Holiday Inn 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

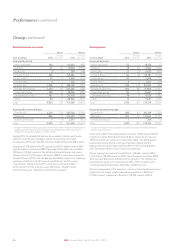

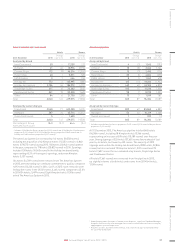

Performance continued

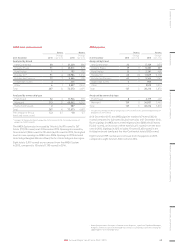

IHG’s 2016 regional priorities

1. Continue to build IHG System size through driving growth in our

priority markets of the UK, Germany, and Russia and the CIS,

and across key cities, localising our brands as necessary.

2. Continue to improve guest experience and increase satisfaction

by focusing on quality and driving innovation to ensure our brands

are preferred.

3. Roll out our ‘Lowest Price Promise’ initiative into additional markets

in Europe post the successful pilot in the UK (see page 23).

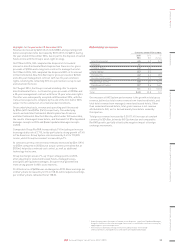

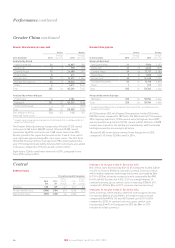

Europe comparable RevPAR movement on previous year

12 months ended 31 December 2015

Franchised

All brands 5.3%

Managed

All brands 6.2%

Continue to grow in priority markets and

key cities, whilst driving brand preference,

focusing on quality and innovation in guest

experience, over the next three years.

Europe

Industry performance in 2015

The hotel industry in Europe is influenced by the larger markets in the

region, in particular the UK and Germany. In 2015, RevPAR increased

7.5% across the region, driven by a 2.8% increase in demand and a

5.4% growth in average daily rate. RevPAR growth in the UK was 4.5%,

driven by a 3.9% increase in average daily rate and a 2.3% increase

Progress against 2015 regional priorities

• Signed 48 hotels, of which 11 are in the UK, 14 are in Germany, and

8 are in Russia and the Commonwealth of Independent States (CIS).

It was our largest number of signings in Germany for the second

year running.

• Achieved an excellent year for InterContinental in Europe, with

five hotel signings and three openings, including the landmark

InterContinental London – The O2 and InterContinental

Bordeaux – Le Grand.

• Improved guest experience through the implementation of the new

Holiday Inn Express hotel design (see page 20).

• Launched the ‘Lowest Price Promise’ campaign, providing a clear

incentive for guests to become part of IHG Rewards Club and book

through our direct channels.

• 10 properties completed the roll-out of the next-generation design

in 2015 and an additional 83 hotels signed up during the year.

• Enhanced operations support with a dedicated Luxury and Boutique

Operations division, restructured the franchise support teams and

introduced a central operations support team.

IHG’s regional performance in 2015

IHG’s regional comparable RevPAR increased by 5.4%, driven by

average daily rate growth of 3.9%. The UK achieved strong growth

of 5.1%, ahead of the industry, led by average daily rate driven growth

in both London and the provinces. In Germany, RevPAR increased by

4.4%, and in Russia, RevPAR declined slightly by 1.6% – both behind

the market. Across the rest of Europe, our RevPAR increased by

mid-single digits, despite challenging trading conditions in Paris

in the last quarter of the year.

in demand. In Germany, RevPAR saw strong growth of 6.5%, driven

by a 4.3% growth in average daily rate and a 2.8% increase in demand.

Russia saw growth of 11.9% driven by a 6.0% increase in average

daily rate.

Source: Smith Travel Research for all of the above industry facts.

38 IHG Annual Report and Form 20-F 2015