Holiday Inn 2015 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Parent Company Financial Statements continued

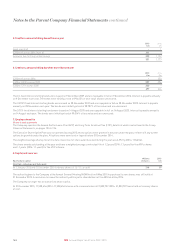

1. Accounting policies continued

Foreign currency

Transactions in foreign currencies are translated to the Company’s functional currency at the foreign exchange rate ruling on the date of the

transaction. Monetary assets and liabilities denominated in foreign currencies are retranslated to the functional currency at the relevant rates

of exchange ruling on the last day of the period. Foreign exchange differences arising on translation are recognised in the income statement.

Non-derivative financial instruments

Non-derivative financial instruments comprise investments in equity securities, amounts due from and amounts due to Group undertakings

and loans and borrowings.

Investments in equity securities

Investments in subsidiaries are carried at cost plus deemed capital contributions arising from share-based payment transactions less any

provision for impairment. The carrying amount is reviewed at each reporting date to determine whether there is any indication of impairment.

If any such indication exists, then the asset’s recoverable amount is estimated. An impairment loss is recognised if the carrying amount of an

asset exceeds its estimated recoverable amount. Impairment losses are recognised in the income statement.

Amounts due from and amounts due to Group undertakings

Amounts due from and amounts due to Group undertakings are initially recognised at fair value. Subsequent to initial recognition they are

measured at amortised cost using the effective interest method, less any impairment losses. The carrying value is assessed at each reporting

date to determine whether there is objective evidence that it is impaired. An impairment loss is calculated as the difference between its carrying

amount and the present value of the estimated future cash flows discounted at the asset’s original effective interest rate.

Interest-bearing borrowings

Interest-bearing borrowings are initially recognised at the fair value of the consideration received less directly attributable transaction costs.

They are subsequently measured at amortised cost. Finance charges, including the transaction costs and any discount or premium on issue,

are recognised in the income statement using the effective interest rate method.

Borrowings are classified as due after more than one year when the repayment date is more than 12 months from the period-end date or where

they are drawn on a facility with more than 12 months to expiry.

Share-based payments

The cost of equity-settled transactions with employees is measured by reference to fair value at the date at which the right to the shares is

granted. Fair value is determined by an external valuer using option pricing models.

The cost of equity-settled transactions is recognised, together with a corresponding increase in equity, over the period in which any performance

or service conditions are fulfilled, ending on the date on which the relevant employees become fully entitled to the award (vesting date).

The income statement charge for a period represents the movement in cumulative expense recognised at the beginning and end of that period.

No expense is recognised for awards that do not ultimately vest, except for awards where vesting is conditional upon a market or non-vesting

condition, which are treated as vesting irrespective of whether or not the market or non-vesting condition is satisfied, provided that all other

performance and/or service conditions are satisfied.

Where the Company grants options over its own shares to the employees of its subsidiaries, it recognises, in the Parent Company Financial

Statements, an increase in the cost of investment in its subsidiaries equivalent to the equity-settled share-based payment charge recognised

in its Consolidated Financial Statements with the corresponding credit being recognised directly in equity.

Treasury shares

Own shares repurchased by the Company and not cancelled (treasury shares) are recognised at cost and deducted from retained earnings.

If reissued, any excess of consideration over purchase price is recognised in the share premium reserve.

146 IHG Annual Report and Form 20-F 2015