Holiday Inn 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

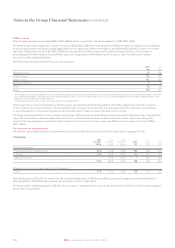

Notes to the Group Financial Statements continued

10. Acquisition of business

On 16 January 2015, the Group acquired a 100% ownership interest in Kimpton Hotel & Restaurant Group, LLC (Kimpton), an unlisted company

based in the US. Kimpton is the world’s largest independent boutique hotel operator and the acquisition makes IHG the market leader in the

boutique segment.

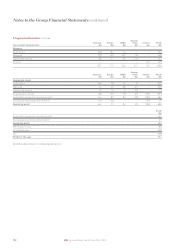

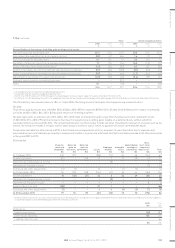

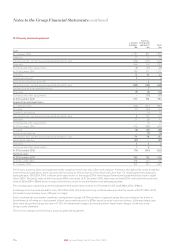

The fair values of the identifiable assets and liabilities of Kimpton at the date of acquisition were as follows:

$m

Identifiable intangible assets:

Brands 193

Management contracts 71

Software 2

Property, plant and equipment 3

Other financial assets 10

Trade and other receivables 29

Cash and cash equivalents 3

Trade and other payables (27)

Non-current liabilities (10)

Net identifiable assets acquired 274

Goodwill 167

Total purchase consideration 441

Net cash outflow arising on acquisition:

$m

Cash consideration, including working capital payment of $11m 441

Less: cash and cash equivalents acquired (3)

438

The goodwill is mainly attributable to the growth opportunities identified for the acquired business, both in the US and globally, plus cost

synergies expected to arise. The amount of goodwill that is expected to be deductible for income tax purposes is $164m.

Included in trade and other receivables are trade receivables with a gross contractual value of $26m, which are expected to be collectable in full.

The fair value of trade receivables approximates the book value of $26m.

No contingent liabilities were recognised as a result of the acquisition.

Kimpton contributed revenue of $59m and operating profit of $18m for the period between the date of acquisition and the balance sheet date.

The results of Kimpton are included in the Americas managed business segment.

If the acquisition had taken place at 1 January 2015, there would have been no material difference to reported Group revenue and operating profit

for the year ended 31 December 2015.

Integration costs of $10m were charged to exceptional administrative expenses in the year ended 31 December 2015. Acquisition transaction

costs of $7m were charged to exceptional administrative expenses in the year ended 31 December 2014.

112 IHG Annual Report and Form 20-F 2015