Holiday Inn 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Group Financial Statements continued

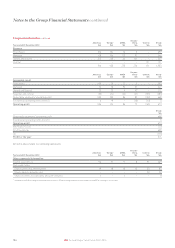

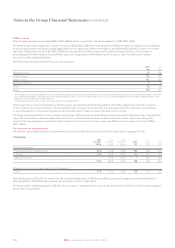

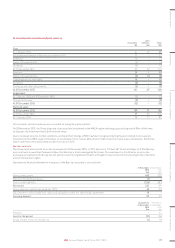

12. Property, plant and equipment

Land and

buildings

$m

Fixtures,

fittings and

equipment

$m

Total

$m

Cost

At 1 January 2014 1,101 871 1,972

Additions 27 52 79

Transfers to non-current assets classified as held for sale (276) (171) (447)

Disposals (144) (61) (205)

Exchange and other adjustments (8) (20) (28)

At 31 December 2014 700 671 1,371

Additions 13 29 42

Capitalised interest 2–2

Acquisition of business (note 10) –33

Transfers to non-current assets classified as held for sale (329) (120) (449)

Reclassification from intangible assets –77

Disposals (9) (3) (12)

Exchange and other adjustments – (11) (11)

At 31 December 2015 377 576 953

Depreciation and impairment

At 1 January 2014 (156) (647) (803)

Provided (11) (32) (43)

System Fund expense –(4)(4)

Transfers to non-current assets classified as held for sale 8 107 115

Disposals 37 58 95

Exchange and other adjustments –1010

At 31 December 2014 (122) (508) (630)

Provided (8) (27) (35)

System Fund expense –(3)(3)

Transfers to non-current assets classified as held for sale 79 78 157

Impairment charges (27) – (27)

Disposals 336

Exchange and other adjustments 167

At 31 December 2015 (74) (451) (525)

Net book value

At 31 December 2015 303 125 428

At 31 December 2014 578 163 741

At 1 January 2014 945 224 1,169

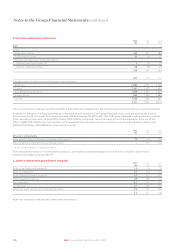

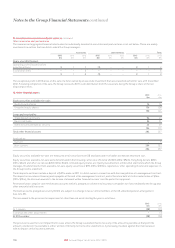

The Group’s property, plant and equipment mainly comprises hotels, but also offices and computer hardware, throughout the world. In addition

to the hotels included above, there was one hotel classified as held for sale at 31 December 2014 (see note 11). Following the hotel disposals

during the year, 43% (2014: 75%) of the net book value relates to the largest (2014: three largest) owned and leased hotel(s) of a total of eight

hotels (2014: 10 hotels), seven of which are open (2014: nine open). At 31 December 2015, there was one hotel (2014: one hotel) with a net book

value of $53m (2014: $36m) which is under construction, not yet in use and therefore not being depreciated.

The carrying value of property, plant and equipment held under finance leases at 31 December 2015 was $184m (2014: $186m).

Including assets classified as held for sale, 22% (2014: 40%) of hotel properties by net book value were directly owned, with 59% (2014:22%)

held under leases having a term of 50 years or longer.

Due to localised adverse market conditions, an impairment charge of $27m has been recognised during the year relating to two hotels in

North America following a re-assessment of their recoverable amounts to $37m, based on value in use calculations. Estimated future cash

flows were discounted at a pre-tax rate of 11.75%. All impairment charges are included within ‘impairment charges’ on the face of the

Group income statement.

There are no charges over the Group’s property, plantandequipment.

114 IHG Annual Report and Form 20-F 2015