Holiday Inn 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

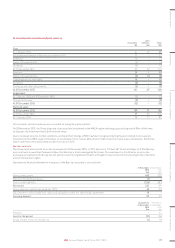

Notes to the Group Financial Statements continued

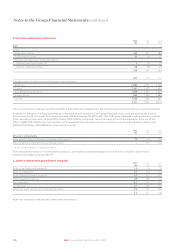

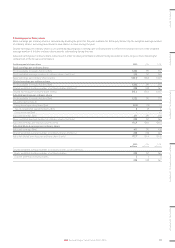

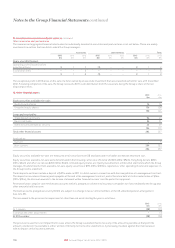

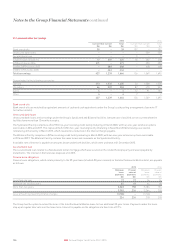

13. Goodwill and other intangible assets continued

Goodwill and brands

During the year, the Group acquired Kimpton (see note 10) resulting in the recognition of goodwill of $167m and brands of $193m, together

with management contracts of $71m.

The Kimpton brands are considered to have an indefinite life given their strong brand awareness and reputation in the upscale boutique hotel

sector, and management’s commitment to continued investment in their growth. The brands are protected by trademarks and there are not

believed to be any legal, regulatory or contractual provisions that limit the useful lives of the brands. In the hotel industry there are a number

of brands that have existed for many years and IHG has brands that are over 60 years old.

The Group tests goodwill and indefinite life intangible assets for impairment annually, or more frequently if there are any indicators that an

impairment may have arisen. The year-end carrying value of goodwill and indefinite life brands have been allocated to cash-generating units

(CGUs) for impairment testing purposes as follows:

2015 2014

Goodwill

$m

Brands

$m

Goodwill

$m

CGU

Americas Managed 63 193 –

Americas Franchised 37 – –

Europe Managed 21 – –

Europe Franchised 10 – –

AMEA Managed and Franchised 102 – 74

233 193 74

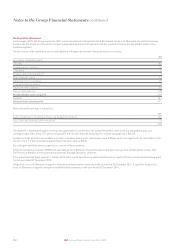

The recoverable amounts of the CGUs are determined from value in use calculations. These calculations cover a five-year period using pre-tax

cash flow forecasts derived from the most recent financial budgets and strategic plans approved by management incorporating growth rates

based on management’s past experience and industry growth forecasts. A terminal value is added using growth rates that do not exceed the

average long-term growth rates for the relevant markets. The cash flows are discounted using pre-tax rates that are based on the Group’s

weighted average cost of capital adjusted to reflect the risks specific to the business model and territory of the CGU being tested.

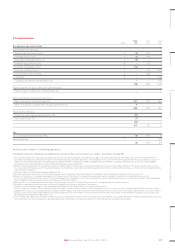

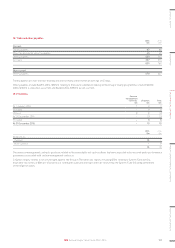

The terminal growth rates and discount rates used in the impairment tests are as follows:

Terminal growth rate Discount rate

2015

%

2014

%

2015

%

2014

%

Americas Managed 2.5 n/a 10.2 n/a

Americas Franchised 2.5 n/a 9.2 n/a

Europe Managed 2.5 n/a 9.9 n/a

Europe Franchised 2.5 n/a 8.9 n/a

AMEA Managed and Franchised 3.5 3.5 12.5 13.7

Impairment was not required at either 31 December 2015 or 31 December 2014. In each case the valuations indicate sufficient headroom such

that a reasonably possible change to key assumptions is unlikely to result in an impairment of the related goodwill.

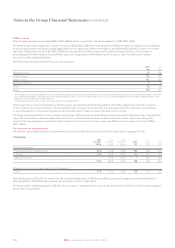

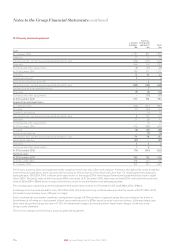

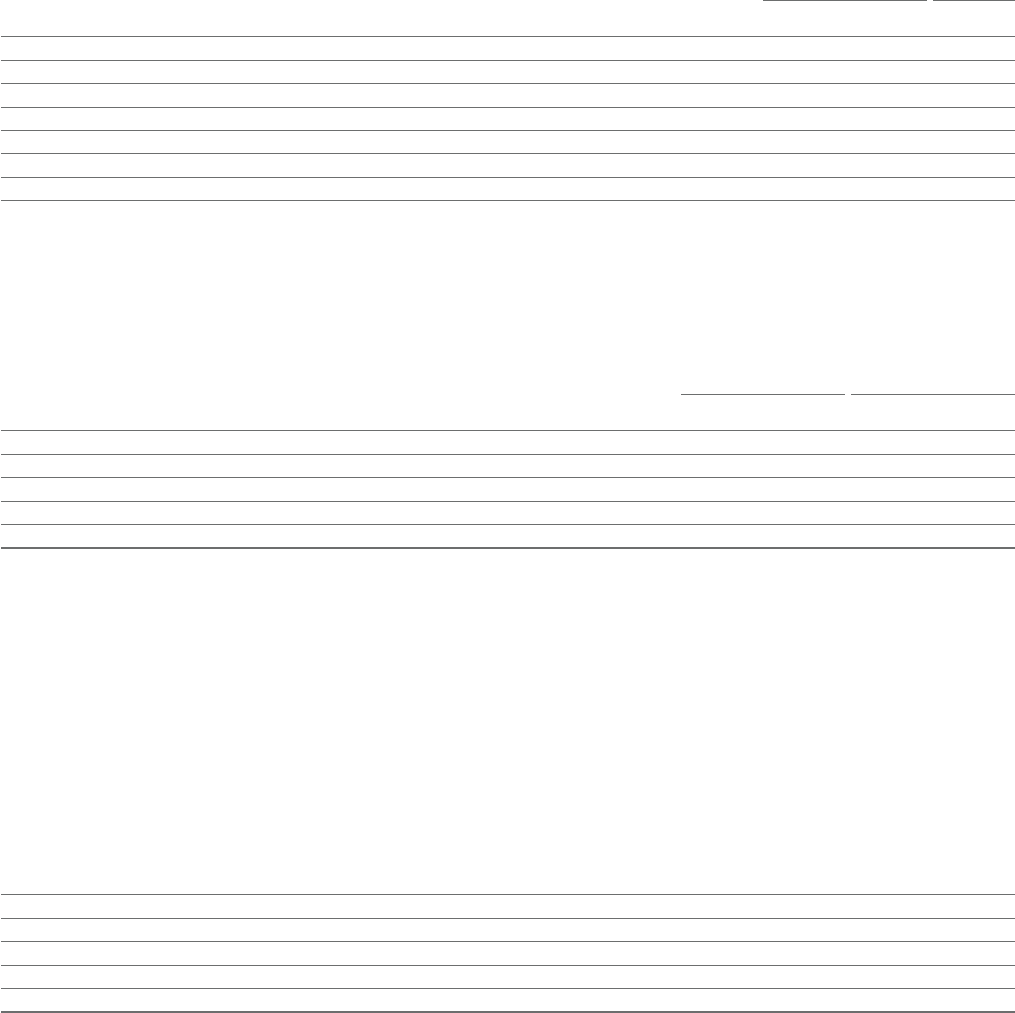

Software

Software includes $85m relating to the development of the next-generation Guest Reservation System with Amadeus. This asset is not yet in use

and therefore not being amortised.

Substantially all software additions are internally developed.

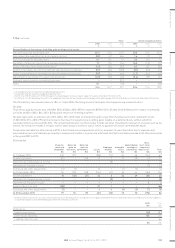

Management contracts

In addition to the management contracts acquired with the Kimpton acquisition, additions to management contracts relate to contract values

recognised as part of the proceeds for hotels sold (see note 11).

At 31 December 2015, the net book value and remaining amortisation period of the principal management contracts was as follows:

Net book

value

$m

Remaining

amortisation

period

Years

Hotel

InterContinental Hong Kong 64 37

InterContinental New York Barclay 39 48

InterContinental London Park Lane 36 47

InterContinental Paris – Le Grand 32 49

The weighted average remaining amortisation period for all management contracts is 32 years (2014: 30 years).

116 IHG Annual Report and Form 20-F 2015