Holiday Inn 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In the prior year, our auditor’s report included a risk of material

misstatement as follows: “the recognition of deferred tax assets

relating to losses”. In the current year, the stability of profits in overseas

jurisdictions and the related UK tax legislation means that the level of

judgement required in determining the amount of deferred tax assets to

be recognised is no longer a risk of material misstatement that had the

greatest effect on our overall audit strategy, the allocation of resources

in the audit and the direction of efforts in the audit team.

The scope of our audit

Tailoring the scope

Our assessment of audit risk, our evaluation of materiality and our

allocation of performance materiality determine our audit scope for

each entity within the Group. Taken together, this enables us to form

an opinion on the Financial Statements. We take into account size,

risk profile, the organisation of the Group, including IHG’s global

accounting centre in India, and effectiveness of group-wide controls,

changes in the business environment and other factors such as Global

Internal Audit review findings when assessing the level of work to be

performed at each entity.

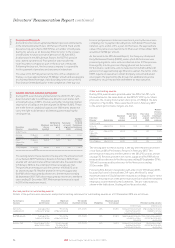

In assessing the risk of material misstatement to the Financial

Statements, and to ensure we had adequate quantitative coverage

of significant accounts in the Financial Statements, we selected 39

components covering components within IHG’s global accounting

centre in India, the United States, the United Kingdom, and China,

which represent the principal business units within the Group.

The Primary Audit Engagement Team (the Primary Team) performs

the audit on those areas of accounting performed centrally such as

litigation and consolidation adjustments.

Of the 39 components selected, we performed an audit of the complete

financial information of 19 components (‘full scope components’)

which were selected based on their size or risk characteristics.

For the remaining 20 components (‘specific scope components’),

we performed audit procedures on specific accounts within that

component that we considered had the potential for the greatest

impact on the significant accounts in the Financial Statements either

because of the size of these accounts or their risk profile. The risks of

material misstatement included in the table above were subject to full

audit procedures.

The reporting components where we performed audit procedures

accounted for 88% (2014: 86%) of the Group’s profit before tax

adjusted for pre-tax exceptional items and 79% (2014: 77%) of the

Group’s revenue.

For the current year, the full scope components contributed 59%

(2014: 63%) of the Group’s profit before tax adjusted for pre-tax

exceptional items, and 60% (2014: 70%) of the Group’s revenue.

The specific scope component contributed 29% (2014: 23%) of the

Group’s profit before tax adjusted for pre-tax exceptional items,

and 19% (2014: 7%) of the Group’s revenue. The audit scope of these

components may not have included testing of all significant accounts

of the component but will have contributed to the coverage of

significant accounts tested for the Group. This included specific

procedures on the income statement of the InterContinental Hong

Kong hotel for the period prior to its disposal.

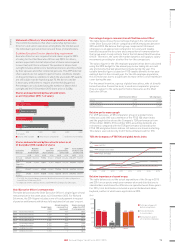

Of the remaining components that together represent 12% of the

Group’s profit before tax adjusted for pre-tax exceptional items; none

are individually greater than 4% of the Group’s profit before tax

adjusted for pre-tax exceptional items. For three components, we

performed review scope procedures. For the remaining components;

none of which are individually greater than 2% of the Group’s profit

before tax adjusted for pre-tax exceptional items, we performed other

procedures, including analytical review at both regional levels and

at owned hotels, and testing of journals across the Group to respond

to any potential risks of material misstatement to the Group

Financial Statements.

In addition to the risks identified as part of our audit planning, the Group undertook the following material non-routine transactions in the year

which affected the allocation of resources and the direction of our audit efforts and for which our audit response was as follows:

Risk Our response to the risk

What we concluded

to the Audit Committee

Disposal of owned hotels

Refer to the Audit Committee Report (page 63);

and note 11 of the Group Financial Statements.

We focus on this area due to the disposal

of both InterContinental Paris – Le Grand

and InterContinental Hong Kong in the year

resulting in the recognition of a combined

$873m gain on disposal. Included within the

calculation of this gain is the recognition of

the fair value of the management contract

agreements entered in to as part of the

disposal transactions, the valuation of which

incorporates a number of judgements.

For each hotel disposal:

• We tested internal financial controls over the disposal transaction

and accounting;

• We inspected all key contracts in relation to the sale, including the

sale and purchase agreement and the related hotel management

agreements, to corroborate that the risks and rewards of ownership

of the asset had passed and hence de-recognition of the hotel

was appropriate.

• We agreed the calculation of the accounting gain recognised on

disposal, including the fair value attributed to the hotel management

agreement. We tested the appropriateness of the assumptions

applied to the discounted cash flow models used in determining

the valuation of the management contract.

• Given the size and nature of the disposal gain, we considered

the appropriateness of its classification as an exceptional item

in line with the Group’s accounting policy for such items as set out

on page 98.

We concluded

that the fair value

attributed to the

hotel management

agreements entered

in to as part of both

transactions to be

reasonable and that

the gains recognised

on disposal of the

owned hotels have

been correctly

calculated.

The disclosure

of these gains as

exceptional items are

in accordance with

the Group’s disclosed

accounting policy for

exceptional items and

is in accordance with

the requirements of

IAS 1, ‘Presentation

of Financial

Statements’.

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

83IHG Annual Report and Form 20-F 2015