Holiday Inn 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Group Financial Statements continued

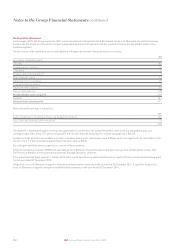

20. Financial risk management

Overview

The Group’s treasury policy is to manage financial risks that arise in relation to underlying business needs. The activities of the treasury function are

carried out in accordance with Board approved policies and are subject to regular audit. The treasury function does not operate as a profit centre.

The treasury function seeks to reduce the financial risks faced by the Group and manages liquidity to meet all foreseeable cash needs. Treasury

activities may include money market investments, repurchase agreements, spot and forward foreign exchange instruments, currency swaps,

interest rate swaps and forward rate agreements. One of the primary objectives of the Group’s treasury risk management policy is to mitigate

the adverse impact of movements in interest rates and foreign exchange rates.

Market risk exposure

The US dollar is the predominant currency of the Group’s revenue and cash flows. Movements in foreign exchange rates can affect the Group’s

reported profit, net assets and interest cover. To hedge foreign exchange exposure, wherever possible, the Group matches the currency of its

debt (either directly or via derivatives) to the currency of its net assets, whilst maximising the amount of US dollars borrowed to reflect the

predominant trading currency.

From time to time, foreign exchange transaction exposure is managed by the forward purchase or sale of foreign currencies. Most significant

exposures of the Group are in currencies that are freely convertible.

Interest rate exposure is managed, using interest rate swaps if appropriate, within set parameters depending on the term of the debt, with

a minimum fixed proportion of 25% of borrowings for each major currency. 100% of borrowings in major currencies were fixed rate debt at

31 December 2015, with the exception of overdrafts. No interest rate swaps were used during 2015, 2014 or 2013.

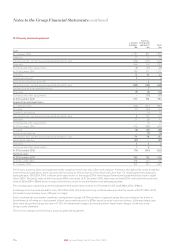

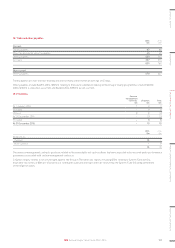

Market risk sensitivities

The following table shows the impact of a general strengthening in the US dollar against sterling and euro on the Group’s profit before tax and

net assets, and the impact of a rise in US dollar, euro and sterling interest rates on the Group’s profit before tax.

2015

$m

2014

$m

2013

$m

Increase/(decrease) in profit before tax

Sterling: US dollar exchange rate 5¢ fall 4.8 4.5 4.1

Euro: US dollar exchange rate 5¢ fall (1.9) (2.2) (2.6)

US dollar interest rates 1% increase (0.9) (6.7) –

Euro interest rates 1% increase –(0.9) –

Sterling interest rates 1% increase 7.9 0.7 –

Increase/(decrease) in net assets

Sterling: US dollar exchange rate 5¢ fall 23.7 29.1 16.0

Euro: US dollar exchange rate 5¢ fall (7.6) (10.9) (14.8)

The impact of a weakening in the US dollar or a fall in interest rates would be the reverse of the above values.

Interest rate sensitivities are calculated based on the year-end net debt position plus, in 2014, the $400m bilateral term loan drawn in 2015

to finance the Kimpton acquisition (see note 21).

122 IHG Annual Report and Form 20-F 2015