Holiday Inn 2015 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

IHG’s 2016 regional priorities

1. Further accelerate System size growth across our brand portfolio

in established, and emerging, key gateway cities and resort

destinations through new constructions and hotel conversions.

2. Deliver above-market RevPAR growth through enhanced levels

of guest satisfaction and loyalty contribution, particularly for the

InterContinental and Holiday Inn brands.

3. Continue to invest in our people across the region to enable their

ability to deliver excellent guest service, innovative marketing

and promotional partnerships and superior financial performance

for our owners.

4. Build upon the momentum of our ‘winning culture’ (see page 18),

which is focused on driving performance and empowering the

business to respond with speed and agility in a diverse and

dynamic region.

Asia, Middle East and Africa (AMEA)

Execute our strategic plans to strengthen

our brands and increase our revenue

share through enhanced guest satisfaction

and greater loyalty contribution, over

the next three years.

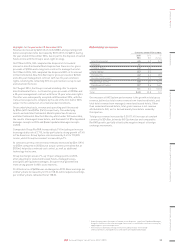

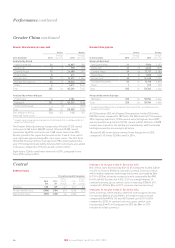

AMEA comparable RevPAR movement onprevious year

12 months ended 31 December 2015

Franchised

All brands (0.5)%

Managed

All brands 5.4%

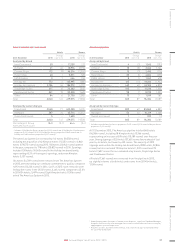

Industry performance in 2015

RevPAR growth in AMEA was 3.6%, driven primarily by a 3.2% gain

in average daily rate. In line with improving GDP growth, Japan saw

strong RevPAR growth of 14.8% due to both average daily rate, which

increased by 13.1%, and demand, which increased by 2.8%. In contrast,

Australia saw RevPAR increase 3.2%, composed of a 1.9% growth in

average daily rate and a 3.0% increase in demand. Thailand saw

RevPAR increase by a strong 13.1%, driven by 15.1% demand growth.

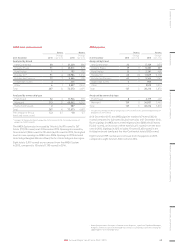

Progress against 2015 regional priorities

• Strengthened our position in the region’s priority markets

and gateway cities with the opening of 22 hotels, including

new InterContinental hotels in the UAE, Indonesia and India.

• Increased our hotel pipeline by over 3,800 rooms with 35 new

signings, eight of which were converted and rebranded within

the year.

• Continued to expand our brand portfolio in AMEA with the

successful launch of Hotel Indigo Bangkok Wireless Road which

opened in the first quarter of 2015, with additional Hotel Indigo

properties in Dubai, Bali and Phuket entering the pipeline.

• Delivered RevPAR growth of 4.5%, supported by targeted marketing

investments in the Middle East and South East Asia, despite

challenging economic and security conditions in parts of the region.

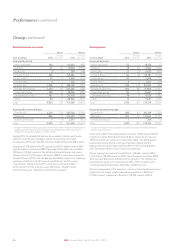

IHG’s regional performance in 2015

Across this large region, IHG is widely represented both

geographically and by brand, and comparisons across the industry

are hard to make. Overall, IHG regional comparable RevPAR increased

4.5%, driven through both occupancy and average daily rate growth.

Performance was led by strong positive trading in the mature market

of Japan, where RevPAR increased by 14.6%, marginally below the

market. Australia increased ahead of the industry at 4.5%; however

the Middle East increased by 0.2%, impacted by declining oil prices.

Our RevPAR growth in India and Indonesia was significantly ahead of

the industry at 6.4% and 1.3%, respectively.

Growth was more modest in India and Saudi Arabia, where RevPAR

increased by 5.0% and 0.9% respectively. RevPAR in the United Arab

Emirates (UAE) declined by 6.7%, driven by a 6.2% decrease in average

daily rate. In Indonesia, RevPAR declined by 6.1% due to a 5.3ppt

decrease in occupancy.

Source: Smith Travel Research for all of the above industry facts.

41

IHG Annual Report and Form 20-F 2015

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS