Holiday Inn 2015 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

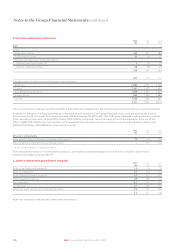

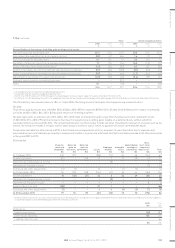

The future redemption liability, which is included in trade and

other payables, was $649m at 31 December 2015. Based on the

conditions existing at the balance sheet date, a one percentage point

decrease in the breakage estimate would increase this liability by

approximately $10m.

Kimpton acquisition – The Group acquired Kimpton Hotel and

Restaurant Group, LLC (Kimpton) on 16 January 2015 and has

recognised the identifiable assets and liabilities acquired at fair value,

with the difference between the fair value of net assets acquired and

the fair value of consideration paid as goodwill. The most significant

assets acquired were intangible assets and the Group engaged an

independent valuation specialist to assist with their identification

and valuation. The Group assessed the competence, capabilities and

objectivity of the specialist, as well as the reasonableness of their

conclusions having regard to the key assumptions including forecast

cash flows, discount rates, royalty rates and long-term growth rates.

As a result of the valuation exercise, management contract assets of

$71m, brand assets of $193m and goodwill of $167m were recognised.

The management contracts were valued using an excess earnings

approach and the brands using the relief-from-royalty method. A

10% reduction in the EBITDA margin applied to forecast management

contract fees would have reduced the management contract valuation

by $17m and a 0.5 percentage point increase in the assumed royalty

rate would have increased the brand valuation by $97m, with

corresponding adjustments to the amount of goodwill recognised.

For the reasons set out in note 13 to the accounts, the brands have

been deemed to have an indefinite life.

Impairment testing – intangible assets with definite useful lives, and

property, plant and equipment are tested for impairment when events

or circumstances indicate that their carrying value may not be

recoverable. Goodwill and intangible assets with indefinite useful lives

are subject to an impairment test on an annual basis or more frequently

if there are indicators of impairment. Assets that do not generate

independent cash flows are combined into cash-generating units.

The impairment testing of individual assets or cash-generating units

requires an assessment of the recoverable amount of the asset or

cash-generating unit. If the carrying value of the asset or cash-

generating unit exceeds its estimated recoverable amount, the asset

or cash-generating unit is written down to its recoverable amount.

Recoverable amount is the greater of fair value less costs of disposal

and value in use. Value in use is assessed based on estimated future

cash flows discounted to their present value using a pre-tax discount

rate that is based on the Group’s weighted average cost of capital

adjusted to reflect the risks specific to the business model and

territory of the cash-generating unit or asset being tested. The

outcome of such an assessment is subjective, and the result sensitive

to the assumed future cash flows to be generated by the cash-

generating units or assets and discount rates applied in calculating

the value in use.

At 31 December 2015, the Group had goodwill of $233m and brands

of $193m, both of which are subject to annual impairment testing.

Information on the impairment tests performed is included in note 13.

The Group also had property, plant and equipment and other

intangible assets with a net book value of $428m and $800m

respectively at 31 December 2015. An impairment charge of $27m was

recognised during the year in relation to two hotel properties in North

America. In respect of those assets requiring an impairment test and

depending on how recoverable amount was assessed, a 10% reduction

in fair value or estimated future cash flows would have resulted in a

further impairment charge of $6m.

Litigation – from time to time, the Group is subject to legal

proceedings the ultimate outcome of each being always subject

to many uncertainties inherent in litigation. A provision for litigation

is made when it is considered probable that a payment will be made

and the amount of the loss can be reasonably estimated. Significant

judgement is made when evaluating, amongst other factors, the

probability of unfavourable outcome and the ability to make a

reasonable estimate of the amount of potential loss. Litigation

provisions are reviewed at each accounting period and revisions

made for changes in facts and circumstances.

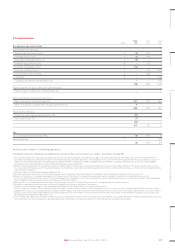

New standards issued but not effective

The new and amended accounting standards discussed below are

those which are expected to be relevant to the Group’s Financial

Statements.

From 1 January 2016, the Group will apply the amendments to

existing standards arising from the Annual Improvements to IFRSs

2012–2014 cycle.

From 1 January 2016, the Group will apply Amendments to IAS 16

and IAS 38 ‘Clarification of Acceptable Methods of Depreciation

and Amortisation’, Amendments to IFRS 11 ‘Accounting for Acquisition

of Interests in Joint Operations’, and Amendments to IAS 1

‘Disclosure Initiative’.

The Group will also apply Amendments to IFRS 10 and IAS 28 ‘Sale or

Contribution of Assets between an Investor and its Associate or Joint

Venture’ on the effective date of these amendments, which have been

deferred indefinitely.

The above amendments are not expected to have a material impact

on the Group’s reported performance or financial position.

IFRS 15 ‘Revenue from Contracts with Customers’ introduces a new

five-step approach to measuring and recognising revenue and is

effective from 1 January 2018.

IFRS 9 ‘Financial Instruments’ was issued as a final standard in July

2014 and is effective from 1 January 2018. The standard introduces

new requirements for classification and measurement of financial

assets and financial liabilities, impairment and hedge accounting.

IFRS 16 ‘Leases’ was issued in January 2016 and is effective from

1 January 2019. The standard eliminates the classification of leases as

either operating or finance leases and introduces a single accounting

model. Lessees will be required to recognise assets and liabilities in

respect of the minimum lease payment for all leases with a term of

more than 12 months, and show depreciation of leased assets and

interest on lease liabilities separately in the income statement.

The Group is currently assessing the impacts of IFRS 15, IFRS 9

and IFRS 16 and plans to adopt these standards on the required

effective dates.

99

IHG Annual Report and Form 20-F 2015

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS