 IHG Annual Report and Form 20-F 2015