Holiday Inn 2015 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2015 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Exchange controls and restrictions

on payment of dividends

There are no restrictions on dividend payments to US citizens.

Although there are currently no UK foreign exchange control

restrictions on the export or import of capital or the payment of

dividends on the ordinary shares or the ADSs, economic sanctions

which may be in force in the UK from time to time impose restrictions

on the payment of dividends to persons resident (or treated as so

resident) in or governments of (or persons exercising public functions

in) certain countries.

Other than economic sanctions which may be in force in the UK from

time to time, there are no restrictions under the Articles or under

English law that limit the right of non-resident or foreign owners to

hold or vote the ordinary shares or the ADSs. In addition, the Articles

contain certain limitations on the voting and other rights of any holder

of ordinary shares whose holding may, in the opinion of the Directors,

result in the loss or failure to secure the reinstatement of any licence

or franchise from any US governmental agency held by Six Continents

Hotels, Inc. or any subsidiary thereof.

Taxation

This section provides a summary of material US federal income

tax and UK tax consequences to the US holders, described below,

of owning and disposing of ordinary shares or ADSs of the Company.

This section addresses only the tax position of a US holder who holds

ordinary shares or ADSs as capital assets. This section does not,

however, discuss all of the tax considerations that may be relevant

to any particular US holder, such as the provisions of the Internal

Revenue Code of 1986, as amended (IR Code) known as the Medicare

Contribution tax or tax consequences to US holders subject to special

rules, such as:

• certain financial institutions;

• insurance companies;

• dealers and traders in securities who use a mark-to-market

method of tax accounting;

• persons holding ordinary shares or ADSs as part of a straddle,

conversion transaction, integrated transaction or wash sale,

or persons entering into a constructive sale with respect to

the ordinary shares or ADSs;

• persons whose functional currency for US federal income tax

purposes is not the US dollar;

• partnerships or other entities classified as partnerships for

US federal income tax purposes;

• persons liable for the alternative minimum tax;

• tax-exempt organisations;

• persons who acquired the Company’s ADSs or ordinary shares

pursuant to the exercise of any employee stock option or otherwise

in connection with employment; or

• persons who, directly or indirectly, own 10 per cent or more of the

Company’s voting stock.

This section does not generally deal with the position of a US holder

who is resident in the UK for UK tax purposes or who is subject to

UK taxation on capital gains or income by virtue of carrying on a

trade, profession or vocation in the UK through a branch, agency

or permanent establishment to which such ADSs or ordinary shares

are attributable (‘trading in the UK’).

As used herein, a ‘US holder’ is a person who, for US federal income

tax purposes, is a beneficial owner of ordinary shares or ADSs and is:

(i) a citizen or individual resident of the US; (ii) a corporation, or other

entity taxable as a corporation, created or organised in or under the

laws of the US, any state therein or the District of Columbia; (iii) an

estate whose income is subject to US federal income tax regardless

of its source; or (iv) a trust, if a US court can exercise primary

supervision over the trust’s administration and one or more US

persons are authorised to control all substantial decisions of the trust.

This section is based on the IR Code, its legislative history, existing and

proposed regulations, published rulings and court decisions, and on

UK tax laws and the published practice of HM Revenue and Customs

(HMRC), all as of the date hereof. These laws, and that practice, are

subject to change, possibly on a retroactive basis.

This section is further based in part upon the representations of

the ADR Depositary and assumes that each obligation in the deposit

agreement and any related agreement will be performed in accordance

with its terms. For US federal income tax purposes, an owner of ADRs

evidencing ADSs will generally be treated as the owner of the underlying

shares represented by those ADSs. For UK tax purposes, in practice,

HMRC will also regard holders of ADSs as the beneficial owners of the

ordinary shares represented by those ADSs (although case law has cast

some doubt on this). The discussion below assumes that HMRC’s

position is followed.

Generally, exchanges of ordinary shares for ADSs, and ADSs for

ordinary shares, will not be subject to US federal income tax or UK

taxation on capital gains, although UK stamp duty reserve tax (SDRT)

may arise as described below.

The US Treasury has expressed concerns that parties to whom ADSs

are pre-released before shares are delivered to the depositary, or

intermediaries in the chain of ownership between holders and the

issuer of the securities underlying the ADSs, may be taking actions that

are inconsistent with the claiming of foreign tax credits by US holders of

ADSs. Such actions would also be inconsistent with the claiming of the

preferential rates of tax, described below, for qualified dividend income.

Accordingly, the availability of the preferential rates of tax for qualified

dividend income described below could be affected by actions taken by

parties to whom the ADSs are pre-released.

Investors should consult their own tax advisors regarding the US

federal, state and local, the UK and other tax consequences of owning

and disposing of ordinary shares or ADSs in their particular

circumstances.

The following disclosures assumes that the Company is not, and will

not become, a positive foreign investments company (PFIC), as

described below.

Taxation of dividends

UK taxation

Under current UK tax law, the Company will not be required to

withhold tax at source from dividend payments it makes.

A US holder who is not resident for UK tax purposes in the UK and

who is not trading in the UK will generally not be liable for UK taxation

on dividends received in respect of the ADSs or ordinary shares.

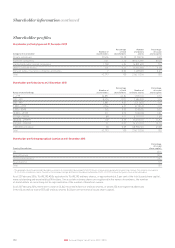

Shareholder information

STRATEGIC REPORT GOVERNANCE GROUP FINANCIAL STATEMENTS ADDITIONAL INFORMATIONPARENT COMPANY FINANCIAL STATEMENTS

165IHG Annual Report and Form 20-F 2015