Holiday Inn 2015 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

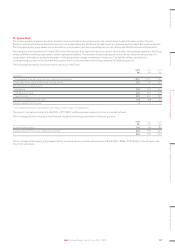

26. Share-based payments continued

The Group recognised a cost of $19m (2014: $21m, 2013: $22m) in operating profit related to equity-settled share-based payment transactions

during the year, net of amounts borne by the SystemFund.

The aggregate consideration in respect of ordinary shares issued under option schemes during the year was $nil (2014: $nil, 2013: $5m).

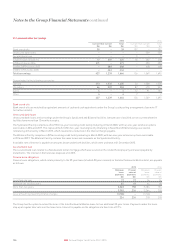

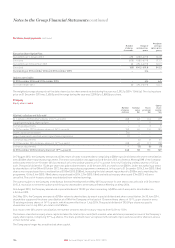

The following table sets forth awards granted during 2015:

APP LTIP

Number of shares awarded in 2015 265,285 1,803,308

The Group uses separate option pricing models and assumptions depending on the plan. The following table sets out information about awards

granted in 2015, 2014 and 2013:

APP LTIP

Binomial valuation model

Monte Carlo Simulation and

Binomial valuation model

2015 2014 2013 2015 2014 2013

Weighted average share price 2,565.0p 1,925.0p 1,928.0p 2,634.0p 1,916.0p 1,913.0p

Expected dividend yield n/a n/a 2.63% 2.34% 2.55% 2.59%

Risk-free interest rate 0.59% 1.29% 0.27%

Volatilitya22% 28% 28%

Term (years) 3.0 3.0 3.0 3.0 3.0 3.0

a The expected volatility was determined by calculating the historical volatility of the Company’s share price corresponding to the expected life of the share award.

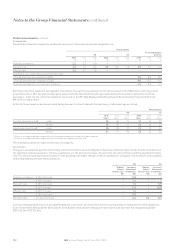

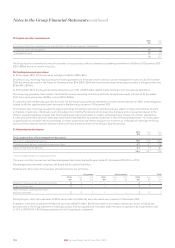

Movements in the awards outstanding under the schemes are as follows:

APP

Number

of shares

thousands

LTIP

Number

of shares

thousands

Outstanding at 1 January 2013 622 7,160

Granted 319 2,227

Vested (72) (2,206)

Lapsed or cancelled (29) (406)

Outstanding at 31 December 2013 840 6,775

Granted 305 2,171

Vested (310) (1,447)

Share capital consolidation (38) –

Lapsed or cancelled (29) (1,379)

Outstanding at 31 December 2014 768 6,120

Granted 265 1,803

Vested (307) (1,278)

Lapsed or cancelled (37) (1,370)

Outstanding at 31 December 2015 689 5,275

Fair value of awards granted during the year (cents) APP LTIP

2015 3,874.5 1,734.5

2014 3,134.6 1,202.1

2013 2,873.4 1,127.9

Weighted average remaining contract life (years) APP LTIP

At 31 December 2015 1.2 1.1

At 31 December 2014 1.1 1.1

At 31 December 2013 1.1 1.1

The above awards do not vest until the performance and service conditions have been met.

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

135IHG Annual Report and Form 20-F 2015