Holiday Inn 2015 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

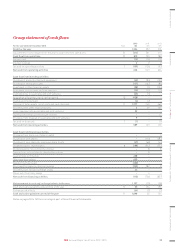

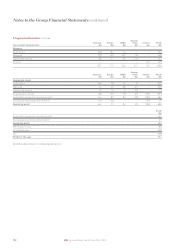

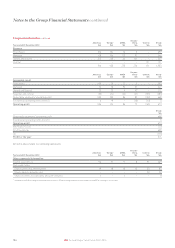

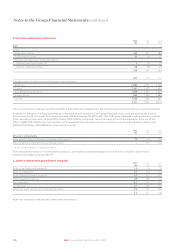

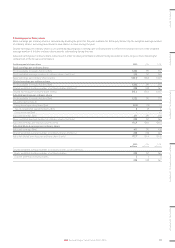

2. Segmental information continued

31 December 2014

Americas

$m

Europe

$m

AMEA

$m

Greater

China

$m

Central

$m

Group

$m

Assets and liabilities

Segment assets 919 316 244 394 346 2,219

Assets classified as held for sale – 310 – – – 310

919 626 244 394 346 2,529

Unallocated assets:

Non-current tax receivable 34

Deferred tax assets 87

Current tax receivable 4

Derivative financial instruments 2

Cash and cash equivalents 162

Total assets 2,818

Segment liabilities (430) (199) (61) (66) (796) (1,552)

Liabilities classified as held for sale – (94) – – – (94)

(430) (293) (61) (66) (796) (1,646)

Unallocated liabilities:

Current tax payable (47)

Deferred tax liabilities (147)

Loans and other borrowings (1,695)

Total liabilities (3,535)

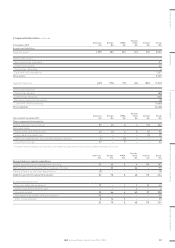

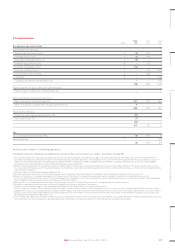

Year ended 31 December 2014

Americas

$m

Europe

$m

AMEA

$m

Greater

China

$m

Central

$m

Group

$m

Other segmental information

Capital expenditure (see below) 75 37 11 6 123 252

Non-cash items:

Depreciation and amortisationa22 18 8 15 33 96

Share-based payments cost ––––2121

Share of losses/(profits) of associates and joint ventures 6 – (2) – – 4

a Included in the $96m of depreciation and amortisation is $41m relating to administrative expenses and $55m relating to cost of sales.

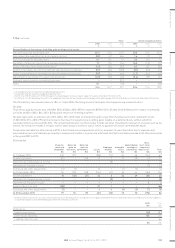

Americas

$m

Europe

$m

AMEA

$m

Greater

China

$m

Central

$m

Group

$m

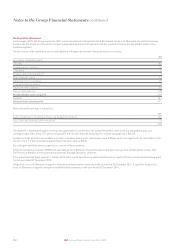

Reconciliation of capital expenditure

Capital expenditure per management reporting 75 37 11 6 123 252

Management contracts acquired on disposal of hotels 50––––50

Capital contributions to associates 15––––15

Other financial assets relating to deferred consideration on disposals 27 25 – – – 52

Timing differences and other adjustments – – – (1) – (1)

Additions per the Financial Statements 167 62 11 5 123 368

Comprising additions to:

Property, plant and equipment 45 12 2 5 15 79

Assets classified as held for sale 13–––4

Intangible assets 78 22 5 – 108 213

Investment in associates and joint ventures 15––––15

Other financial assets 28 25 4 – – 57

167 62 11 5 123 368

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

103IHG Annual Report and Form 20-F 2015