Holiday Inn 2015 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Performance continued

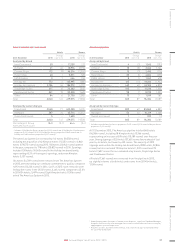

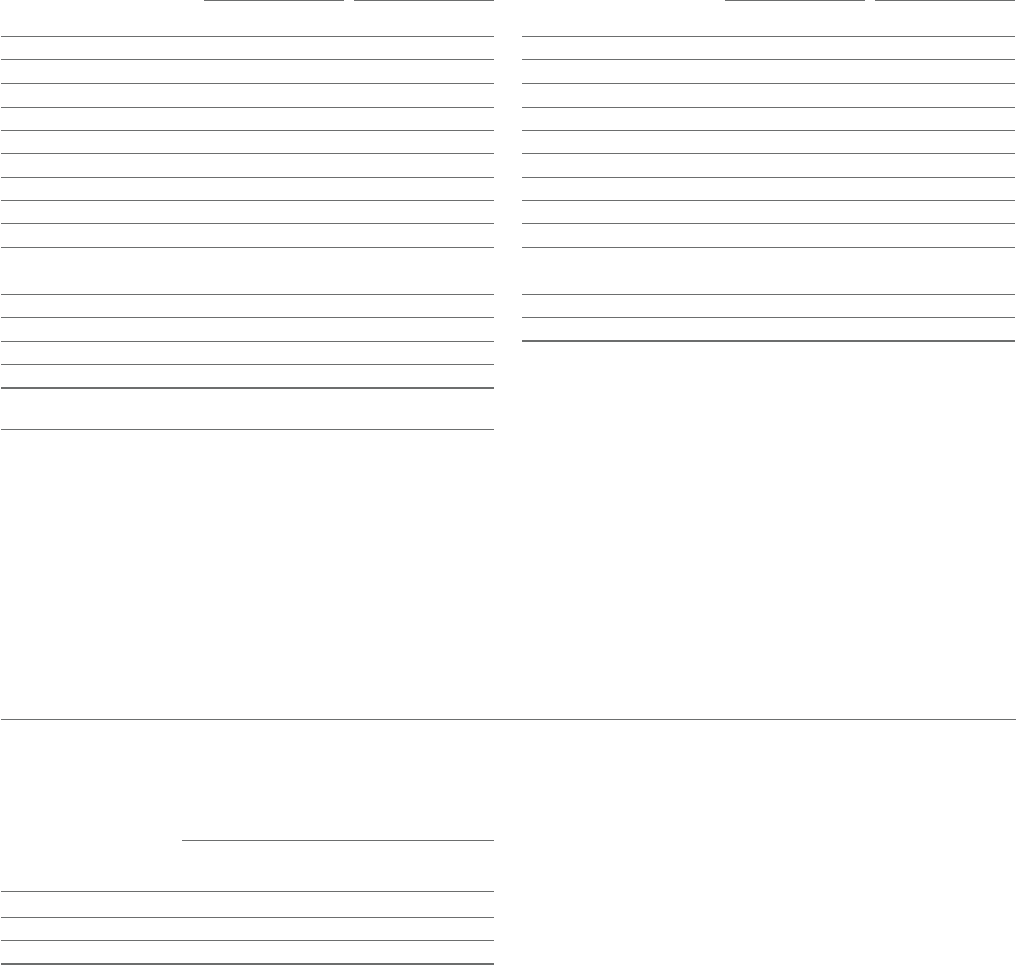

Greater China hotel and room count

Hotels Rooms

At 31 December 2015

Change

over 2014 2015

Change

over 2014

Analysed by brand

InterContinental 34 1 13,807 265

HUALUXE 3 3 798 798

Crowne Plaza 75 2 26,688 575

Hotel Indigo 5 – 611 (1)

Holiday Inna 78 5 24,971 1,564

Holiday Inn Express 64 9 16,023 1,947

Other 6 4 2,611 2,167

Total 265 24 85,509 7,315

Analysed by ownership type

Franchised 4– 2,184 –

Managed 261 25 83,325 7,818

Owned and leased –(1) – (503)

Total 265 24 85,509 7,315

Percentage of Group

hotel and room count

5.3 0.3 11.5 0.5

a Includes seven Holiday Inn Resort properties (2,235 rooms) (2014: six Holiday Inn Resort

properties (1,825 rooms)).

The Greater China System size increased by 24 hotels (7,315 rooms)

in the year to 265 hotels (85,509 rooms). 32 hotels (9,380 rooms)

opened during 2015, two hotels and 1,268 rooms lower than 2014.

Recent growth in the region has focused on tier 2 and 3 cities, which

now represent approximately 68% of our open rooms. The first three

HUALUXE Hotels and Resorts properties (798 rooms) opened in the

year. 19 Holiday Inn brand family hotels (4,567 rooms) were also added

in the year, compared to 19 hotels (4,445 rooms) in 2014.

Eight hotels (2,065 rooms) were removed in 2015, compared to one

hotel (999 rooms) in 2014.

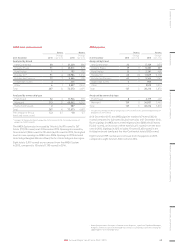

Greater China pipeline

Hotels Rooms

At 31 December 2015

Change

over 2014 2015

Change

over 2014

Analysed by brand

InterContinental 21 3 7,900 1,222

HUALUXE 21 (3) 6,632 (919)

Crowne Plaza 39 (5) 12,717 (2,084)

Hotel Indigo 9 (1) 1,500 (146)

Holiday Innb 49 6 14,638 2,254

Holiday Inn Express 65 15 15,118 3,840

Other 11 279 279

Total 205 16 58,784 4,446

Analysed by ownership type

Managed 205 16 58,784 4,446

Total 205 16 58,784 4,446

b Includes three Holiday Inn Resort properties (820 rooms) (2014: two Holiday Inn Resort

properties (767 rooms)).

At 31 December 2015, the Greater China pipeline totalled 205 hotels

(58,784 rooms) compared to 189 hotels (54,338 rooms) at 31 December

2014. Signings (66 hotels, 19,516 rooms) were the highest since 2007,

and increased from 64 hotels (15,754 rooms) in 2014. 48 hotels (12,878

rooms) were signed for the Holiday Inn brand family, with the Holiday

Inn Express pipeline increasing to 65 hotels.

18 hotels (5,690 rooms) were removed from the pipeline in 2015,

compared to 15 hotels (5,358 rooms) in 2014.

Greater China continued

Central

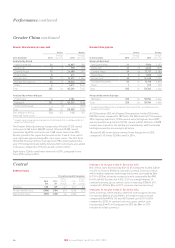

Central results

12 months ended 31 December

2015

$m

2014

$m

2015 vs

2014 %

change

2013

$m

2014 vs

2013 %

change

Revenue 135 129 4.7 121 6.6

Gross central costs (286) (284) (0.7) (276) (2.9)

Net central costs (151) (155) 2.6 (155) –

Highlights for the year ended 31 December 2015

Net central costs decreased by $4m (2.6%) compared to 2014 (a $5m

or 3.2% increase to $160m at constant currency). Central revenue,

which mainly comprises technology fee income, increased by $6m

(4.7%) to $135m, driven by increases in both comparable RevPAR

(4.4%) and IHG System size (4.8%, 3.2% excluding Kimpton). At

constant currency, gross central costs increased by $13m (4.6%)

compared to 2014 (a $2m or 0.7% increase at actual currency).

Highlights for the year ended 31 December 2014

Central revenue, which mainly comprises technology fee income,

increased by $8m (6.6%) to $129m, driven by increases in both

comparable RevPAR (6.1%) and IHG System size (3.4%) in 2014

compared to 2013. At constant currency, gross central costs

increased by $4m (1.4%) compared to 2013 (an $8m or 2.9%

increase at actual currency).

46 IHG Annual Report and Form 20-F 2015