Holiday Inn 2015 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

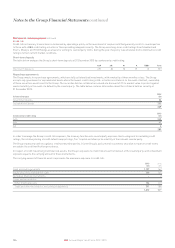

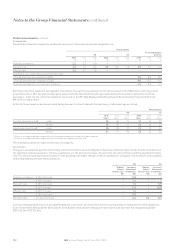

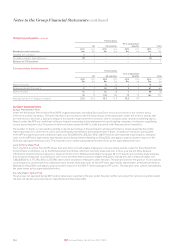

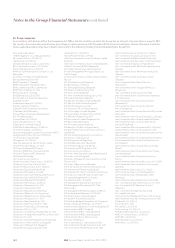

25. Retirement benefits continued

Movement in benefit obligation

Pension plans

UK US and other

Post-employment

benefits Total

2015

$m

2014

$m

2015

$m

2014

$m

2015

$m

2014

$m

2015

$m

2014

$m

Benefit obligation at 1 January 31 659 255 233 24 24 310 916

Current service cost –––1–––1

Interest expense 124 810 1110 35

Settlement gain before costs –(3) (2) –––(2) (3)

Benefits paid –(18) (14) (14) (1) (1) (15) (33)

Committed cash-out payments –(57) (11) –––(11) (57)

Re-measurement (gains)/losses (4) 86 (10) 26 (3) –(17) 112

Derecognised on buy-out –(640) (11) –––(11) (640)

Transfers to non-current assets classified as held for sale ––(12) –––(12) –

Exchange adjustments (1) (20) (1) (1) ––(2) (21)

Benefit obligation at 31 December 27 31 202 255 21 24 250 310

Comprising:

Funded plans ––150 199 ––150 199

Unfunded plans 27 31 52 56 21 24 100 111

27 31 202 255 21 24 250 310

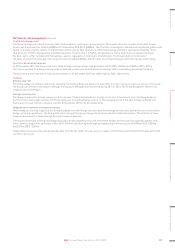

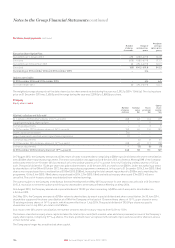

Movement in plan assets

Pension plans

UK US and other

Post-employment

benefits Total

2015

$m

2014

$m

2015

$m

2014

$m

2015

$m

2014

$m

2015

$m

2014

$m

Fair value of plan assets at 1 January 8582 167 159 ––175 741

Company contributions –3811 11915

Benefits paid –(18) (14) (14) (1) (1) (15) (33)

Interest income –22 57––529

Re-measurement gains/(losses) –83 (7) 5––(7) 88

Administration costs (1) (3) (1) –––(2) (3)

Derecognised on buy-out –(640) (22) –––(22) (640)

Transfer to defined contribution plan (7) –––––(7) –

Transfers to non-current assets classified as held for sale ––(15) –––(15) –

Exchange adjustments –(21) –(1) –––(22)

Fair value of plan assets at 31 December – 8121 167 ––121 175

Company contributions are expected to be $9m in 2016.

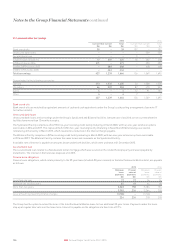

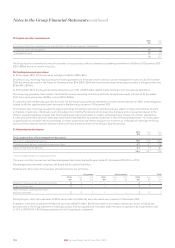

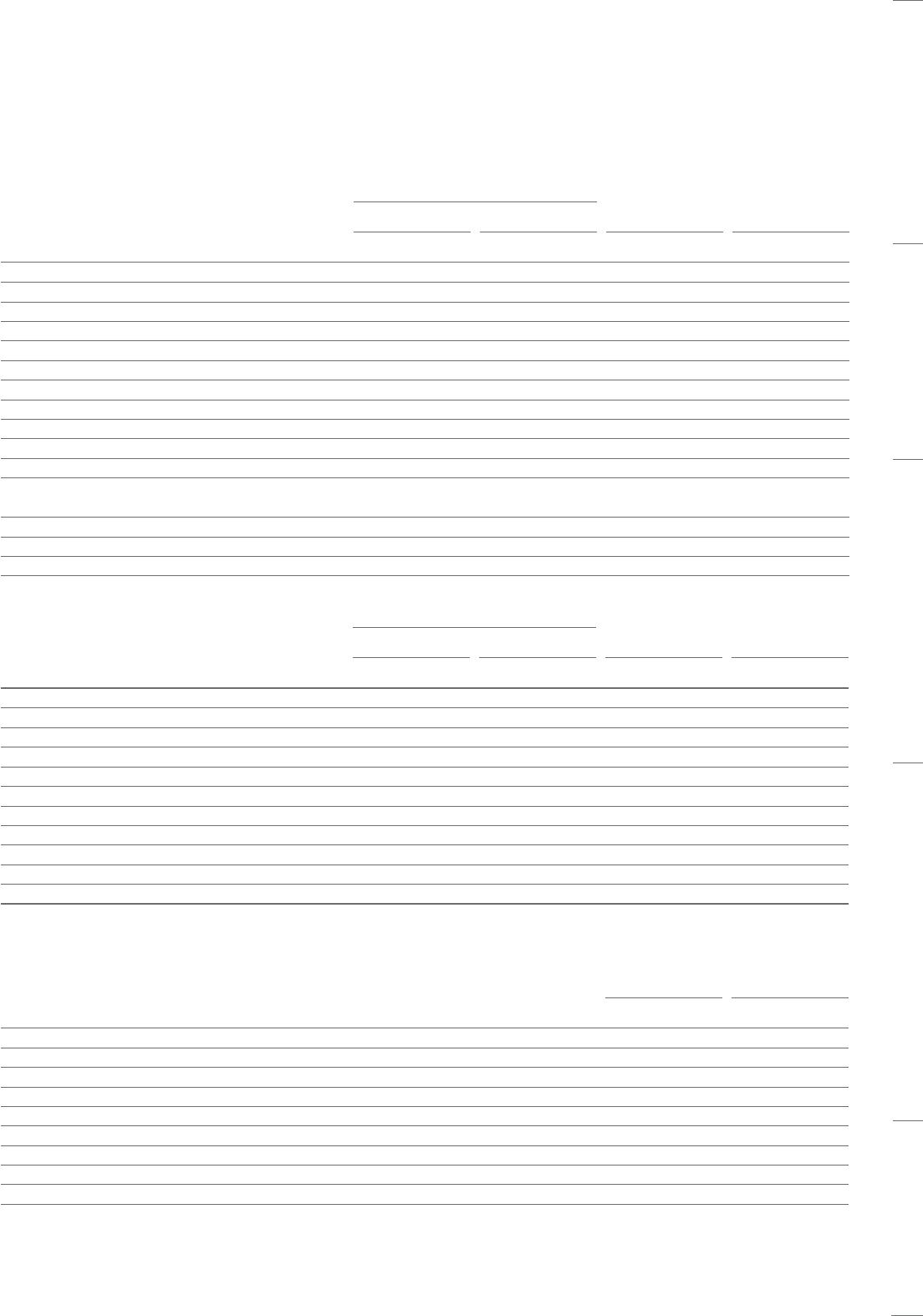

The plan assets are measured at fair value and comprise the following:

UK US and other

2015

$m

2014

$m

2015

$m

2014

$m

Investments quoted in active markets

Investment funds:

Global equities ––17 21

Corporate bonds ––101 131

Property ––22

Unquoted investments

Qualifying insurance policy –––11

Cash and other –812

–8121 167

In accordance with accounting standards, the fair value of a qualifying insurance policy is deemed to be the present value of the pension

obligations secured by thatpolicy.

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

133IHG Annual Report and Form 20-F 2015